The panic that set off a seven-week sell-off in February cattle prices appears to have eased. It's now up to the market to find a new trading range.

The panic that set off a seven-week sell-off in February cattle prices appears to have eased. It's now up to the market to find a new trading range.

While senators push for a congressional vote to block the rule allowing the importation of beef from Paraguay, the secretaries of Agriculture from eight states send their own letter to U.S. Agriculture Secretary Tom Vilsack also raising their concerns as well.

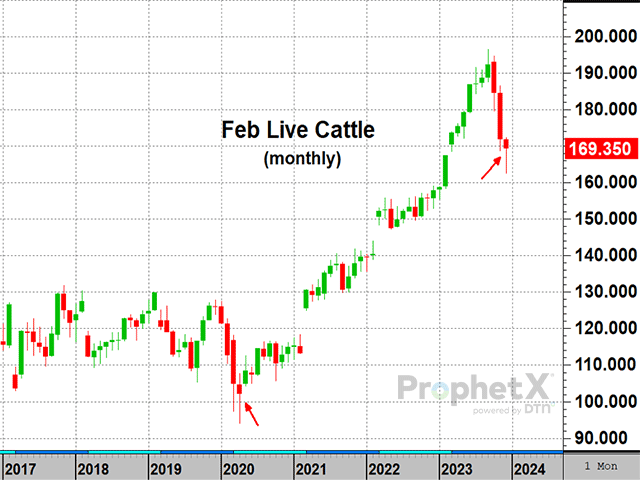

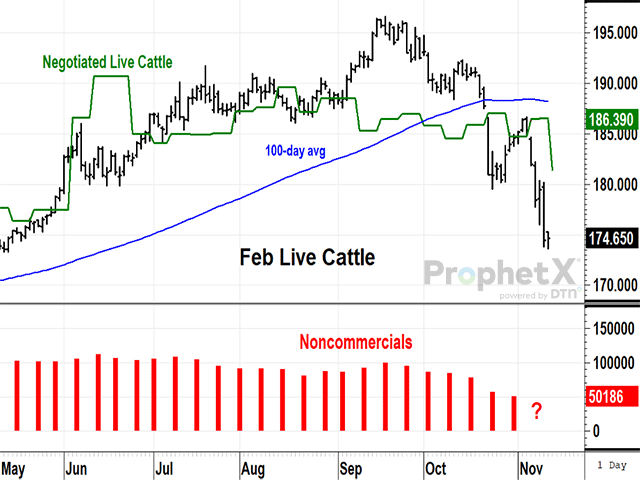

After a sharp, seven-week selloff in February cattle prices, hints of support finally started to show in the latest week.

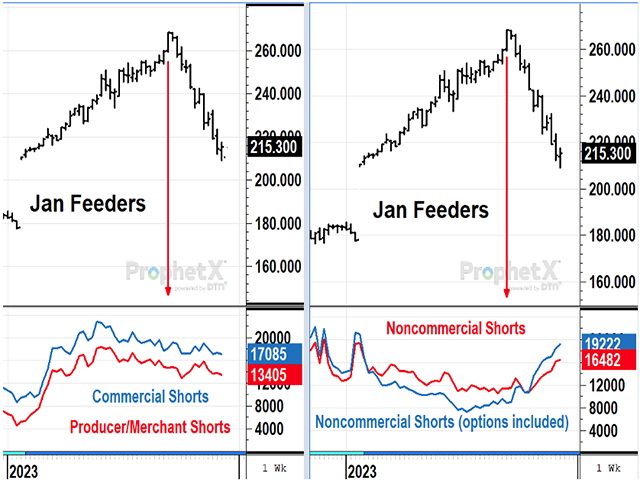

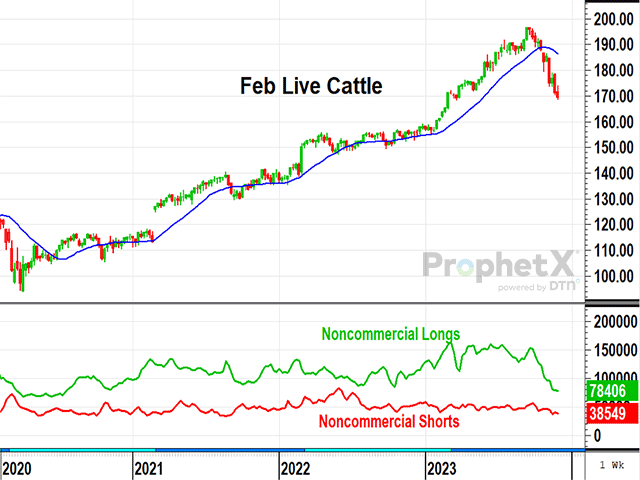

Rumors are flying around social media, trying to explain the sharp sell-off in cattle and feeder prices. CFTC data on trader positions help us understand which rumors have merit and which don't.

February live cattle posted their eighth weekly loss in the past eleven weeks, the largest correction in prices since 2020. In an unusual twist, bearish specs have been covering their short positions.

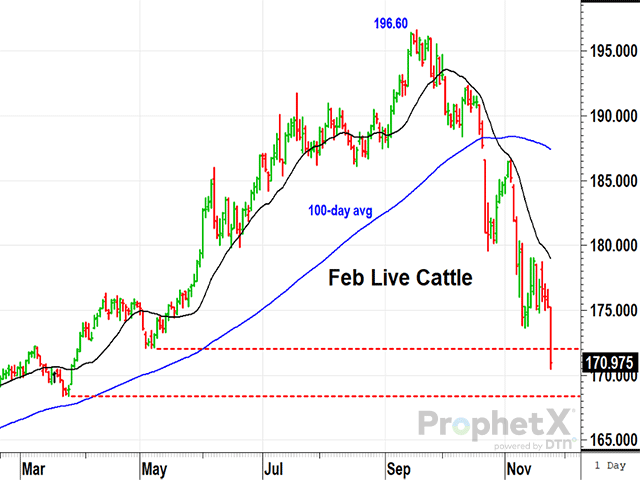

At the end of Black Friday's short post-holiday session, February live cattle was marked down 13% from a September high, an unexpected discount on a day known for bargain sales.

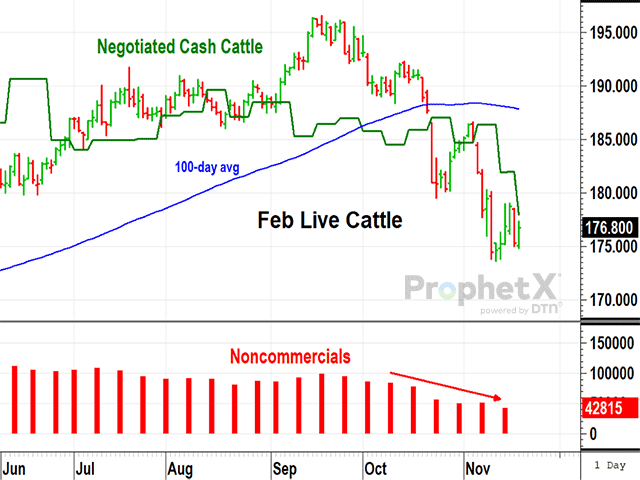

February live cattle prices showed better support in the week ending Nov. 17, but it's fair to say traders were nervous heading into Friday's On-Feed report.

February live cattle prices fell over $10 in the week ending Nov. 10, and cash prices were also lower, but not as much. Demand concerns, plus a shakedown of bullish spec positions, are the mostly likely culprits.

In the November WASDE report released Thursday morning, beef production forecasts were increased significantly for 2024, but several other contributing factors led to a bearish market freefall in the cattle complex, according to DTN analysts.

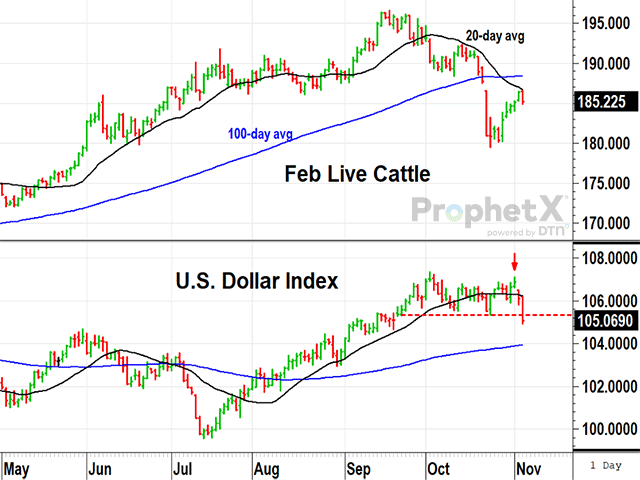

February live cattle prices remain limited by October's bearish on-feed report as the U.S. dollar turns south, prompted by a pause from the Fed.

USDA's bearish on-feed report spooked bullish specs in the cattle market, but fundamentally, the market looks as bullish as ever.

The bearish surprise from last week's USDA Cattle on Feed report hit cattle prices hard to begin this week. While there will continue to be uncertainty and volatility, analysts still see fundamentally the cattle market being in a bullish situation.

USDA extended the deadline for the Milk Loss Program to Oct. 30. The program pays for milk dumped due to certain disasters in 2020, 2021 and 2022.

The fundamental stronghold that the market has possessed through 2023 hasn't changed, but it seems like the closer we get to 2024, the more external pressures continue to build. The attack on Israel by Hamas on Oct. 7 just increased the pressure.

Supplies of market-ready cattle are supposed to grow increasingly thin in the fourth quarter of 2023, which could ignite another rally in the cash cattle market, but managing supplies isn't only done from a headcount perspective. One must consider what these cattle are weighing...

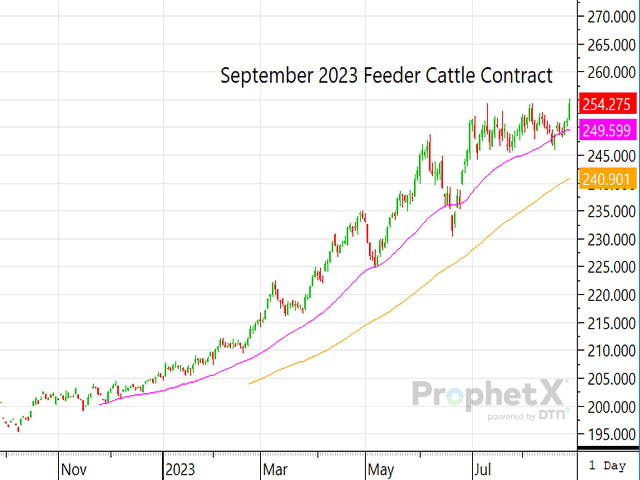

Just like we sometimes want to remind traders, it's not always about here and now. There's always a long-term game in the market being played, too.

Tight fed cattle supplies continue to support the cash cattle market and send prices higher as packers scramble to find enough cattle.

There are a lot of moving pieces affecting the cattle complex, and it seems like the market may be coming alive again.

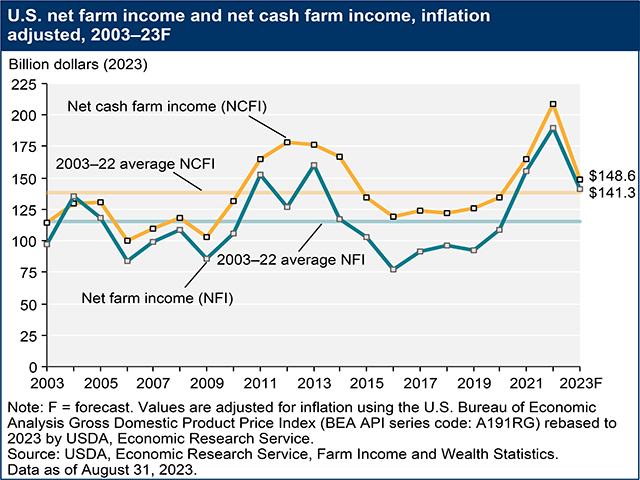

USDA's latest projection for net farm income shows farmers nationally will see lower income projections for the first time in five years. Net farm income in 2023 is projected to be 22.8% lower than in 2022, which was a record year. Livestock cash receipts are forecast to fall...

The rally in 2014-15 lasted a year and a half, but this rally, the one we are currently witnessing, doesn't mirror the last. We have greater challenges ahead with higher interest rates, a compromised economy and an election year looming.

DIM[2x3] LBL[blogs-harringtons-sort-cull-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-harringtons-sort-cull-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]