Canada Markets

Statistics Canada Reports Higher Production

The size of Canada's crop grew larger on paper following Statistics Canada's December report. It included the first producer surveys conducted on crop production for 2023. The survey was conducted from Oct. 6 to Nov. 12, with 27,200 producers surveyed. This report also changes from previous reports in that all provinces are surveyed.

According to Statistics Canada's estimate for total field crop production, 89.849 million metric tons (mmt) were produced in 2023, down 7.5% from 2022 and 2.3% below the five-year average. Next to the drought-reduced crop of 72.9 mmt in 2021, this is the second smallest production estimated in eight years. Late rains on the prairies saw conditions improve in the late season similar to the Midwest row crop experience.

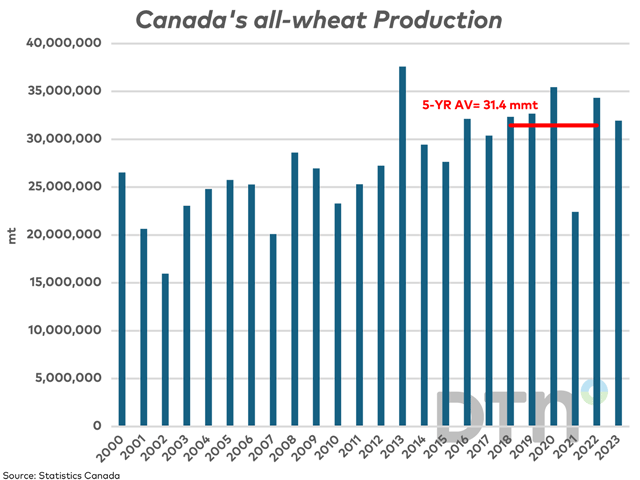

Canada's all-wheat production was estimated at 31.954 mmt, up from the 29.8 mmt estimate released in September derived from August model data. This volume is down 6.9% from the estimated 2022 production, while 1.6% higher than the five-year average. This would be the seventh-largest wheat crop produced. It is interesting to note that since the model-based approach was used exclusively in 2020, the all-wheat forecast has been revised higher in three of four years in the December forecast.

The largest revision was made for spring wheat with the estimate revised 2.1 mmt higher to 24.762 mmt. The figure is above expectations, down 4.2% from last year, 4.8% higher than the five-year average and the fifth-largest crop seen in Statistics Canada tables. The yield estimate for Saskatchewan spring wheat is 44.3 bushels per acre (bpa), higher than the provincial government's final estimate of 42.6 bpa for hard red spring wheat and 43.5 bpa for other spring wheat varieties. The official spring wheat estimate for Alberta is 47.1 bpa, which compares to the province's dryland forecast of 43.4 bpa. The average estimate for Manitoba is 58 bpa, in line with the 55-60 bpa estimate released by the Manitoba government.

Today's estimate helps explain the rapid pace of exports achieved over the first 17 weeks of the crop year. It is interesting to note that while 2.1 mmt is added to AAFC's export forecast for 2023-24, the current pace of exports is still ahead of the pace needed to reach this forecast. This considers licensed exports only, excluding unlicensed exports and the export of flour.

Given today's production estimates, 81.8% of production is hard red spring wheat, the smallest percentage calculated in seven years, which compares to the five-year average of 83.9% and the 10-year average of 83.6%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Traders took the news of increased Canadian production in stride, with spring wheat following winter wheat higher today, poised to close higher for a fifth session and above the contract's 20-day moving average for the first time since Nov. 15. Soft red winter sales reported by the U.S. to China are a driver in today's trade.

Durum protection was revised slightly lower this month to 4.045 mmt, down 30.1% from one year ago and 22.8% below the five-year average. This estimate came close to expectations; the December durum production estimate has been revised lower in three of the past four years (2020-23).

Statistics Canada revised canola production higher by 959,606 metric tons, as widely expected, to 18.328 mmt, down only 2% from 2022 and down 1.5% from the five-year average. Statistics Canada tables show this to be the ninth-largest crop on record. It is interesting to note that Statistics Canada's yield estimate for Alberta is .5 bpa higher than the Alberta government's estimate, which is 1.6 bpa higher than the Saskatchewan government's estimate. It is also 1.2 bpa higher than the 42 bpa estimate released by Manitoba Agriculture.

Following the release of this data, the January contract traded within $1/mt in both directions, reaching a high of $5.30/mt above Friday's close while late-morning weakness in the soy complex dragged canola lower.

Canada's barley production was revised higher on better-than-expected yields, with production estimated at 8.896 mmt, down 10.9% from a year ago and 4.3% below the five-year average. This is just over 1 mmt higher than the estimate released in September and may weigh further on prices with exports facing increased competition from Australia into China and the U.S. producing a record corn crop.

Oat production was revised higher to 2.636 mmt, still the lowest production seen in 13 years. This volume is down 49.6% from one year ago and 35.3% from the five-year average. Oat stocks will remain close to historic lows in 2023-24.

Lentil production was revised slightly higher to 1.671 mmt, as expected in pre-report estimates, down 27.4% from one year ago and 26.3% below the five-year average. Dry pea production was revised higher to 2.609 mmt, also as expected in pre-report estimates, while it remains 23.8% below 2022 and 27.8% below the five-year average.

Canada's soybean production was revised slightly higher to 6.981 mmt, up 6.7% from 2022 and 6.8% higher than the five-year average. This is the highest production seen in five years, coming in near the upper end of pre-report estimates. Quebec grew production by 12.6% to a record 1.269 mmt while Ontario grew production by 1% year-over-year to 4.036 mmt, the highest estimate in five years. Manitoba's lower yields were offset by a sharp 41% increase in harvested acres, with production estimated at 1.567 mmt, up 18.8% from last year, the highest in five years and the fourth highest on record.

Corn production across the country was revised slightly higher to a record 15.076 mmt, slightly higher than the average of pre-report estimates seen in two polls conducted in the trade. This volume is up 3.7% from last year, while 7.7% higher than the five-year average. Quebec production fell by 6.1% to 3.3 mmt, the smallest crop produced in three years. Ontario production at 9.632 mmt is up 2% from last year while the second-largest crop on record. Manitoba's corn production surged 34% on sharply higher acres planted, with production estimated at a record 1.786 mmt.

**

It's time to register for DTN's Virtual Ag Summit on Dec. 5 and 6, a virtual event that offers discussions of farmland values, tax advice, the latest technological advances and the challenges of having a family business. On Dec. 6, DTN Ag Meteorologist John Baranick will give an early glimpse of what to expect from the weather in 2024 and DTN Lead Analyst Todd Hultman will give his best assessment of where he thinks corn and soybean prices are headed in the year ahead.

Register for this free event at www.dtn.link/DTNAgSummit23. Can't make it those two days? A recorded link will be provided, but you need to register.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .