Canada Markets

March Canola Achieves a Weekly Gain

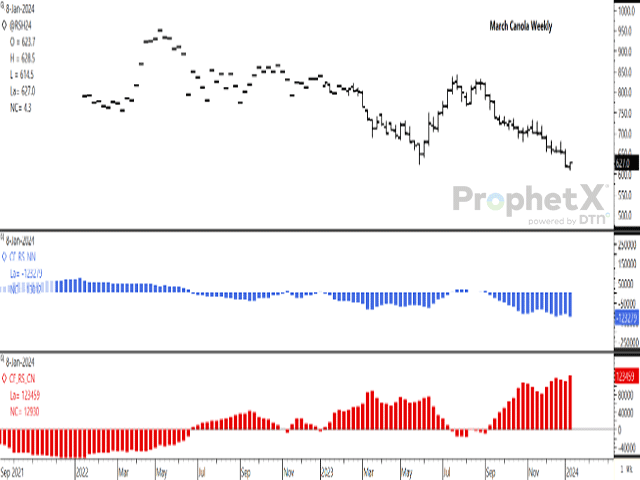

Following the Jan. 8 contract low reached on the March daily chart, the contract has closed higher in three of four sessions. During the week the contract gained $8.10/metric ton for its first higher weekly close in nine weeks. This is a step in the right direction following a drop of $89.80/mt over eight weeks.

The two studies on the attached chart bears watching. The blue bars on the first study shows the noncommercial net-futures position, including the CFTC's data released today for the week ending Jan. 9. After paring this net-short position during the past two weeks, trade across the speculative crowd shows this group increasing their bearish net-short position by 13,102 contracts during the recent week, reaching a fresh record net-short position of 123,279 contracts.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Note that a record position for canola is unlike one reported for other crops, with the CFTC starting to track canola in its Commitment of Traders beginning in August 2018.

The red bars on the lower study shows noncommercial traders moving to a record 123,459 net-long position as of Jan. 9. This group is buying futures to hedge current or future sales.

The test will be the resolve of the speculative traders.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .