Technically Speaking

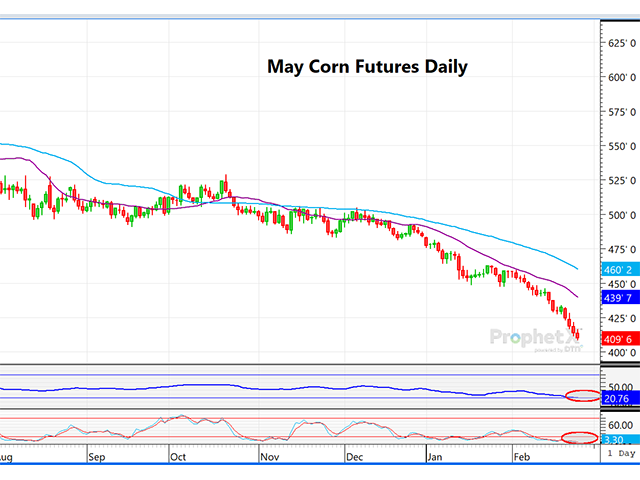

Corn Futures Very Oversold as Funds Continue to Pile Into New Shorts

May corn has continued to move sharply lower, and a lower close Monday would be the eleventh in the past 15 trading days. In that time, commodity funds, or large speculators have added to a growing and now record net-short position in corn. As of last Tuesday, Feb. 20, the CFTC tells us the position for all noncommercial traders is a record net-short 266,000 contracts. In the group of managed money funds, the net-short amounts to a near-record 329,000 contracts as of Tuesday. These funds will typically have options positions along with futures. If you add in additional estimated fund selling for last Wednesday through Friday, it is likely the fund position is now closer to 355,000 contracts and a new record short. While the trend has definitely been the friend of fund managers, the position may be getting extreme, and we are entering a period of seasonal strength. I am not sure what bullish catalyst might encourage fund managers to take profits and buy in corn. However, this is a market that seems to be as technically oversold as I have seen in years. That does not mean we will rally corn immediately, but when funds go to unwind this monstrous position and buy in their shorts, watch for a dynamic rally to ensue. However, we do need a catalyst, and so far, one has not emerged.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As in corn, the soybean market has been stair-stepping down to new lows, with another new one registered Monday morning. As in corn, funds have also loaded the boat on the short side, with the noncommercial traders net short close to 161,000 contracts as of Tuesday -- a record large position. Soybeans, unlike corn, have an export profile that is poor, with sales off 20% from a year ago. While USDA already lowered sales by 35 million bushels (mb) in February, it seems safe to say another reduction is coming. However, many private crop scouts and analysts have their Brazil soybean crop production estimate far below USDA. Many are in the 145 million metric tons (mmt) to 149-mmt camp compared to USDA's lofty 156-mmt estimate. Granted, there will be more soybeans coming from Argentina this year following last year's drought. However, the jury is still out on Brazil's final production and the U.S.'s yet-to-be-planted crop. Once again, although the bullish catalyst is so far absent, once funds decide to cover their shorts in soybeans we could see a big run-up in prices, much as we saw the big plunge in soymeal when funds exited their record net long a few months ago. It is just something to keep an eye on as we go forward. Soybeans are also very oversold with respect to momentum indicators.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@DTN.com

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .