Technically Speaking

Soybean Meal Finds Support, Gives Soybeans A Lift

It was just two weeks ago, this space explained how both December soybean meal and December soybean oil turned lower in September and broke important support levels at the end of the month. In the most recent week ending Friday, Oct. 13, December meal broke its streak of four lower closes and finished up $17.90 at $390, a quick and unexpected reversal of direction. Friday's news from USDA that 100,000 metric tons of meal were sold to unknown destinations was the only obvious explanation for the higher move, but we also see the December contract closing $9 above the March contract on Friday, a sign of active commercial demand.

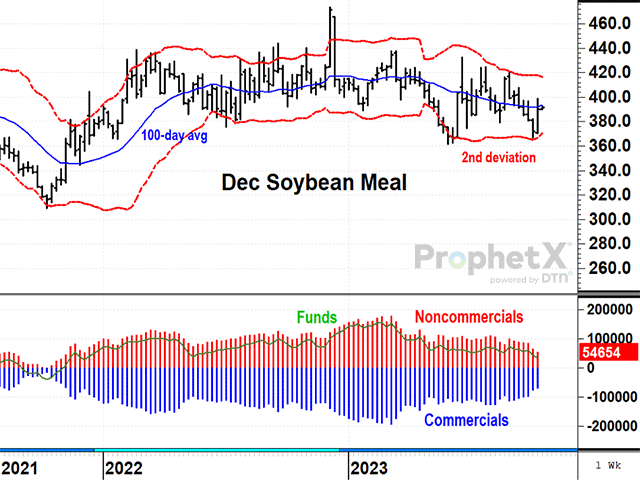

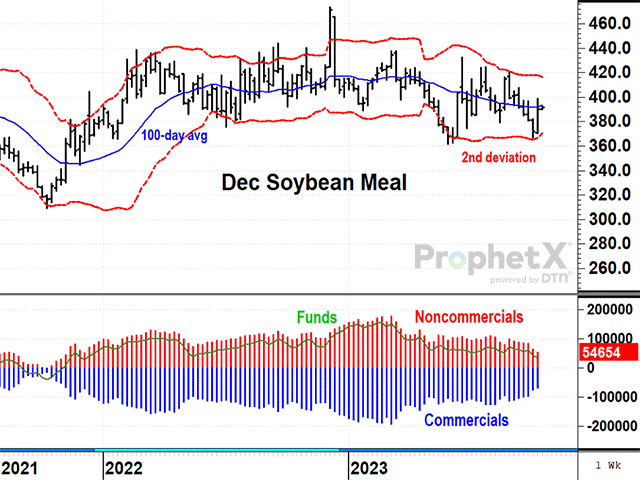

A look at the weekly chart shows prices have been trading roughly sideways for 20 months and have largely stayed within two standard deviations of the 100-day average. Last week's pivot occurred near the same lower boundary and suggests the meal market has support near $367. Technically speaking, December soybean meal held the lower boundary of its longer-term, sideways range and appears to have enough support to at least keep prices stable for now. Noncommercials have been loyally net long in soybean meal for over two years and remain net long, even after September's lower prices.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

One day before USDA's WASDE report on Oct. 12, November soybeans fell to $12.52 1/2, their lowest close in nearly four months. Not only were things looking bearish, but noncommercials were unloading net longs, falling to their smallest net long position in three years. There was also the problem of soy products losing value, mentioned in this blog two weeks ago. USDA's new estimates on Oct. 12 gave soybean prices a little encouragement, keeping U.S. ending stocks at an eight-year low of 220 million bushels and reducing world soybean stocks by 133 million bushels to 4.25 billion bushels, still a record high.

Possibly even more important, December soybean meal jumped up $15.80 on report day to a new October high and pulled soybean prices higher. November soybeans finished the week ending Oct. 13 up 14 1/4 cents at $12.80 1/4, the first higher close after six straight declines. So far, the trend remains down for November soybeans, but the higher weekly close may have started a change in momentum for a market expecting tight supplies in 2023-24. A close above the 100-day average at $13.13, if it happened, would bring a change in trend.

Todd Hultman can be reached at Todd.Hultman@dtn.com.

The comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .