Technically Speaking

Corn Has Valid Reasons to Rise in the Short Run, but Will It?

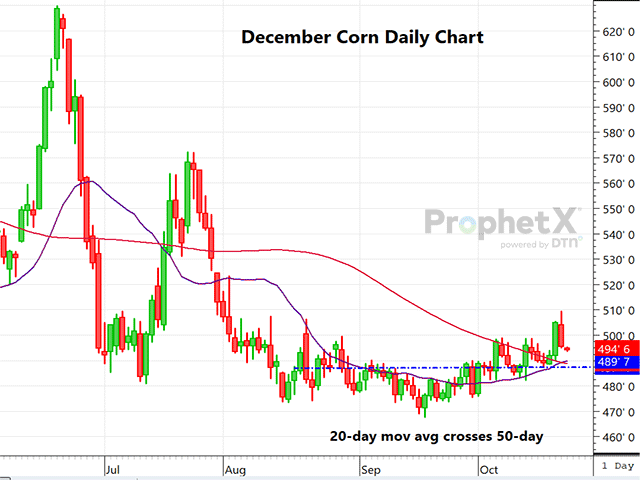

The U.S. corn futures market on last Thursday had what appeared to be a breakout when December rallied above the $5.00 resistance, even reaching the 100-day moving average at $5.09. Two trading days later you could call that a "fake out breakout" as corn retreated again. However, as long as December can stay above that $4.88-$4.90 level, I can see the possibility, at least in the short run, of corn moving higher again. For one, we had the 20-day moving average just cross the 50-day moving average to the upside. In my own mind, this can often be a sign of a trend change. That remains to be seen.

However, on the demand front, U.S. corn is now at parity with Brazilian FOB corn offers, and we could see corn export demand pick up into the winter. On the domestic side, ethanol margins remain very good. In addition, Monday's crop progress report is likely to show the corn harvest as 60% to 62% done, and basis is improving. Perhaps the outside market factor that could influence corn prices is crude oil. So far, even in the face of the expanding Israel-Hamas war, crude oil has remained tame. However, in the event that this conflict expands, bringing other forces such as Iran in, that could lead to a spike in oil, and hence the energy-related products such as corn.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Soybean meal has been on a near parabolic rise since the recent low set just 20 days ago. December soymeal has risen a huge $63 per ton in 20 days. However, Monday is showing some subtle signs that a correction could be forthcoming.

Fundamentally, soymeal should remain strong, with record exports that are likely to continue until new crop Argentine beans are available. However, the relative strength index is close to 70%, with stochastics up around 93% to 94% hinting at being overbought. Through 11 a.m. Monday, December meal is showing what could be a reversal pattern on the charts, dependent on the close for sure. Any correction is bound to be a short-lived one as both crush margins and export sales remain robust.

Dana Mantini can be reached at Dana.Mantini@DTN.com

The comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .