Technically Speaking

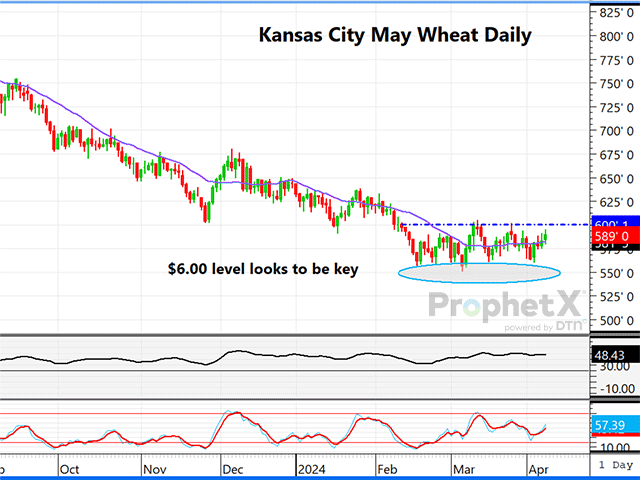

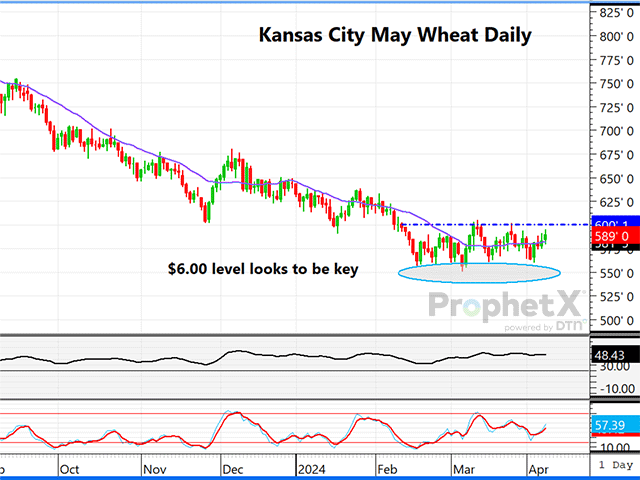

Kansas City Wheat Could Be Close to Turning, But It Has Been a Struggle All Year

KC JULY WHEAT:

As weak as U.S. and world wheat markets have been this year it is tough to predict when things might turn. The three U.S. wheat futures markets showed some promise of reversing in the past four days. Kansas City seems to be leading the way up. Despite winter wheat ratings much better than a year ago in April, weather in this month typically determines hard red winter wheat yield. The world is still fighting the aggressive export posture of Russia -- the No. 1 one wheat exporter following a few years of bin-busting crops. Couple that with USDA's lowest U.S. wheat export projection in years, and there is little reason for optimism. However, there are some geopolitical issues and weather problems in various major exporting regions that could swing the tide.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The forecast for the next few weeks in the Central and Southern Plains does not indicate much moisture for hard red winter areas, and temperatures are moving higher. In parts of Europe there has been too much rain, and in other parts of Europe and the Black Sea it has been much too warm and dry. France' wheat crop this year is now rated just 63% good to excellent -- down 30 percentage points from a year ago. Russia appears to be having quality issues with some of its major exporting firms, which could potentially switch some export business elsewhere. On the technical side, KC May wheat momentum is turning higher, but there is a big obstacle in the way in the form of the $6.00 level. KC May will need to jump above that level to extend the rally and break the bearish trend that has held a grip on wheat markets since July of 2023. It's a long shot, but I think KC wheat has a chance.

MAY SOYBEAN OIL FUTURES:

Although May bean oil is under heavy pressure early Monday, influenced by the third consecutive fall in Malaysian palm oil futures and the weakness in crude oil, there is a reason to be optimistic for bean oil prices. The May contract appears to be coiling in a small bull flag chart pattern. The 20-day moving average has also crossed over the 50-day moving average -- sometimes a valid forerunner of a change in trend. However, with early Monday weakness, the May contract is now below the 20-day average at 48.34, and likely needs to close above that again to keep the potential for higher prices intact. The fundamentals are in place for rising biodiesel production and demand, which argues in favor of bean oil down the road. There is no doubt USDA soybean production estimates for South America on Thursday will have something to say about the potential for U.S. soybean and products prices.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@DTN.com

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .