Canada Markets

Canola Shipments Slow in Week 17

The Canadian Grain Commission reported 87,000 metric tons (mt) of canola exported in week 17, or the week ending Nov. 25, the smallest volume shipped in three weeks and compares to the four-week average of 158,475 mt and the 160,000 mt needed this week in order to stay on track to reach Agriculture and Agri-Food Canada's current 7.7-million-metric-ton (mmt) forecast. This data was presented just ahead of Statistics Canada's Dec. 4 production estimates, with pre-report polls pointing to an expected upward revision in the canola production estimate for 2023.

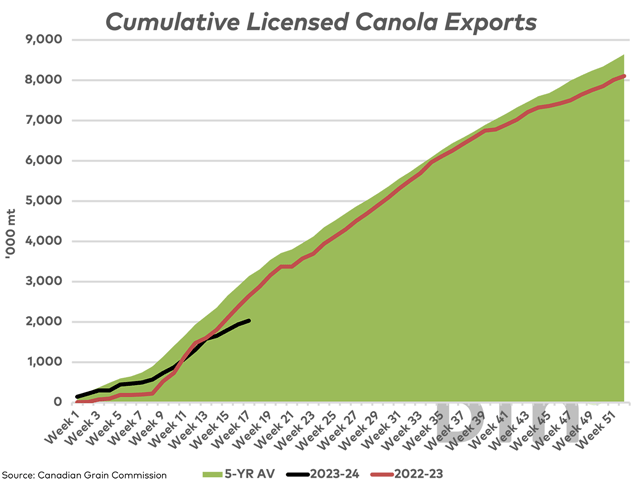

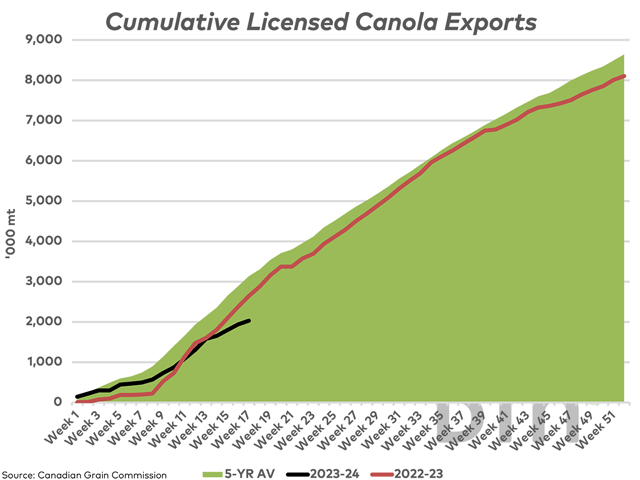

Cumulative exports of 2.0267 mmt are down 617,000 mt or 23.3% from the same period in 2022-23 while down 1.1 mmt or 35.4% from the five-year average. This is seen by the trend in the black line on the attached graphic, with the trend seen flattening on the chart when compared to the previous crop year (red line) and the five-year average (green shaded area).

When one considers the seasonality of historical canola shipments, we see that over the past five years, week 17 exports accounted for 30.6% to 45.3% of total exports for the crop year, averaging 37.1%. When this average pace is used to project forward exports for 2023-24, this suggests movement of 5.5 mmt, well-below the current 7.7 mmt AAFC forecast and the 7.954 mmt shipped in 2022-23. As in all things market related, historical data may play a limited role in describing the future.

As mentioned in Thursday's Plains and Prairies Closing Comments, UkrAgroConsult reports that China News is indicating that large shipments of Canadian canola have been received by China's crushers in November, accounting for a large surge in stocks over the month. At the same time, rapeseed oil imports are also seen increasing, leading to what is viewed as an oversupply of rapeseed oil and pressure on prices. A DTN ProphetX chart shows the price of Canadian canola at China's ports has increased $4/mt USD this week to $566.50/mt USD, down from the Nov. 13 high of $580.75/mt USD which was a four-week high.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Positive data is seen in the CGC's domestic disappearance data, which shows disappearance at 202,900 mt for week 17, above 200,000 mt for the seventh time this crop year and above the volume needed this week to reach the current AAFC forecast. Cumulative disappearance is seen at 3.4752 mmt, up 9.7% from the same period in 2022-23 and 7.7% higher than the five-year average.

Total disappearance of canola is reported at 5.5019 mmt as of week 17, down 5.3% from the same period in 2022-23, while behind the pace forecast by AAFC who have forecast an expected drop of 3.6% year-over-year.

**

It's time to register for DTN's Virtual Ag Summit on Dec. 5 and 6, a virtual event that offers discussions of farmland values, tax advice, the latest technological advances and the challenges of having a family business. On Dec. 6, DTN Ag Meteorologist John Baranick will give an early glimpse of what to expect from the weather in 2024 and DTN Lead Analyst Todd Hultman will give his best assessment of where he thinks corn and soybean prices are headed in the year ahead.

Register for this free event at www.dtn.link/DTNAgSummit23. Can't make it those two days? A recorded link will be provided, but you need to register.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @CliffJamieson

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .