Technically Speaking

Monthly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed at $35.99, down $1.29 on the monthly chart. After posting a new low of $27.10 in January, the lowest price since November 2003, the spot-month contract posted a strong rally to close out the month. This move led to the establishment of a bullish crossover by monthly stochastics below the oversold level of 20% and possibly a bullish spike reversal on the continuous monthly chart. If so, then the major (long-term) trend would be considered up with an initial price target of $51.01. This price marks the 23.6% retracement level of the previous downtrend from $128.40 through the January low. Keep in mind that spike reversals are one of the least reliable technical signals studied.

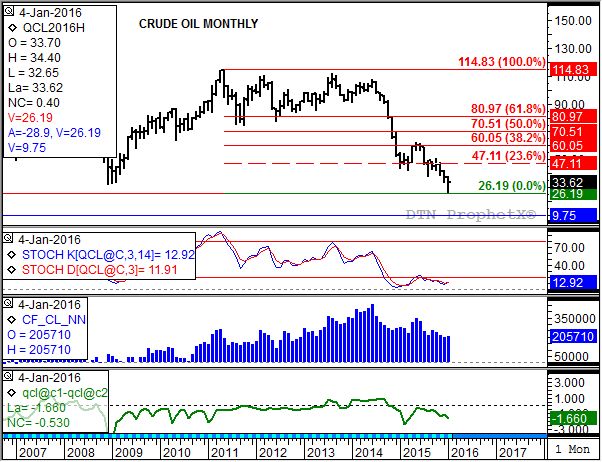

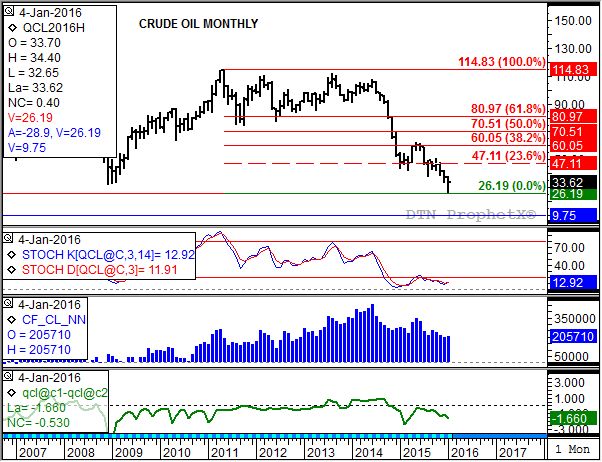

Crude Oil: The spot-month contract closed at $33.62, down $3.42 on the monthly chart. After posting a new low of $26.19 in January, the lowest price since May 2003, the spot-month contract posted a strong rally to close out the month. This move led to the establishment of a bullish crossover by monthly stochastics below the oversold level of 20% and possibly a bullish spike reversal on the continuous monthly chart. If so, then the major (long-term) trend would be considered up with an initial price target of $47.11. This price marks the 23.6% retracement level of the previous downtrend from $114.83 through the January low. Keep in mind that spike reversals are one of the least reliable technical signals studied, and that the spot futures spread continues to trend down indicating an increasing bearish fundamental situation.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed at $1.0787, down 2.20cts on the monthly chart. As with the crude oil markets, the spot-month distillates contract moved to a new low of $0.8487 in January before rallying. This established a bullish crossover by monthly stochastics below the oversold level of 20% as well as a potential bullish spike reversal. If the major (long-term) trend has turned up, then the initial upside target is $1.4437. This price marks the 23.6% retracement level of the previous downtrend from $3.37 through the January low.

Gasoline: The spot-month contract closed at $1.1323, down 13.49cts on the monthly chart. Like the oil markets (crude, distillates) the spot-month RBOB contract posted a new low of $0.9924 during January. However, unlike the above mentioned markets gasoline die not see the clear establishment of a bullish spike reversal or a bullish crossover by monthly stochastics. This would suggest that the major (long-term) trend remains down, or at least should move sideways above the January low. However the weekly chart did turn more bullish, and the market's 5-year and 10-year seasonal indexes show a tendency for the spot-month to post a strong rally, 20% and 23% respectively, through the last weekly close in April.

Ethanol: The spot-month contract closed at $1.426, up 0.26cts on the monthly chart. The major (long-term) trend remains sideways with the spot-month contract posting January low of $1.296. This establishes a major (long-term) double-bottom pattern with the low of $1.292 (December 2014), setting the stage for an uptrend if the contract can move above the interim high of $1.709 (May 2015). This would then project a possible test of retracement resistance at $2.181, the 50% level of the previous downtrend from $3.07 through the $1.292 low.

Natural Gas: The spot-month contract closed at $2.298, down 3.9cts on the monthly chart. The major (long-term) trend remains up with the bullish spike reversal and bullish crossover by monthly stochastics still in effect. Initial resistance remains at $2.636, the 23.6% retracement level of the previous downtrend from $5.72 through the December 2015 low of $1.684. Beyond that, the 33% retracement level is pegged at $3.028.

Propane (Conway cash price): Conway propane closed at $0.3238, down 1.00ct on its monthly chart. Like much of the rest of the energy complex cash propane looks to have established a bullish spike reversal during January. After posting a new low of $0.2525 the market was able to rally through the end of the month. This led to a bullish crossover below the oversold level of 20% by monthly stochastics, also indicating the major (long-term) trend has turned up.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .