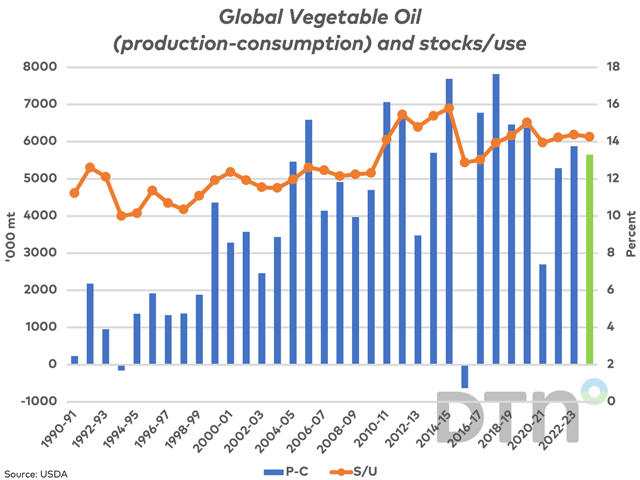

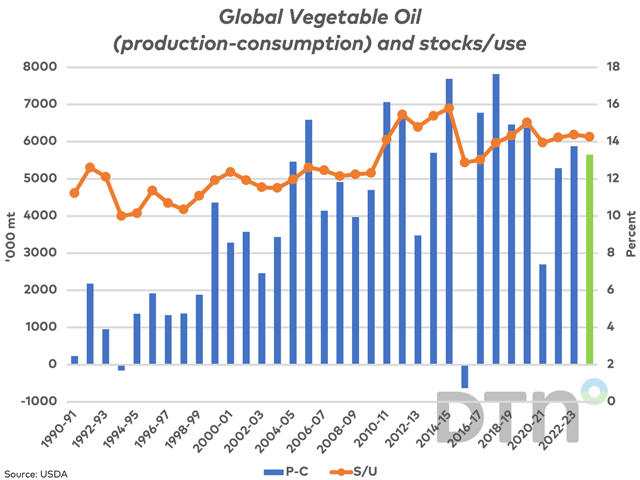

The amount by which global vegetable oil production exceeds global consumption is forecast to fall for the first time in three years, while the global stocks/use ratio for the nine vegetable oils combined is forecast to remain flat.

The amount by which global vegetable oil production exceeds global consumption is forecast to fall for the first time in three years, while the global stocks/use ratio for the nine vegetable oils combined is forecast to remain flat.

As of Aug. 7, an estimated 4% of the provincial harvest is complete, which compares to the five-year average of 2%.

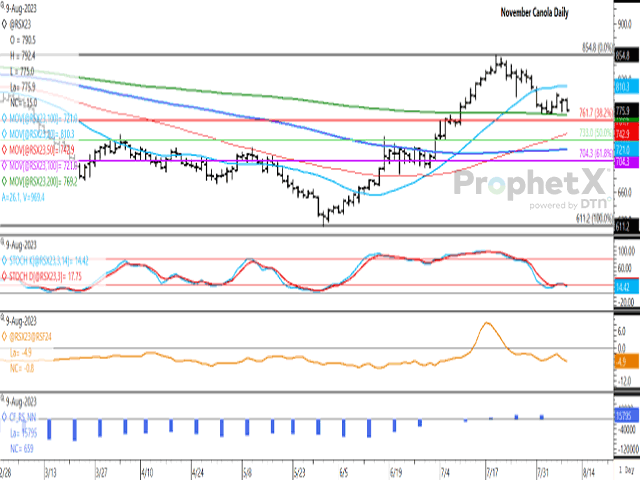

Nearby November canola continues to struggle, although remains above support and is trading sideways overall.

Statistics Canada's June exports represent the first 11 months of 2022-23 and the first 10 months of the row-crop crop year. This study looks at miscellaneous trade data for grain and grain products.

China has penalized Australia with an 80.5% anti-dumping tariff since 2020, which will come to an end on August 5. This will have implications for Canada's barley trade.

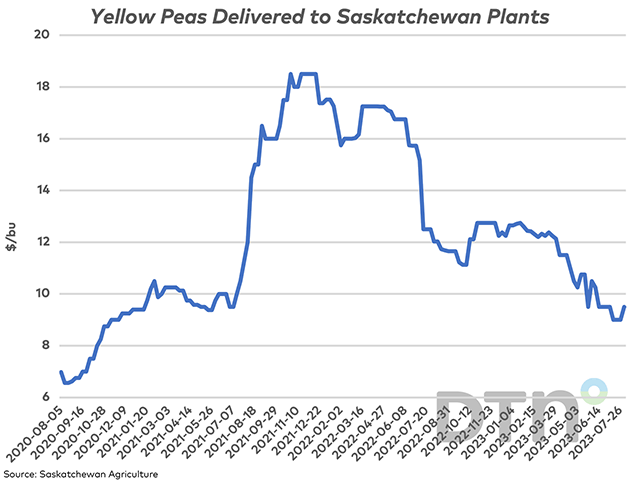

Saskatchewan yellow pea bids are reported higher as combines start to roll.

The Canadian dollar has given up close to 1 cent against the USD in the past two sessions.

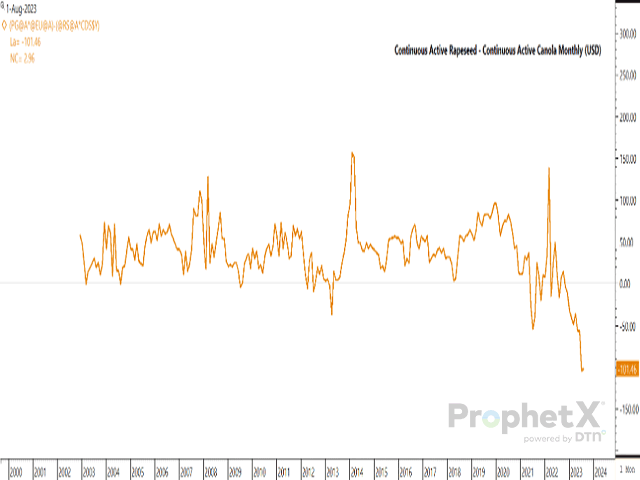

This monthly chart shows the rapeseed/canola spread closing at its largest spread on record over the month of July.

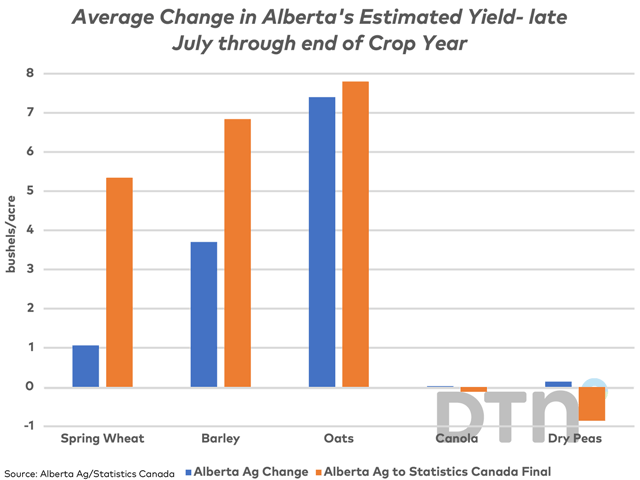

This study looks at Alberta Agriculture's initial crop yield estimate and how it relates to the final Statistics Canada estimate on average for select crops.

After pressure for producers and prairie farm groups, the Canadian Grain Commission has repealed their wheat grading changes set to be implemented on Aug. 1 that would have resulted in lower grades and prices for producers.

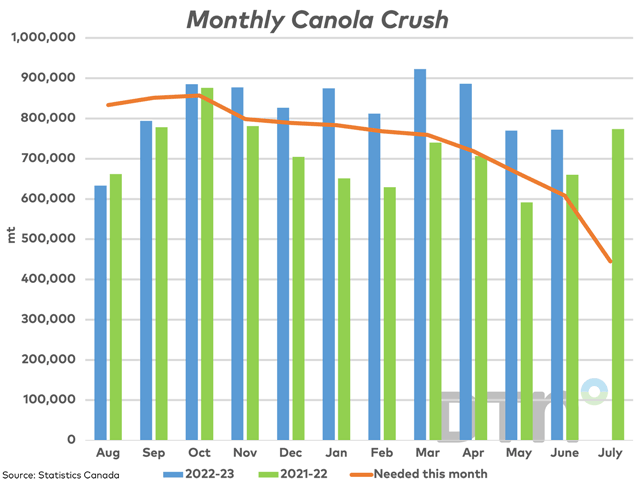

Statistics Canada reports the June canola crush up slightly from the previous month, while is nearing the crop year forecast set by AAFC.

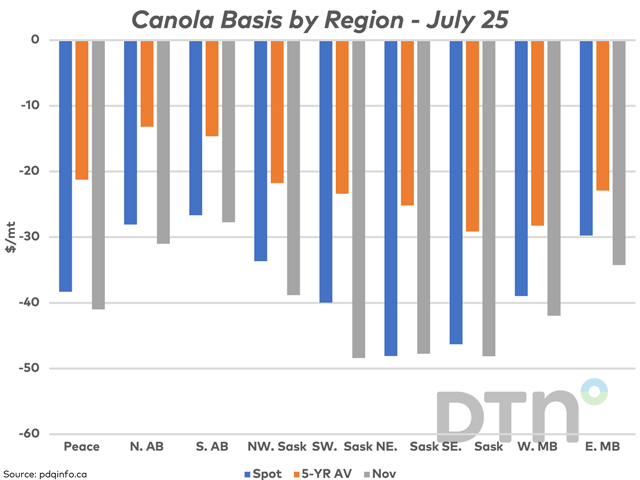

Despite uncertainty surrounding canola's prairie production potential and export trade from Ukraine, bearish commercial signals are seen.

AAFC's July revisions has led to a year-over-year drop in forecast all-wheat stocks from 2021-22 to 2022-23 for the first time.

The December spring wheat contract has broken through resistance in recent days while breaking out of a range traded since December.

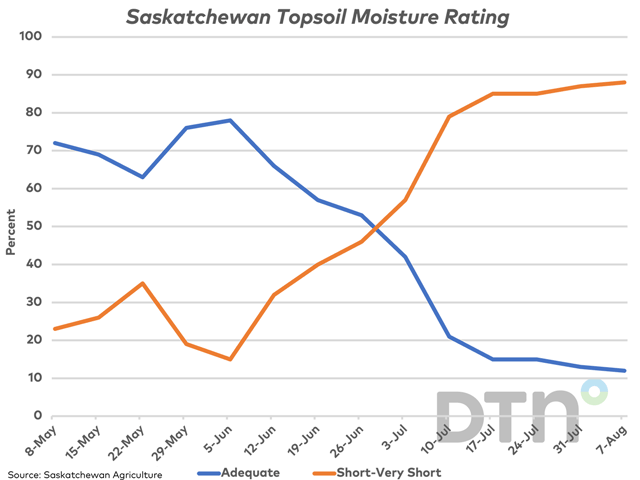

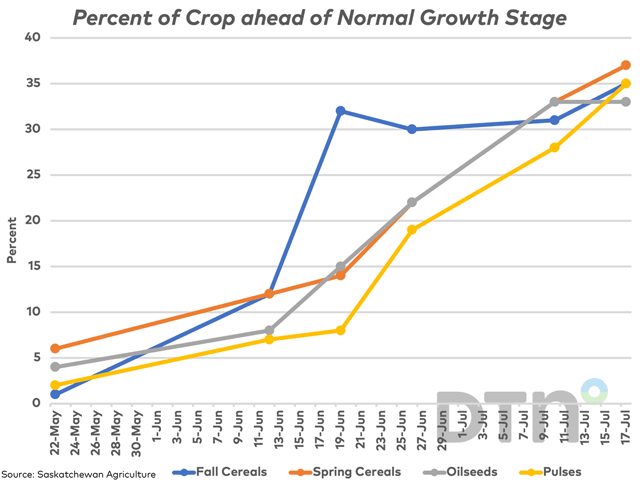

The Saskatchewan government's Crop Report shows a significant and growing percentage of the crop ahead of normal growth stages as of July 17, signaling the likelihood of an early harvest.

The December spring wheat contract has broken through resistance in recent days while breaking out of a range traded since December.

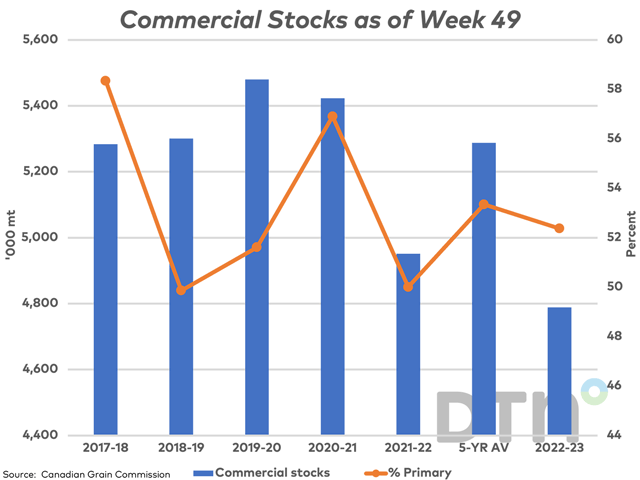

Commercial stocks of all principal field crops are reported at the lowest level seen in 10 years as of week 49.

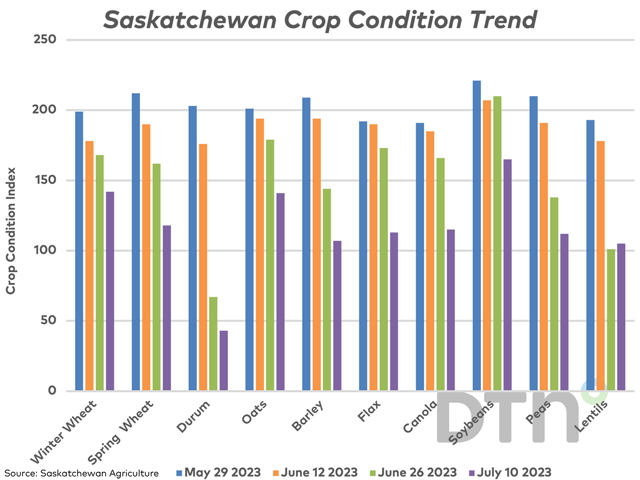

The crop condition index calculated for most Saskatchewan crops slid lower over the past two weeks as dry conditions expand.

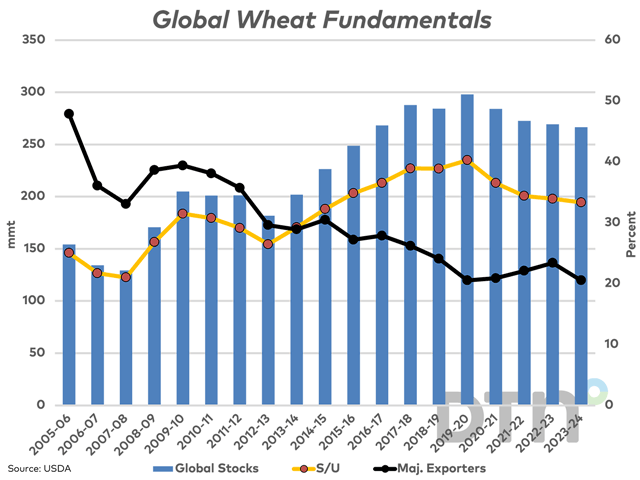

The USDA's July revisions saw a switch from a year-over-year increase in global wheat stocks to a drop in stocks forecast for a fourth year.

Despite the looming end of the current Black Sea deal that allows for exports of Ukrainian grain and products, European milling wheat is trading sideways.

DIM[2x3] LBL[blogs-canada-markets-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-canada-markets-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]