Sort & Cull

Live Cattle Become Black Friday Sale, Encounter More Liquidation

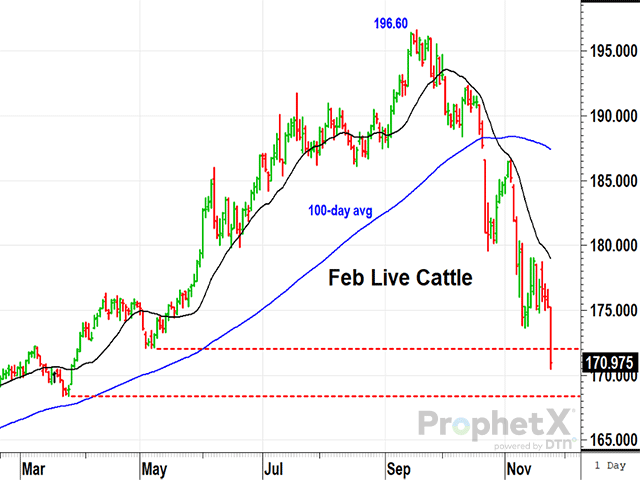

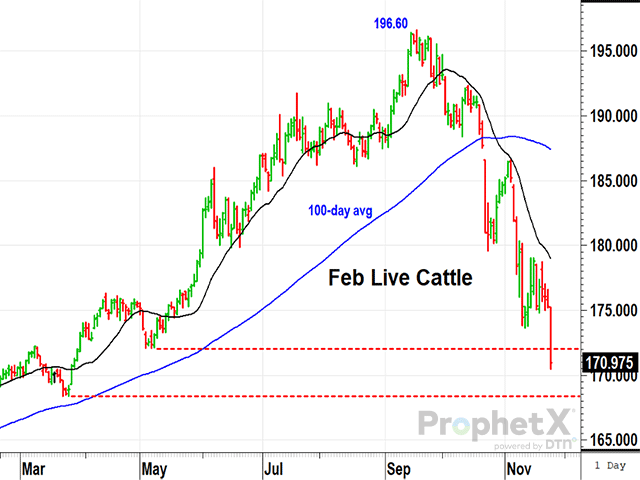

February live cattle closed down $5.82 at $170.97 in the week ending Nov. 24, 2023, the lowest close since March. Of that drop, $4.30 happened on Black Friday, a short post-holiday trading session more known for football games and shopping bargains. It was the third sharp price decline since USDA surprised markets on Oct. 20 with higher-than-expected placements. Placements in the Nov. 17 report were not as high as expected, but Friday's sharp drop in prices showed the liquidation is not over yet. CFTC data last showed non-commercials still net-long 42,815 contracts as of Nov. 17 and the next update will come Monday, Nov. 27, due to the holiday schedule.

It remains to be seen if consumers will benefit from Friday's bargain prices as boxed beef prices were mixed on the week with choice cuts up $4.16 and selects down $1.94. Cash trades were a bit scattered during the holiday week but were generally $1 to $2 lower -- not as bearish as the losses on the week's futures board.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Technically speaking, Friday's lower close in February live cattle fell below the May low near $172, but it may be wise to give prices a few days to see if Friday's close was an honest reflection of a worried market or if it was a bearish raid by traders, taking advantage of holiday distractions. Friday's low put February cattle prices down 13% from the September high of $196.60 and has seen open interest decline 14% during that time, significant liquidation from weak hands. It will be interesting to see how much more noncommercial liquidation takes place in Monday afternoon's report.

The toughest part about cash prices since the October on-feed report is that packers have shown little need for negotiated supply, reinforced by significant discounts in negotiated prices below formula. To see support return to cattle, a firmer showing of negotiated prices will be an important key, something to watch for in Monday's USDA reports.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .