Fundamentally Speaking

Corn Stocks-to-Use Ratios

In a prior post we noted that despite a decline in output among some key producers, on the surface the wheat situation does not look especially bullish.

Even with the drop in global stockpiles, the world wheat stocks-to-use ratio at 35.0% appears to the second highest in at least 30 years next to the year ago 36.9%.

However, a little probing of the data indicates that the world stocks-to-use ratio (not including China) is projected at 20.0% for the 2018/19 season which is the lowest level for the world stocks-to-use ratio (less China) since the 17.5% ratio in the 2007/08 marketing year, the season wheat prices ran to record highs.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Another way to look at the world wheat situation was to look at the available supplies in the major exporting countries which includes Argentina, Australia, Canada, the European Union, Russia, Ukraine and the U.S.

Using this measurement, the stocks-to-use ratio of the major exporters comes in this year at 22.3% which is well below the 2017/18 mark of 28.4% and is the lowest since 21.3% was seen in the 2012/13 season when wheat futures ran to their second highest levels of all time.

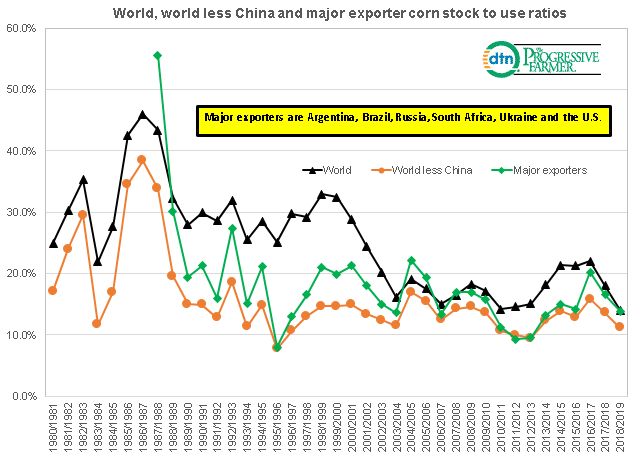

In this piece we do the same thing with corn; we had already noted that the global corn stocks-to-use ratio at 14.0% for the 2018/19 season is the lowest ever, falling below the prior low of 14.2% in the 2010/11 season.

However, if one takes out China (which is the world's largest corn producing and consuming nation and has, according to the latest USDA WASDE report, 38.5% of the world's stockpile) the stocks-to-use ratio in that regard is 11.2%, which though down from the 2017/18 figure of 13.6%, is still higher than seen in the 2010-2013 period and well above the 1995/96 low of 7.7%.

Similarly, if one just takes the stocks-to-use ratio of the major world corn exporters which include Argentina, Brazil, Russia, South Africa, the U.S. and Ukraine, the 2018/19 projection is 13.8% above the 2010-2014 average of 10.8% and well above the 1995/96 low of 7.9%.

The story of this little exercise is that a relatively high world wheat stocks-to-use ratio belies what is an increasingly bullish wheat situation as recent market action would attest, while the lowest global corn stocks-to-use ratio may not be as friendly as that number would suggest.

(KA)

© Copyright 2018 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .