Technically Speaking

Corn Price Outlook Stays Bearish in Early 2024

CORN:

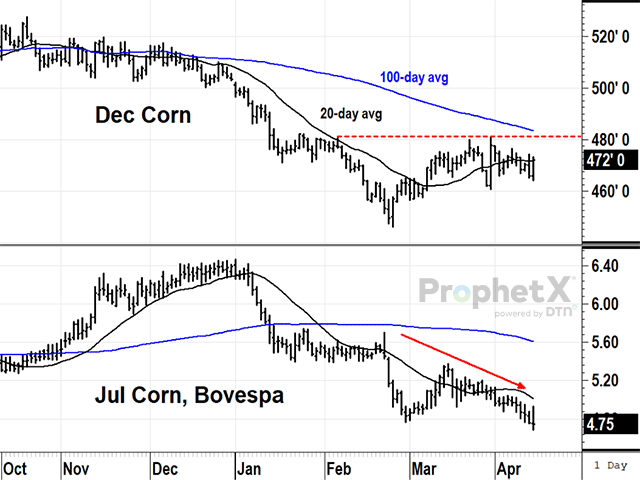

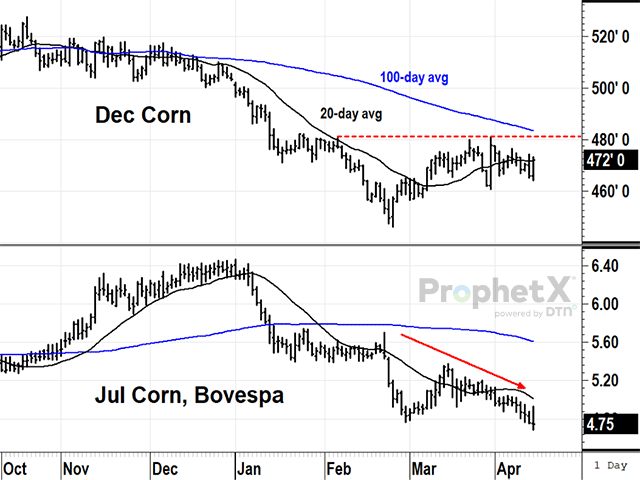

After a quiet week of trading, December corn ended down a half-cent at $4.72 a bushel on April 12, staying below resistance at $4.81 after USDA lowered its estimate of U.S. ending corn stocks from 2.172 billion bushels (bb) to 2.122 bb on Thursday.

According to the Buenos Aires Grain Exchange, Argentina has harvested 15% of a corn crop that is expected to total 49.5 million metric tons (mmt) or 1.95 bb in 2023-24. In Brazil, the new safrinha crop has received consistent rain so far, but the forecast is turning drier in central Brazil this week, likely making the transition to the dry season in the next few weeks. USDA estimates Brazil's corn production at 124.0 mmt or 4.88 bb in 2023-24, down almost 10% from last year's record-high 137 mmt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Brazil's Conab has a lower estimate of 111.0 mmt or 4.37 bb of production, based on an average yield of 87 bushels per acre. Despite Conab's lower estimate, the price of July corn on Brazil's Bovespa exchange shows no sign yet of concern about a lack of supplies, ending at the U.S. equivalent of $4.75 a bushel on April 12, the lowest in nearly nine months.

Technically speaking, December corn in the U.S. has shown signs of better support since making a low of $4.46 on Feb. 26, but the rebound has flattened the past month and prices have been unable to overcome resistance at $4.81, the March high and at $4.83, the site of the 100-day average. Sustained closes above $4.81 in December corn, if they happened, would turn the trend up and pressure specs holding over 190,000 net shorts as of April 9. Until then, the trend in December corn remains down with no sign of help yet from prices in Brazil.

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on social platform X @ToddHultman1

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .