Technically Speaking

Livestock Check-in Ahead of Christmas

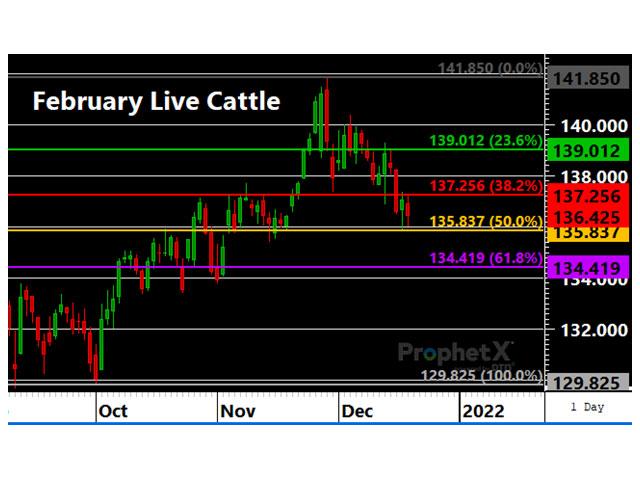

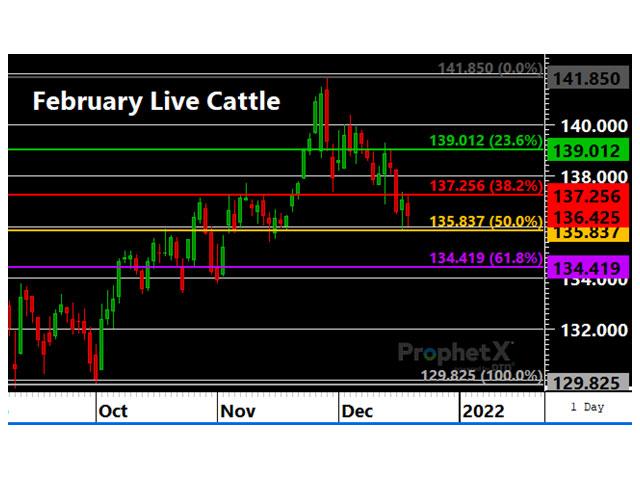

February Live Cattle:

After an impressive rally from September to new contract highs in late November, live cattle futures have retraced almost exactly 50% of the previous rally effort. The February contract has now entered somewhat of a "no-man's land" as the proximity to contract highs and major fall lows are now equidistant. That said, trends are still solidly down on most applicable time scales with downward momentum showing no signs of abating after last week's trade. To give more confidence about price finding support, we would want to see a bullish divergence from price around either the 50% retracement level or the 61.8% retracement down at $134.419. Spot prices slipped below the 50-day moving average on Friday while the 100-day was held on both Thursday and Friday. The 200-day moving average rests down at $134.05. We could envision price becoming sticky around the 50- and 100-day moving averages, allowing time for momentum indicators to find a bottom and turn higher. These issues considered, a bearish policy remains advised in February live cattle with the acknowledgement we could be very close to price finding an interim bottom.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

March Feeder Cattle:

Feeder cattle have witnessed similar price action to live cattle the last two weeks but turned in a particularly disappointing session Friday. The selling pressure drove the March contract through the 50- and 100-day moving averages, but also brought price closer to the 50% retracement of the Nov. 1 to Nov. 29 rally. Momentum indicators are still in a nosedive thanks to Friday's selling, showing no signs of forming a near-term bottom. If price can't find interim support at the 50% retracement, we would be looking ahead to the 61.8% retracement, which lines up quite well with the consolidation effort from Nov. 3-17 around $158.125 to $161.600. A fair amount of length has been shed by the managed fund community of late, putting their current position in more neutral territory. We would expect price to find support just below spot levels.

February Lean Hogs:

Hog futures have put forth trendy, impulsive price action higher since the bottom on Dec. 8, arguing for continued strength in the sessions ahead. After a minor correction from $81.225 to $78.675 on Dec. 13-15, price took out the Dec. 13 corrective high, a positive technical sign. In the process, Feb lean hogs encountered the 100-day moving average with the highs from Friday. So far, the contract has not been able to overcome the indicator, a sign to watch with early week trade. Momentum is strong, trending solidly higher and supportive of follow-through to the upside. If the 100-day moving average is overcome, the 200-day lies ahead at $81.998. Between the moving averages and resistance from the corrective highs at $82.700, the sledding could get more difficult if the contract is to remain on its upward trajectory. These issues considered, a cautiously bullish policy is advised, acknowledging the preponderance of resistance just above spot prices.

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grains and grain futures involve substantial risk and are not suitable for everyone.

Tregg Cronin can be reached at tmcronin31@gmail.com

Follow Tregg on Twitter @5thWave_tcronin

(c) Copyright 2021 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .