Canada Markets

Commercials Send Bearish Signals

Despite dry soils across the Prairies, a lack of precipitation making its way to southern areas of Saskatchewan and Alberta, a sharply lower production forecast for Australia and growing concerns over Ukraine's ability to export grains, including rapeseed, bearish signals are seen in the canola market.

CFTC data for the week ending July 18 shows noncommercial traders moving from a bearish net-short to a bullish net-long position for the first time since early January or in 28 weeks. The position was modest at 4,109 contracts net-long, while there is a chance that this week's Friday data release will show that the speculative trade may have returned to a bearish net-short as of July 25.

The Nov/Jan futures spread reached a bullish inverse of $9/mt as of July 17 but this spread has weakened every day since and as of Wednesday morning, is seen at minis $3.20/metric ton or a carry of $3.20/mt, the weakest spread seen since July 10.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Another signal is the Nov23/July24 futures spread, a relationship that spans the crop year. This spread reached an inverse of $46.50/mt on July 19 (November over the July), while on Wednesday morning is seen at $15.60/mt, with front-end trade losing its lustre relative to the back month.

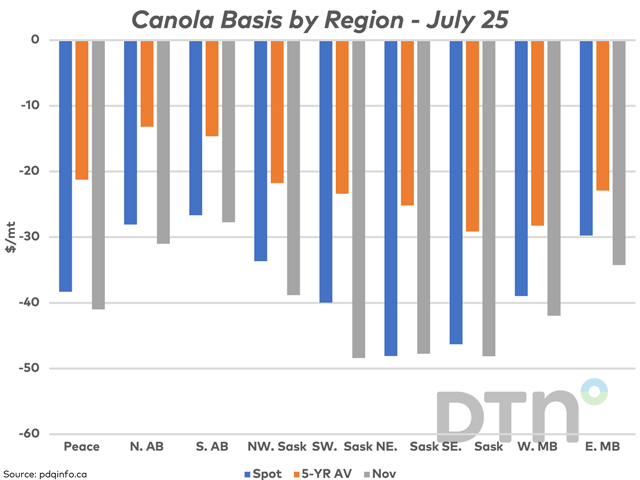

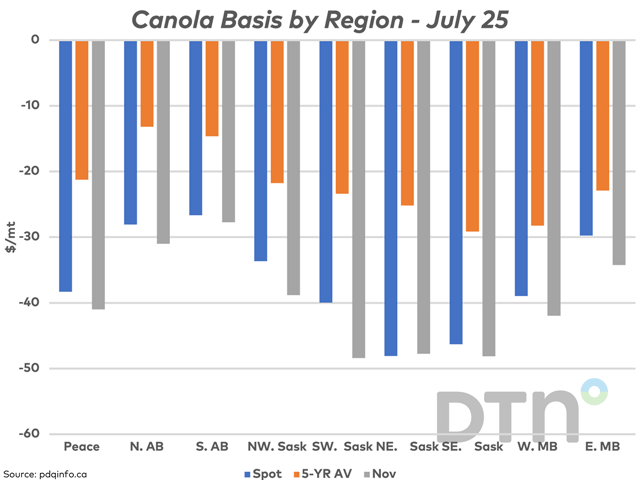

Another signal is seen in cash prices as reported by pdqinfo.ca. The average spot basis across the nine prairie regions monitored weakened from $6/mt to $10.35/mt on July 25, while as seen on the attached chart, spot cash basis (blue bars) is weaker than the five-year average across the prairies (brown bars).

Despite a tight carryout expected as of the end of July and uncertainty surrounding production, the new-crop November delivery basis (grey bars) is even wider or weaker across the nine prairie regions monitored.

A positive technical signal was seen on July 25 when the November contract bounced from a low of $796/mt, with psychological support of $800/mt kicking in which led to a close near the upper end of the session's $37.30/mt trading range. Also, despite recent volatility, the November contract has closed within a narrow $6/mt range over the past three sessions.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .