Sort & Cull

Cash Cattle Markets Show Signs of Demand Returning to Country

Editor's note: DTN Livestock Analyst ShayLe Stewart will be out of the office for a few weeks. We will continue to update her Sort and Cull blog with livestock market content. Please send any questions or comments to Editor-in-Chief Greg Horstmeier at greg.horstmeier@dtn.com.

**

For the week ended Dec. 29, February live cattle were down a tick at $168.50 and March feeder cattle were down $1.30 at $223.10, a quiet week of trading, sandwiched between Christmas and the New Year holiday. Even after sharp, fourth-quarter selloffs in both contracts, spot prices of feeder cattle finished 2023 20% higher than they started and spot prices of live cattle were up 7%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

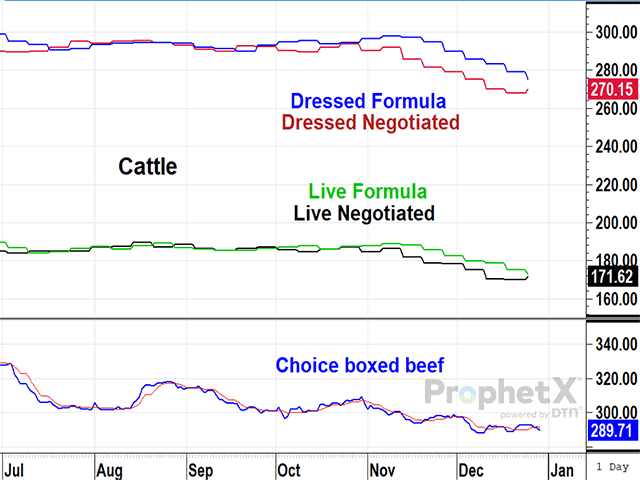

The more interesting part of the cattle market in the final week of 2023 took place on the cash side where DTN reported live trade in the South at mostly $172, $1 higher on the week, while northern trade was mostly $2 to $3 at $272 to $273. After eight weeks of packers showing little interest in negotiated cattle, it appears demand is finally coming back to the country.

Pertaining to retail demand, the price of choice boxed beef was down $3.22 in the final week of 2023, ending at $289.71, but it's difficult to be worried about the demand side of the market for beef. The U.S. has been pushing record levels of employment for a year now and the return of domestic oil production to a new record high has brought down inflation pressures and given the market new hope for lower interest rates in 2024.

On Jan. 31, USDA will publish its estimates of U.S. cattle and calves inventory on Jan. 1, a report with bullish potential. It is possible the January report will find a smaller U.S. inventory than the 2014 low of 88.5 million, a time when U.S. population was 17 million smaller. Surprises are always possible, but with no sign of herd expansion underway, higher cattle prices still seem likely in 2024.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly Twitter, @ToddHultman1

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .