Canada Markets

AAFC Releases Early Look at 2023-34

Agriculture and Agri-Food Canada's January Outlook for Principal Field Crops report includes supply and demand estimates for the 2023-24 crop year and provides a starting point for discussion for the year ahead.

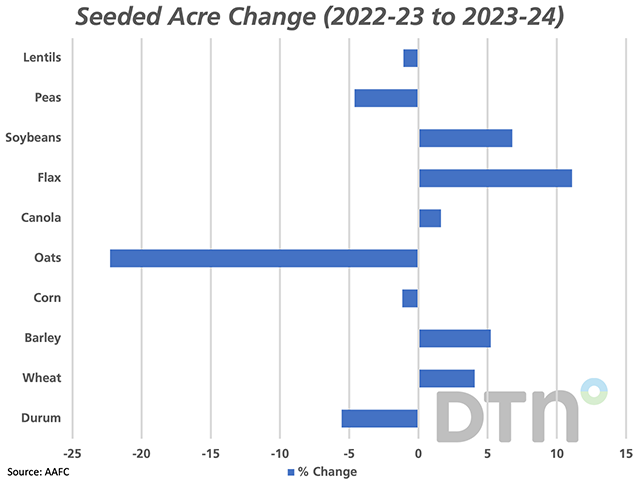

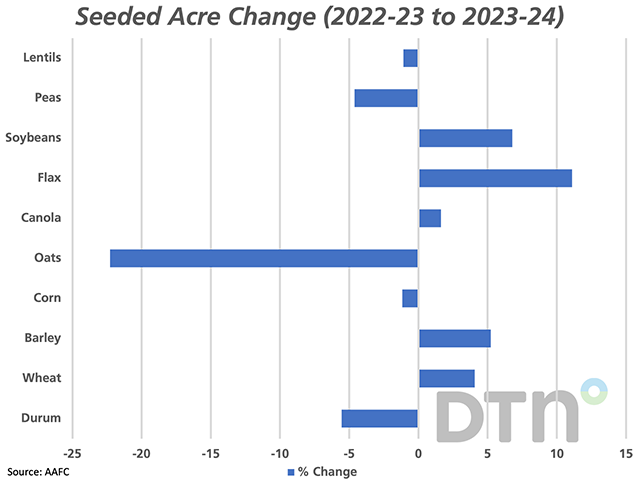

The attached chart shows AAFC's forecast change in seeded acres for select crops. When measured in acres, changes in acres appear small from 2022 to 2023, although on a percentage basis shown on the chart, year-over-year changes for crops such as oats, flax and soybeans stand out.

The largest percentage change is seen in oat acres, which are forecast to fall by 22.3% to 3.059 million acres, which would be the smallest acreage seeded in five years. AAFC's current forecast for 2022-23 shows the oat price forecast to fall by 35% from the previous year's average with a further drop forecast for 2023-24, while ending stocks in 2022-23 are forecast to swell by 262% to the largest held since 2009-10, or 13 years.

The next largest percentage change is seen for flax, with AAFC estimating flax acres climbing by 11% to 865,000 acres. This forecast may be viewed as optimistic, with flax exports as of week 24 down 50% from one year ago as exporters struggle against competitors, while stocks for 2022-23 are forecast to grow to the largest in five years and forecast to grow further in 2023-24. The forecast producer return is also shown to fall for a second year in 2023-24.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Looking at the row crops, corn acres are forecast to fall by 1.2% in 2023, with a modest gain in Western Canada acres off-set by a drop in eastern acres. The forecast 3.580 million seeded acres reflects a drop of 2.3% from the record acres planted in 2013 and only slightly below the five-year average. Soybean acres are forecast to rise by 6.8% to 5.634 million acres, which would be the largest area seeded in four years and above the five-year average. Lower input costs are seen favoring soybeans.

Looking at the biggest crops on the prairies, wheat acres (excluding durum) are forecast to rise by 4.1% to 20.171 million acres, which would be the largest wheat area seeded in 10 years. Producers see opportunity for favorable prices and movement of wheat. Current USDA forecast show global wheat stocks for 2022-23 the lowest in six years, although when China's estimated stocks are removed from the total, stocks are the tightest seen in 14 years which continues to buoy expectations for the crop year ahead. Drought in the Southern U.S. Plains and a reduced crop in Ukraine contribute to the favorable situation faced for wheat over the year ahead.

At the same time, durum acres are forecast to fall by 5.6% to 5.673 million acres, the lowest in four years. The average price for durum estimated by AAFC is forecast to fall by $181/metric ton or 29% in 2022-23, while is currently forecast to fall further in 2023-24 with stocks forecast to grow larger.

Canola acres are forecast to rise by a modest 1.6% to 21.745 million acres, the largest area planted since 2021 and would be the fifth largest area seeded on record. Industry will be disappointed in this response, which is seen as the average track Vancouver price forecast by AAFC is expected to fall for a second year in 2023-24 while is still higher than the five-year average.

Across all principal field crops, seeded acres are forecast to rise by 0.4% to 77.9 million acres, while average yield is forecast only slightly below the 2022 average. Production of all principal field crops is to fall by 1.226 mmt to 94.833, while total supplies are forecast to rise by 1 mmt. Forecast exports and domestic use is higher for 2023-24, while stocks of all principal field crops are to rise 590,000 mt to 12.290 million metric tons. Of all the principal field crops, only stocks of corn, oats and dry beans are forecast to fall year-over-year, while stocks of peas and sunflower seed is forecast to remain unchanged.

Price is forecast lower in 2023-24 for all principal field crops, with the forecast average price for grains and oilseeds shown to fall $10/mt to $40/mt from the current crop year, while the forecast price for pulses and special crops are shown to fall from $40/mt to $655/mt (mustard) in the 2023-24 crop year.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .