Canada Markets

Lentil Prices Push Higher

This week's Statistics Canada crop production estimates pegged the lentil crop at 1.537 million metric tons (mmt) based on their July model data, which would make the 2023 crop the smallest since 2009, or four years. This was below the average of pre-report estimates of 1.9 mmt, Agriculture and Agri-Food Canada's unofficial estimate of 1.8 mmt, the 2.3 mmt produced in 2022 and the five-year average at 2.267 mmt.

It is interesting to note that during the past three years, or since Statistics Canada has relied exclusively on the model-based approach for both its July and August reports (released in August and September), the September report found a smaller production in two of three years, while averaging a modest 1.4% drop from the previous estimate over the three years. At the same time, this week's estimate fell far short of trade expectations, with comments made that we could see an upward revision in production ahead in order to narrow the gap.

Based on AAFC's current supply and demand estimates, crop year supplies for 2023-24 would be 1.712 mmt when production is updated with this week's production estimate, down sharply from an estimated five-year average of 2.924 mmt and also the lowest seen since 2009-10. This will potentially change in the upcoming weeks, when Statistics Canada reports July 31 stocks on Sept. 8 and production estimates based on the August model on Sept. 14.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

This comes at a time when India's monsoon is being watched closely. DTN weather analysts describe the monsoon season as disappointing to-date, "thanks to a building El-Nino and a change in the pattern across the Indian Ocean." India's Meteorological Department's Special Daily Weather Report for Sept. 1 shows the seasonal rainfall for the June 1 through Sept. 1 period down 11% from the long period average, with a deficient moisture situation faced in 12 of 36 regions of the country. This affects the re-charging of soils prior to the winter pulse crop, while at a time when food inflation is a key issue for the Indian government.

On Friday, business-standard.com reported that food items pushed India's July inflation rate to a 15-month high of 7.44%, up from 4.87% in June, with pulses listed as a contributing factor. While imports are a potential solution, the Indian rupee closed at a record low against the USD on Aug. 31, adding to the cost of imports, with pressure expected to continue over the upcoming months.

Also of significance is Australia's winter crop potential, with DTN noting a hotter and drier pattern for most of the country that is to continue into early September.

The effects of El Nino remain on the radar for India and neigbouring pulse-growing countries as well as Australia.

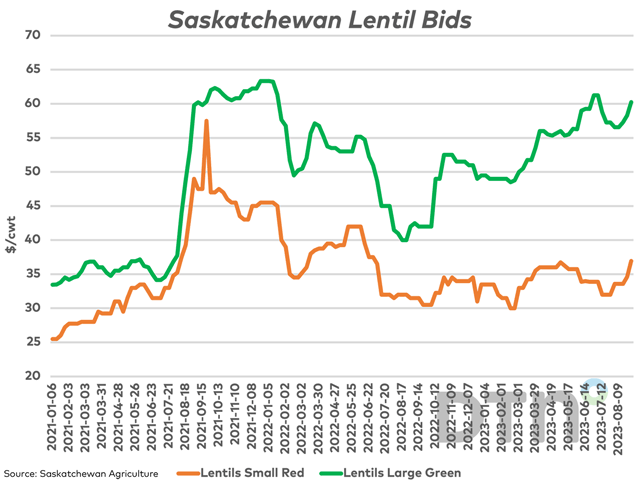

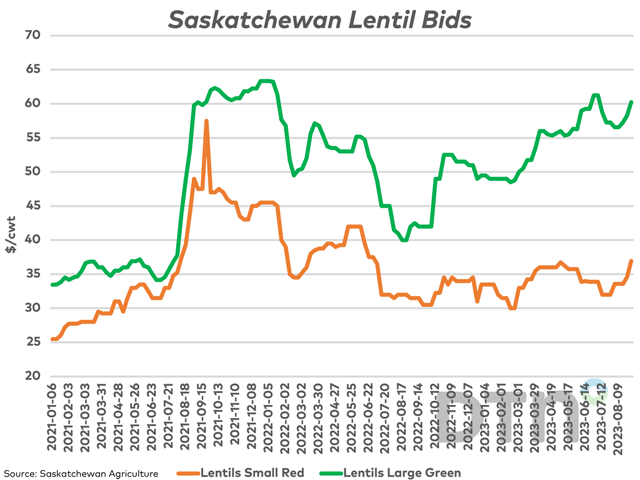

Saskatchewan Agriculture's weekly cash bids delivered to processing plants in the province rising for a third week for large green lentils to $60.25/cwt, while one broker is reporting this price at $60/cwt FOB farm. This compares to $42 reported for this week last year and the five-year average of $32.85/cwt for this week. Recent highs on the attached chart are seen at $61.25 reached in July and $63.33 reached in December 2021 and January 2022.

The red lentil price has risen for two consecutive weeks to $36.94/cwt, while brokers have reported the price as high as $40 FOB. This compares to $31.50 this time last year and the five-year average for this week at $26.10/cwt. Nearby resistance is seen on the chart at $42, reached in May 2022 and $45.50, reached in December 2021.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .