Technically Speaking

Weekly Analysis: Grain Markets

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.37, down 13 cents for the week. The secondary (intermediate-term) trend is sideways as the NCI.X tests initial support at $3.36. Below that is an area of support calculated between $3.29 and $3.23. Weekly stochastics remain neutral-to-bearish above the oversold level of 20%.

Corn (Old-crop futures): The March contract closed 10.00cts lower at $3.64 1/2. All three trends (major, secondary, and minor) are sideways though the contract is testing secondary (intermediate-term) support at the recent low of $3.62 1/2. Major (long-term) support remains at $3.50 1/4. Weekly (secondary) stochastics are bearish below the oversold level of 20%.

Corn (New-crop futures): The December 2016 contract closed 8.00cts lower at $3.89. The secondary (intermediate-term) trend remains down with initial support at the 4-week low of $3.85 3/4. Below that is the contract low of $3.77 posted the week of August 10, 2015. Weekly stochastics are neutral-to-bearish above the oversold level of 20%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

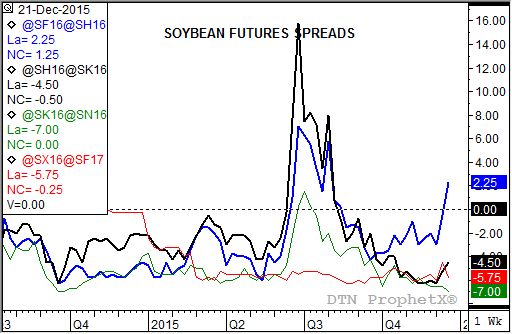

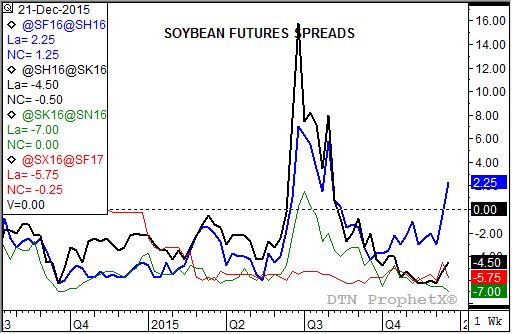

Soybeans (Cash): The DTN National Soybean Index (NSI.X, national average cash price) closed at $8.25, down 21 cents for the week. The secondary (intermediate-term) trend is sideways with initial support at the 4-week low of $8.16, then the major (long-term) double-bottom low near $8.09. Weekly stochastics are neutral-to-bearish above the oversold level of 20%. However, support could continue to come from the uptrends in old-crop futures spreads (See chart. Blue line = January to March spread, black line = March to May spread).

Soybeans (Old-crop futures): The March contract closed 19.75cts lower at $8.73. The secondary (intermediate-term) trend is sideways between the recent high of $9.11 1/2 and contract low of $8.47. March beans are holding near the mid-point of $8.79 1/4. Weekly stochastic are neutral-to-bearish above the oversold level of 20%.

Soybeans (New-crop futures): The November 2016 contract closed 17.25cts lower at $8.90. The secondary (intermediate-term) trend is sideways between the recent high of $9.26 1/2 and contract low of $8.50. Nov beans are holding near the mid-point of $8.88 1/4. Weekly stochastic are neutral-to-bearish remain neutral-to-bearish.

SRW Wheat (Cash): The DTN SRW Wheat National Index (SR.X, national average cash price) closed at $4.28, down 12 cents for the week. The SR.X remains in a wide ranging secondary (intermediate-term) sideways trend. Initial support is at $4.20, then $4.11. Initial resistance is at the high of $4.54, then $4.77.

HRW Wheat (Cash): The DTN HRW Wheat National Index (HW.X, national average cash price) closed at $3.99, down 23 cents for the week. The secondary (intermediate-term) quickly turned sideways once again with the HW.X closing last week at its previous low of $3.99. A move below this level would project a major (long-term) target of $3.66 (the previous low of $3.99 minus the previous short-term sideways range of 33 cents). The major low remains near $3.42 from June 2010.

HRS Wheat (Cash): The DTN HRS Wheat National Index (SW.X, national average cash price) closed at $4.81, down 6 cents for the week. The secondary (intermediate-term) trend remains down. Next support is at the major (long-term) low of $4.44 from September 2015. Weekly stochastics are bearish.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .