Sort & Cull

February Live Cattle End Another Week Higher

Editor's note: DTN Livestock Analyst ShayLe Stewart will be out of the office for a few weeks. We will continue to update her Sort and Cull blog with livestock market content. Please send any questions or comments to Editor-in-Chief Greg Horstmeier at greg.horstmeier@dtn.com.

**

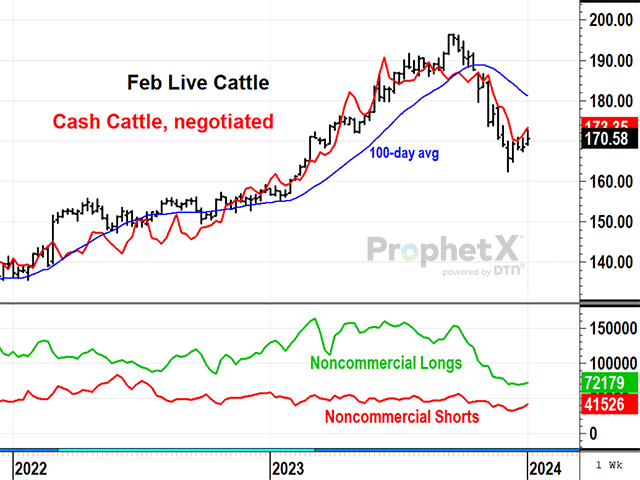

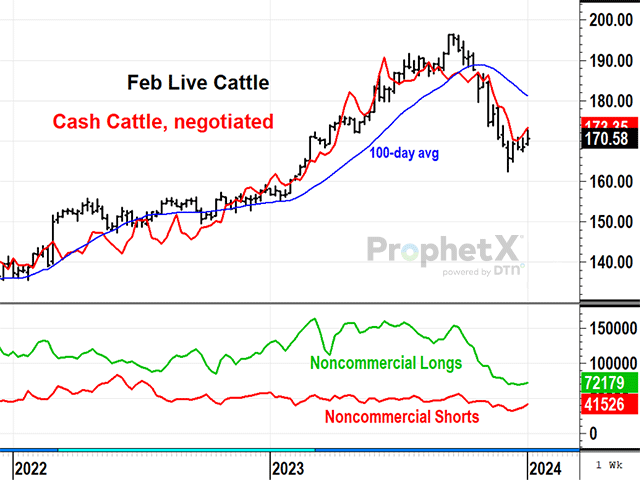

February live cattle closed up $2.07 in the week ending Jan. 5, climbing back to $170.57 from the December low of $162.40. For a third consecutive week, cash cattle prices showed small gains with DTN reporting southern trade $1 higher and northern trade $2 higher on the week. While the selling has abated, the rebound has not been as strong and this week's cash trade was marred by a $12.55 drop in choice boxed beef to $277.16, the lowest since February, while selects were only down 80 cents.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

One interesting wrinkle is seen in the positions of noncommercial shorts in live cattle, the speculative segment of the market that is betting cattle prices will go lower. It was unusual that specs that were short live cattle in September when February futures were above $192 and cash prices were around $187, bought back over 23,000 contracts as February prices fell to their December low. It was the kind of savvy move we would normally see from commercials, not bearish specs that had been wrong for over a year.

It is also curious that this bearish segment of the market added back over 8,000 shorts as February prices bounced up from their low. However, it is not the specs that will determine the outcome of cattle prices in 2024. On Jan. 31, USDA will release its estimates of cattle and calves in the U.S. as of January 1, last seen in July at 95.9 million head with 29.4 million beef cows, the lowest number of beef cows since 1971. Last January's calf count of 13.62 million head was the lowest since 2015 and has a good chance of being even lower on Jan. 31.

In November, USDA's long-term baseline projections estimated the number of beef cows will fall to 98.22 million head in 2024, a drop of more than 2%. For now, that is just a guess, but given the surge of fourth-quarter placements, it is difficult to see how any expansion of the herd has yet begun. For now, the best clues are cash trade, the active slaughter pace and the ability of negotiated cattle prices to hold above $170.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly Twitter, @ToddHultman1

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .