Canada Markets

Statistics Canada Estimates 2023 Seeded Acres

Statistics Canada released its Principal field crop areas, 2023 report today. The agency reports that planting intentions were obtained in producer surveys from Dec. 12, 2022, to Jan. 14, 2023, which involved 9,500 producers. This is the first time that this survey was not conducted during the month of March, with this report historically referred to as "March intentions." In addition, Statistics Canada surveyed 9,500 producers, which is 2,000 lower than the 11,500 producers surveyed in 2022.

Statistics Canada stated "This change is part of the ongoing AgZero initiative within the Agriculture Division at Statistics Canada, which aims to assess the feasibility of using alternative methods to produce quality estimates." This sounds like code for cost cutting, which could have a detrimental effect on the accuracy of estimates.

According to Statistics Canada tables, 77.832 million acres will be seeded to the principal field crops in 2023, up 651,000 acres from 2022. This is made possible by a 671,000-acre reduction in estimated summer fallow acres, which are estimated at a historic low of 1.319 million acres, although by a narrow margin.

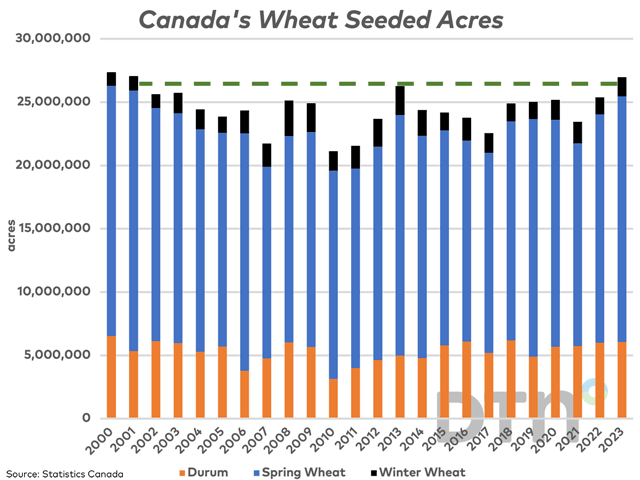

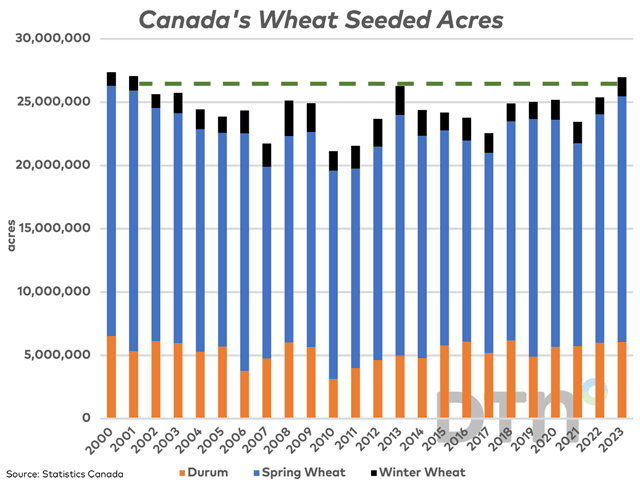

As widely expected, Canada's wheat acres are forecast to surge, with all-wheat acres estimated at 26.968 million acres, up 6.2% from 2022 and would be the largest area seeded since 2001, if achieved. (See attached chart). This area is 8.8% higher than the five-year average and lands at the upper end of the range of pre-report estimates seen from a number of sources.

The largest change is seen in spring wheat acres, which are estimated at 19.390 million acres, up 7.5% from last year and 10.1% higher than the five-year average, also landing at the upper end of the range of pre-report estimates. Like the all-wheat estimate, the estimate for spring wheat acres is also the largest seen since 2001.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

All three prairie provinces are forecast to increase spring wheat acres, with Saskatchewan increasing spring wheat acres by 10.2%, Alberta by 5.9% and Manitoba by 4.2%. While Saskatchewan producers plan to seed the largest area in 10 years, the estimate for Alberta is the largest since 1993.

Durum acres are expected to rise by a modest 0.9% to 6.062 million acres, which is 6.3% higher than the five-year average. Pre-report estimates were leaning towards a slight drop in acres. The increase in acres is taking place in Saskatchewan, with acres rising by 2.9% to 5.005 million acres, which would be the largest area seeded since 2008. Alberta producers are forecast to reduce acres by 5.4% to 1.028 million acres.

Canola acres seeded in 2023 are forecast to increase by a modest 0.9% to 21.597 million acres, slightly below the majority of pre-report estimates and 0.4% lower than the five-year average. Producers see varying opportunities across the Prairies, with Saskatchewan producers increasing acres by 3.7% while Alberta producers are forecast to reduce acres by 2.6% and Manitoba producers forecast to lower acres by 0.9%. This is viewed as supportive for the market overall, with canola showing strength along with European rapeseed on Wednesday, although is led by the July contract. There are some reports of canola seed shortages on the Prairies that may have an overall effect on this forecast. This forecast will be viewed as troubling, given the massive expansion of crush capacity planned for the Prairies.

Barley acres are expected to rise by 0.6% to 7.085 million acres, which is 3.8% lower than the five-year average. This was below the average pre-report estimates. This is also below the 7.4 million acres estimated by AAFC this month, a forecast that included a modest 100,000 mt increase in year-over-year stocks. Reports are indicating that Australia has come to an agreement with China to allow exports to resume, a move that is expected to severely impact Canada's barley exports to China, which could further limit the potential for acres to grow.

Producers in Manitoba are forecast to reduce barley acres by 14.4% and Saskatchewan producers are forecast to lower acres by 4.7%, while Alberta producers are forecast to increase acres by 7.3%, which will be viewed favourably by the Alberta livestock industry.

The area dedicated to oats is forecast to fall by 22.4% to 3.056 million acres, or the lowest area in five years, while 15.7% below the five-year average. This estimate was close to the forecast seen in pre-report estimates. A quick glance at Saskatchewan Agriculture's weekly data shows the price for No. 2 CW oats down 48.4% or $213/mt from one year ago, while AAFC is estimating 2022-23 stocks to rise by 917,000 mt or 275% year-over-year, deterring producers.

Saskatchewan producers are forecast to lower the area seeded to lentils in 2023, with the estimated area down 8% to 3.976 million acres, which would be the lowest in four years and 2.1% below the five-year average. This area is close to pre-report expectations. The area intended for dry peas is forecast to fall by 4.6% in 2023 to 3.212 million acres, a fourth consecutive drop to a level that is 17.3% below the five-year average. This is exactly equal to the current AAFC forecast for 2023-24, which shows ending stocks remaining unchanged year-over-year, with a higher 2022-23 carryout offsetting an expected drop in production.

Sobyean acres are forecast at 5.512 million acres, up 4.5% from 2022 and 0.1% higher than the five-year average. This area is slightly lower than expected in pre-report estimates. It is interesting to note a shift in acres to the west, with a 4.8% drop in Quebec acres, a 5.4% drop in Ontario acres, by far the largest producer at 2.915 million acres, which is offset by a 37.3% increase in Manitoba acres. Manitoba producers are estimated to seed 1.559 million acres, or the largest area seeded in five years. The 423,700-acre increase in Manitoba is the second largest year-over-year increase on record, next to the 644,603 acre increase reported for 2017.

Corn acres for grain are estimated to rise by 2.8% from last year to 3.725 million acres, roughly as expected in pre-report estimates. This area is up 2.4% from the five-year average and represents a record area for the country. While Quebec acres are forecast to remain steady in 2023, Ontario producers are expected to increase acres by 3.1% to a record 1.112 million and Manitoba producers are expected to increase corn area by 21.9% to a record 461,600 acres.

The next Principal field crops report will be released on June 28.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .