Technically Speaking

December Corn: Double Bottom or More Downside Ahead?

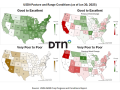

Granted, corn yield potential has made a remarkable turnaround following timely July and early August rains. However, with a forecast that is once again expected to turn hotter and drier, and with a very poor start to the season, corn yields are far from guaranteed to be as good as last week's crop production report would indicate.

The corn market is at a point where it is extremely oversold and U.S. corn has overtaken Brazilian corn as the world's cheapest. That, coupled with the end of the Black Sea Grain Initiative and the uncertain future for Ukraine grain export capability, means demand for U.S. corn should pick up dramatically in coming months. Should December hold the $4.81 level, we could be looking at a double bottom. If, however, corn should break that level, it is possible to see another leg down. I would tend to lean in favor of the former.

KANSAS CITY DECEMBER WHEAT FUTURES:Like corn, KC December wheat futures have plunged in the last few weeks; just since July 25 they have fallen $1.90 per bushel. In that same time frame, we have seen an uptick in weather issues involving major wheat exporters.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The ongoing drought in Argentina covers a good 50% to 60% of Argentine wheat fields, with no change in the pattern nearby. Canada's southern Prairies have endured heat and extreme drought, and even though WASDE only dropped production by 2 million metric tons (mmt) to 33 mmt, there are other private crop scouts who see a crop that could be sub-30 mmt. India is having a less than ideal monsoon, and there have been hints of a sub-100-mmt crop there and the need to import from 5 mmt to 8 mmt of wheat. In Australia, the forecast remains dry and concerning. There are quality issues in both German and French wheat due to too much water at harvest.

So, there are many bullish backdrops in wheat. In addition to that, this is a market that is now extremely oversold early Monday. With the managed fund short in Chicago wheat likely now close to 70,000 contracts, this is a market that is difficult to be short.

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Dana Mantini can be reached at Dana.Mantini@DTN.com

Follow him on X, formerly known as Twitter, @mantini_r

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .