Canada Markets

November Canola Response to Statistics Canada's First Acreage Estimates

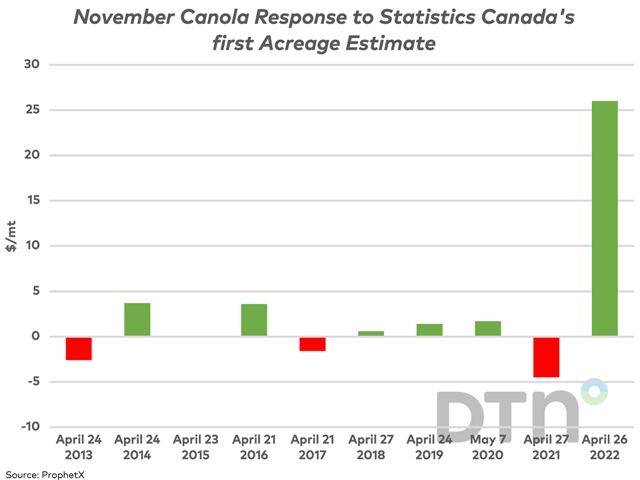

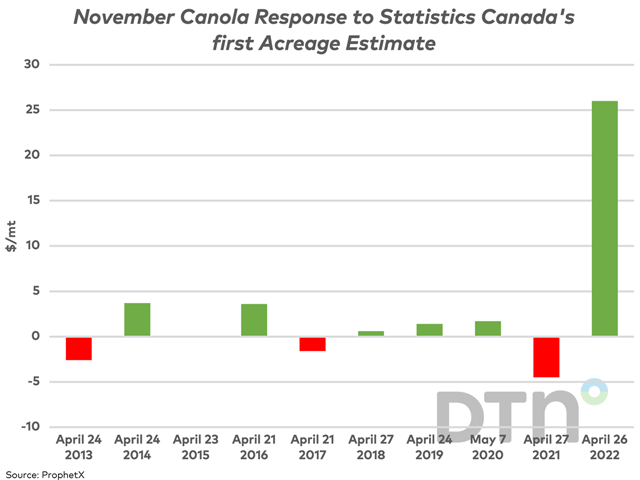

Ahead of the April 26 release of Statistics Canada's Principal field crop areas report, based on March producer surveys, we look at the daily move in the November canola contract on the day of the report for the past 10 years.

Over this period (2013 to 2022), the November contract has ranged from a drop of $4.50/metric ton in 2021 to a gain of $26/mt in 2022. The November contract has fallen three times on report day over the past 10 years, increased on six of the 10 years and closed unchanged in one of the 10 years. The overall average indicates that the report is not a huge driver of price, averaging a $2.83/mt gain over the 10 years, while averaging a $0.26/mt gain in the nine years prior to 2022 (2013 to 2021).

In April 2022, Statistics Canada dealt a blow to the canola market, estimating acres down 7% from the previous year which was 6% below the previous five-year average. Acres to be planted were estimated at 20.9 million, with the range of pre-report estimates from 21.6 million to 22.75 million acres, while AAFC's unofficial estimate showed an area that was down 3.2% at 21.745 million acres.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The canola market was already in an uptrend, while gained $26/metric ton (mt) following the report along with a further $16.30/mt gain over the two days following to reach a high of $1,128/mt on April 29, an all-time high for any November contract.

On July 5, Statistics Canada's June report indicated that canola acres would fall by 4.7% to 21.4 million metric tons (mmt), or 500,000 mt higher than the initial report. Seasonal factors ahead of harvest saw the November contract reach a Sept. 8 low of $766/mt.

While big moves are uncommon, 2022's estimates remain a fresh reminder that it can happen.

Ahead of the 2023 report on April 26, five sources of pre-report estimates range from a drop of 200,000 acres to an increase of 1.1 million acres, with four of five sources pointing to a year-over-year increase in acres. At the same time, either end of the range of estimates could result in a significant price move.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .