A sharp drop in the Canadian dollar against its U.S. counterpart saw Canada's currency reach a 2024 low against the USD, while breaching chart support.

A sharp drop in the Canadian dollar against its U.S. counterpart saw Canada's currency reach a 2024 low against the USD, while breaching chart support.

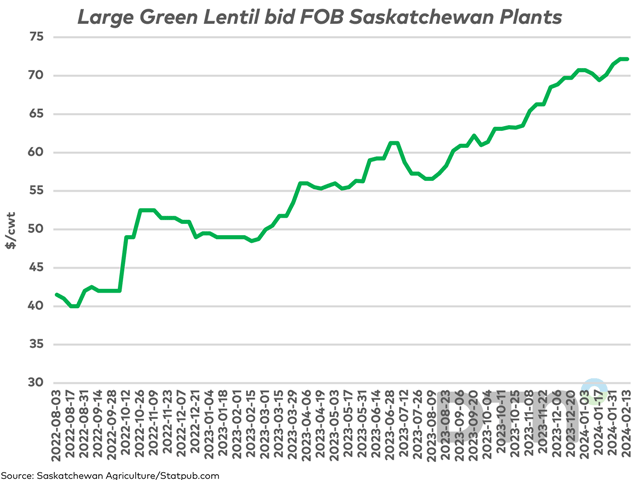

Large green lentil bids remain attractive in old-crop and new-crop positions.

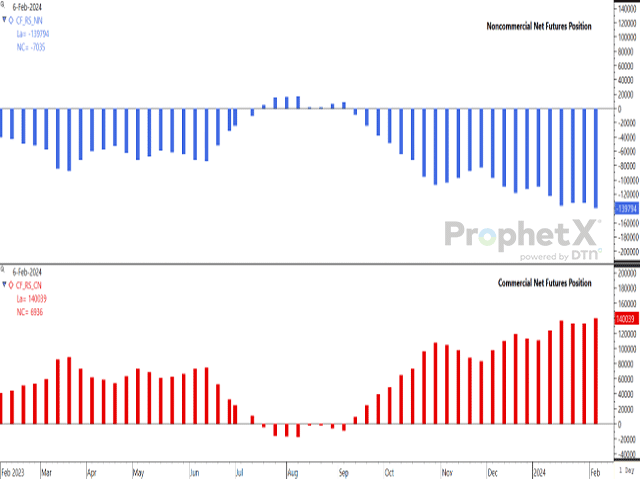

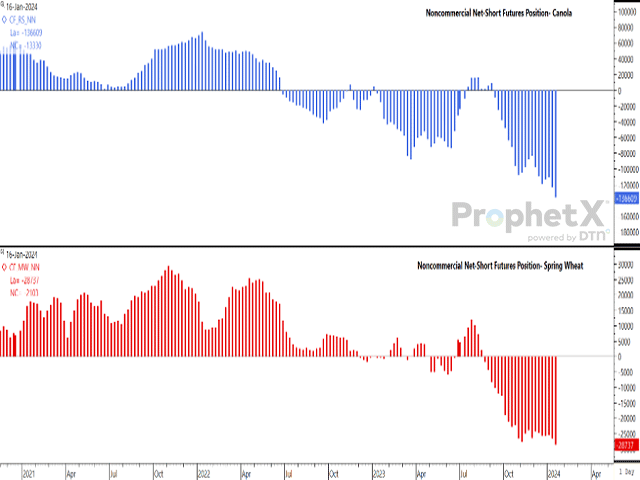

Both commercial and noncommercial traders moved to fresh record net futures positions in canola for the week ending Feb. 6.

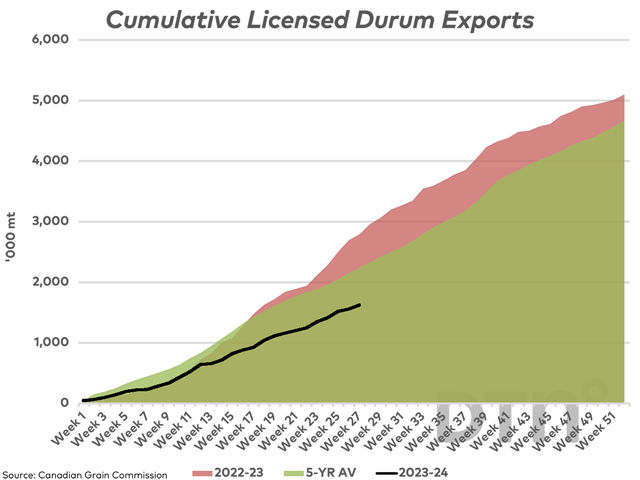

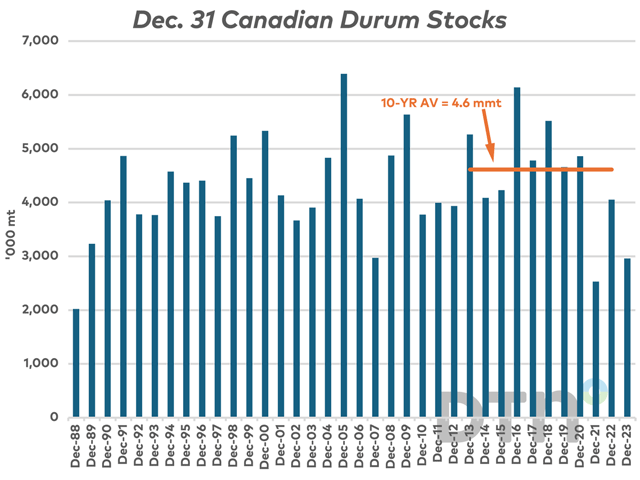

This week's reports point to Canada's tightening durum stocks while prairie prices continue to face pressure.

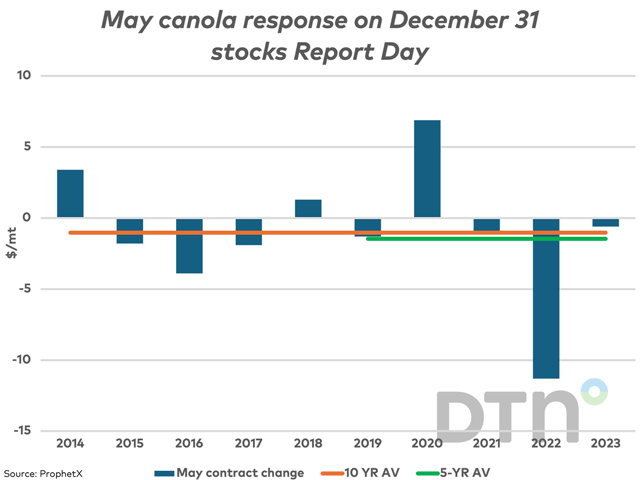

Statistics Canada released its official estimates for Dec. 31 grain stocks today, a report largely overshadowed by the USDA's February WASDE report.

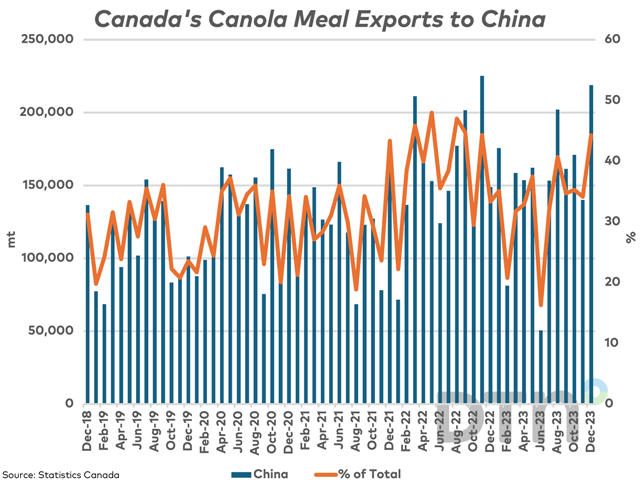

This study looks at miscellaneous December trade data for select crops and crop products.

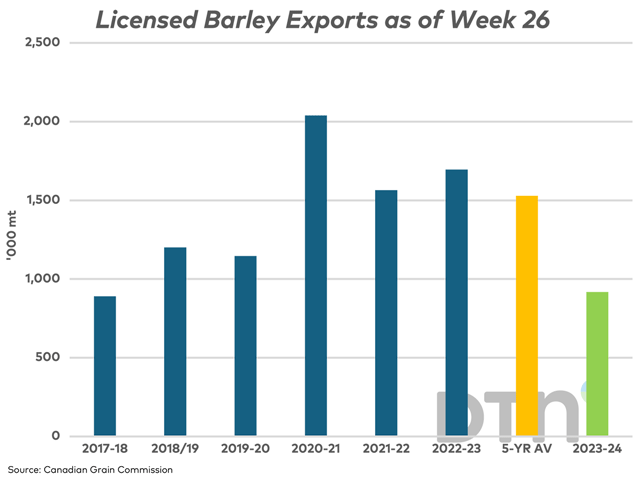

Canada's barley exports are down from the previous year, as expected, while movement over the first half of the crop year would indicate the government export forecast is overstated.

This study looks at the response of the nearby May canola contract on the day when the Statistics Canada Dec. 31 Grain Stocks report has been released in the past.

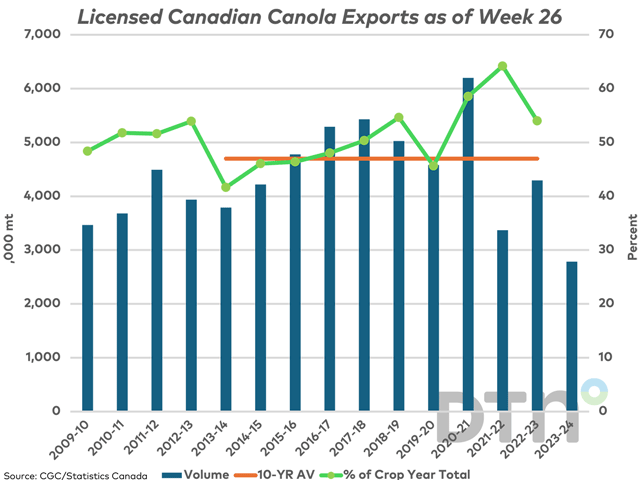

Canola exports improved in week 26 but remain weak, with the cumulative volume shipped over the first half of 2023-24 well behind AAFC's forecast pace.

December MGEX spring wheat is holding above the contract low reached in January.

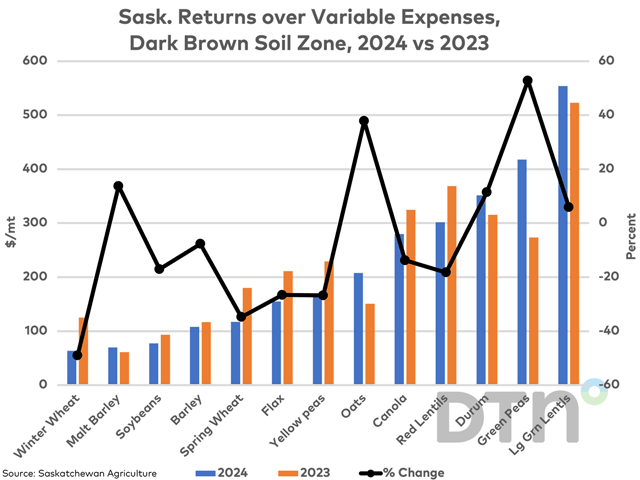

This study looks at estimated crop returns found in the Saskatchewan government's annual Crop Planning Guide for 2024, which estimates costs and returns for 31 crops.

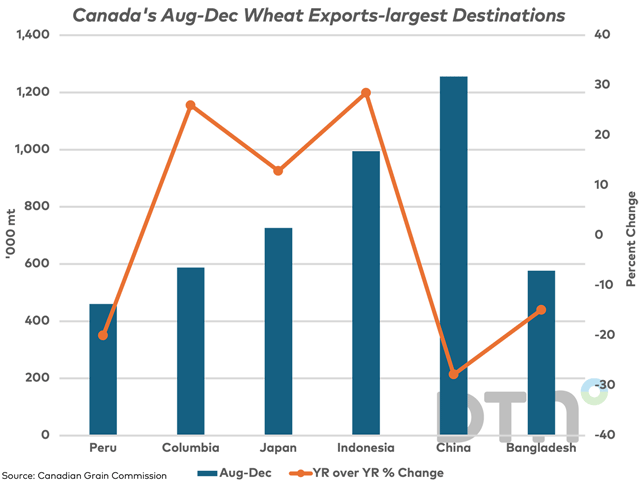

This study looks at the CGC's August-through-December export data for wheat (excluding durum). Movement remains favorable despite growing global competition.

March European milling wheat reached a fresh low on Monday on bearish fundamental data released.

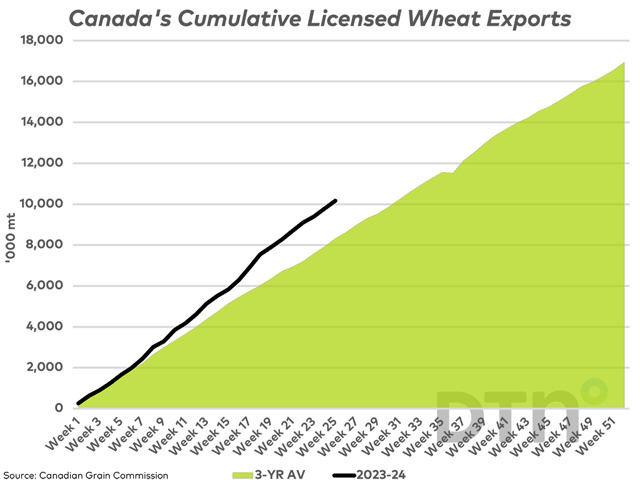

Canada's wheat exports continue at a pace well ahead of the current forecast pace.

Soybean oil trade faced heavy selling on Thursday, while the contract's May 2023 low is the next level of potential chart support.

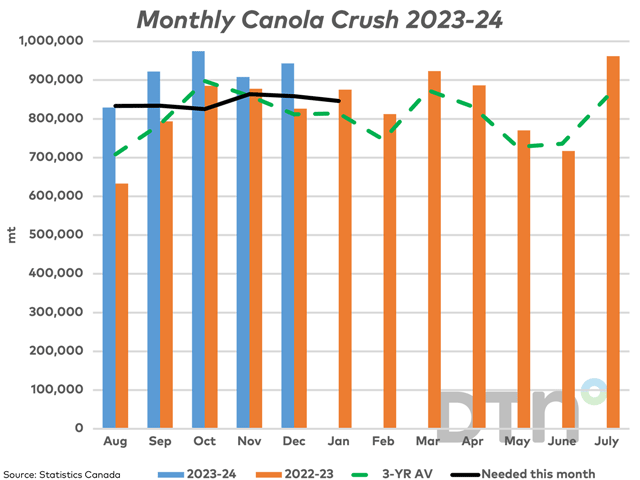

Canada's canola crush increased for a third time in four months, while runs ahead of the pace needed to reach the current government forecast.

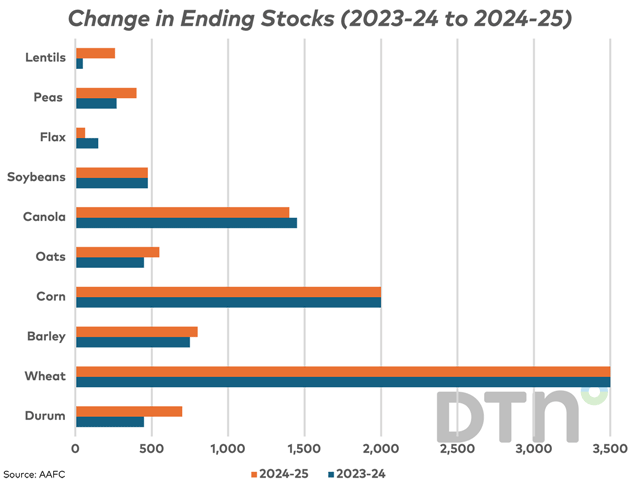

AAFC's earliest forecast for 2024-25 shows higher production and supply for Canada's principal field crops, while higher forecast exports and domestic use are unable to prevent a rise in total grain stocks.

For the second time since late October, noncommercial traders hold a record bearish net-short position in both hard red spring wheat and canola futures.

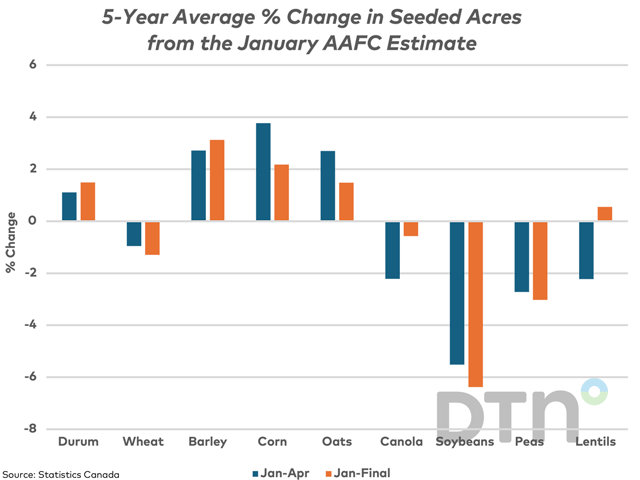

AAFC will soon release its initial forecasts for principal field crops for 2024-25. This study looks at the percent change in Statistics Canada's estimated seeded acres from this initial estimate.

Canada's government and agricultural industry may once again be tested with a potential strike looming at the Port of Montreal.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]