Technically Speaking

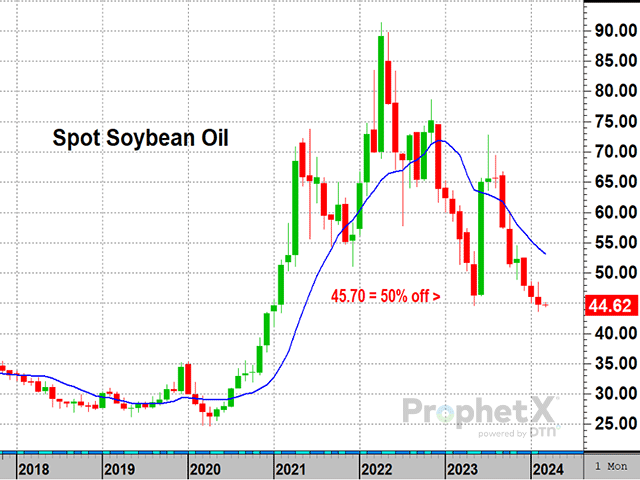

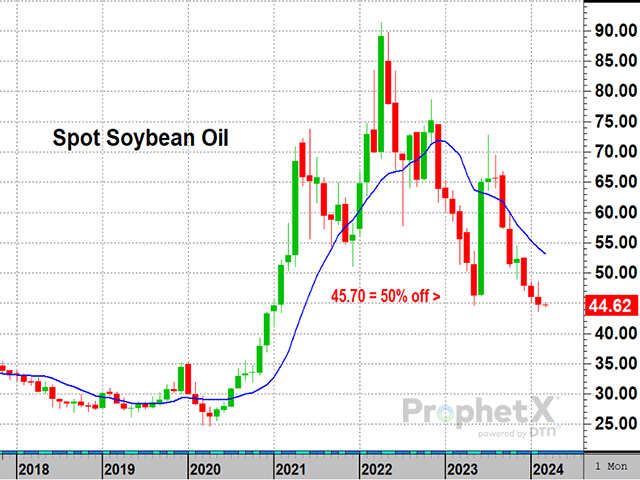

Can Soybean Oil Prices Find Support Amid 2024's Bearish Mood?

March soybean oil closed at 44.62 cents Friday, March 1, a gain of 0.60 cents on the week after posting a loss of 1.36 cents in the month of February. Technically speaking, the current price is an interesting level of possible support as prices finished the week slightly above a prior low, made in the week ended June 3, 2023. The low of that week was 44.53, a level of support described as a half-off sale in a DTN closing market video on June 2 and discussed in a subsequent Todd's Take on July 28: https://www.dtnpf.com/…. Not to be confused with a 50% retracement, the half-off sale is a popular tool used by the retail industry to generate demand for a limited time and is known for bringing customers in the door.

Given the seven-month selloff in soybean oil prices, it will be interesting to see if the half-off sale will once again generate bullish enthusiasm or be ignored. One of the difficulties this time is that the grain market, in general, is in a depressed mood. Specs are short record amounts of grain and oilseed contracts and 2024 prices have been on a downhill slide. On the other hand, the U.S. Energy Department reported a record high 13.02 billion pounds of soybean oil were used to make biofuels in 2023, 24% more than the previous year. At the same time, spot palm oil prices are showing unusually bullish behavior, getting close to challenging this year's highest palm oil price.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As of Friday, March 1, the March soybean oil contract is in its delivery period and the May contract is priced 0.54 cent above the March at 45.16 cents. Specs are net short 38,926 contracts of soybean oil as of Feb. 27, the largest short position since May 2019. So far, the trend in soybean oil remains down; but a close in the May contract, above the January high of 48.89 cents, if it happened, would be an early bullish hint of a possible change in trend for soybean oil and offer a bullish influence to the market's demand for soybeans.

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

Follow him on X, formerly Twitter, @ToddHultman1

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .