Fundamentally Speaking

Soybean Meal Export Sales Through January

Nearby soybean meal futures have moved to new contract lows recently with the low in the March 2016 contract of $260.40/ton the lowest level for a spot contract since April of 2010 when values were close to $250/ton.

Should that area not hold the next level of support would be seen at the $237 region last hit in the fall of 2008 when all commodity markets were crashing in response to the beginnings of the Great Recession and below that are levels last seen in the summer of 2007.

There are a number of reasons why high protein meal values are at some of the lowest levels in years but some highlights include combined exports out of Argentina and Brazil this year are pegged at 46.85 million metric tons, a new record and 9.1% greater than the prior year as another record soybean crop out of South America along with the ongoing depreciation of the U.S. dollar vis-à-vis the Argentine peso and the Brazilian real has made their supplies quite a bit cheaper in the world market.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

There is also the ongoing weakness in the Chinese economy along with their lower hog inventories and increased use of DDG in the feed rations has slowed their rate of soybean meal consumption.

Finally up until recently many of the key U.S. feeding areas have had a relatively mild winter with above average temperatures limiting the inclusion rate of protein meals that is usually hiked in the winter.

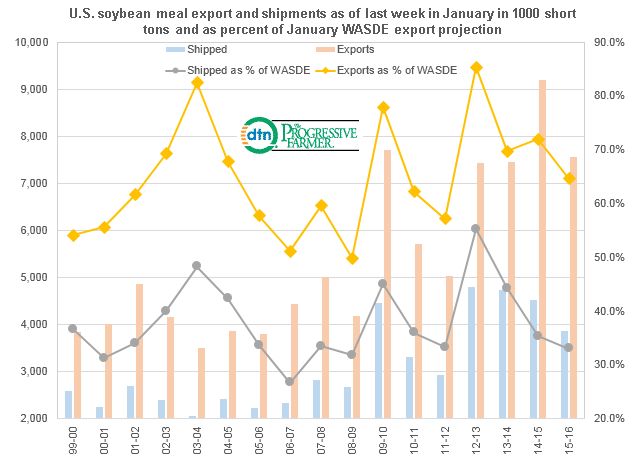

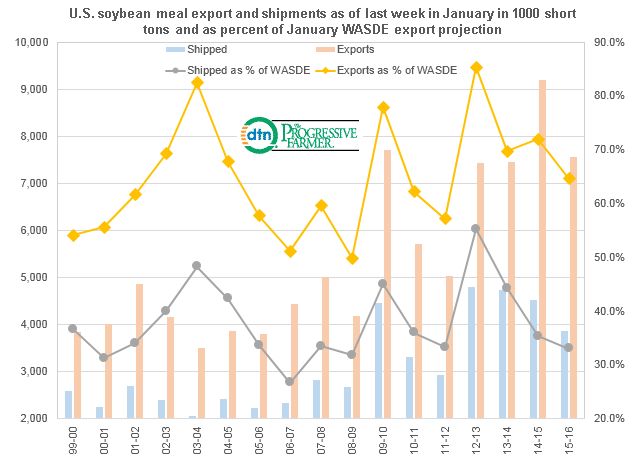

The accompanying graphic charts U.S. soybean meal export sales and shipments as of the last week of January in 1000 short tons and each of them as a percent of the USDA's soybean meal export projection given in the January WASDE report.

The export figure of 7.557 million tons is actually the second highest volume ever for this point in the marketing year next to the year ago figure of 9.204 million but it is only 64.6% of the January WASDE projection, the lowest in four years.

Meanwhile 3.50 million tons were shipped as of the end of last month, the lowest figure in four years and 33.0% of the January WASDE figure, the lowest percent since the 2008-09 season.

Hence a likely reduction in the crush estimate beyond the mere 10 million bushel reduction in this past week's February WASDE estimate seems like in subsequent supply-demand reports.

(KA)

Comments

To comment, please Log In or Join our Community .