Fundamentally Speaking

A Look at State Corn Yields Compared to US Total Yield

July corn futures are edging back to contract lows from the end of February as last week's USDA WASDE data was not all that friendly. Corn ending stocks were pared by just 50 million bushels (mb) versus some trade ideas the carryout could be slashed by closer to 200 mb.

WASDE's unchanged South American corn production estimates added to the negative sentiment along with ideas U.S. farmers will seed at least one million more acres than the 90-million figure posted in March's USDA Planting Intentions report. Also at play are weather forecasts that appear favorable into early May.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Keep in mind USDA's initial yield forecast is 181.0 bushels per acre (bpa), a new record by far that could result in more than adequate production even if planted area stays 4.6 million acres below year-ago levels.

Of course, it is a long way from now until harvest. We have seen over the past few years hopes of bumper production dashed by adverse weather, be it flooding rains that delayed plantings, drought in key sections of the Corn Belt, high heat during pollination, derechos, freezes -- you name it.

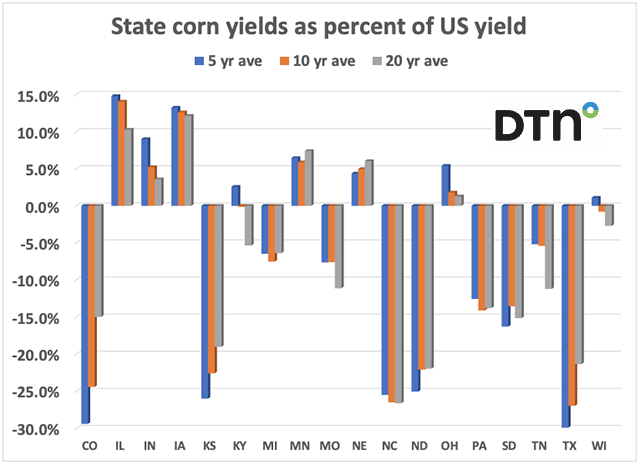

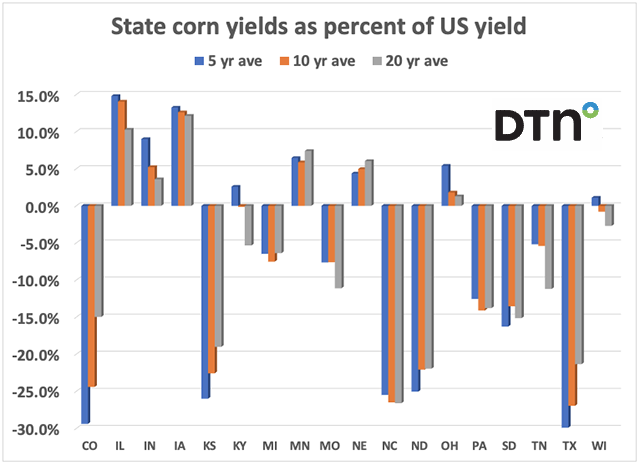

We should note some feel the reason the national corn yield has not been that impressive in recent seasons is in addition to adverse weather, increasingly larger amounts of production are coming from some of the lower-yielding states, especially in areas of the Plains. For instance, states like Kansas and North Dakota have seen increased corn planting at the expense of other crops traditionally were seeded there such as spring wheat, minor oilseeds, sunflowers and sorghum. Exploring this idea further, the accompanying chart shows the state yields of the top 18 corn-producing states as a percent of the U.S. yield, looking at the 20-, 10- and 5-year averages.

There really are only six states that have yields consistently above the U.S. yield: Illinois, Indiana, Iowa, Minnesota, Nebraska and Ohio. The best yields are in Illinois where over the past five years corn has averaged 14.8% above the U.S. yield and this is even higher than the 10-year average of 14.1% and better and the 20-year average of 10.3%. So, Illinois yields have improved relative to the rest of the country. The same pattern is seen in Indiana and Ohio to a lesser extent.

On the other hand, yields relative to the U.S. yields have gotten progressively worse in a state like Colorado where the 5-state average yield is 29.4% below the U.S. yield and that is lower than the 10-year average of down 24.4% and the 20-year average of off just 15.0%. Other states showing a similar pattern where recent yields compared to the U.S. yield have declined over the years include Kansas, North Dakota and Texas -- all in the Plains where drought conditions had been pervasive for years.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .