Canada Markets

A Look at the Spring Wheat Basis

DTN's weekly basis analysis shows the U.S. national average spring wheat basis at 34 cents under the March Minneapolis future as of Dec. 12, unchanged over the previous week but 9 cents weaker than the five-year average.

The most recent USDA report shows the spring wheat export estimate unchanged from the previous November report while ending stocks of spring wheat are to rise by 20 million bushels (mb), or 12.7%, to 178 mb (4.8 million metric tons). Stocks as a percentage of use are forecast to rise to 34.7% from 32.2% in 2022-23, which would be the highest stocks/use ratio in three years.

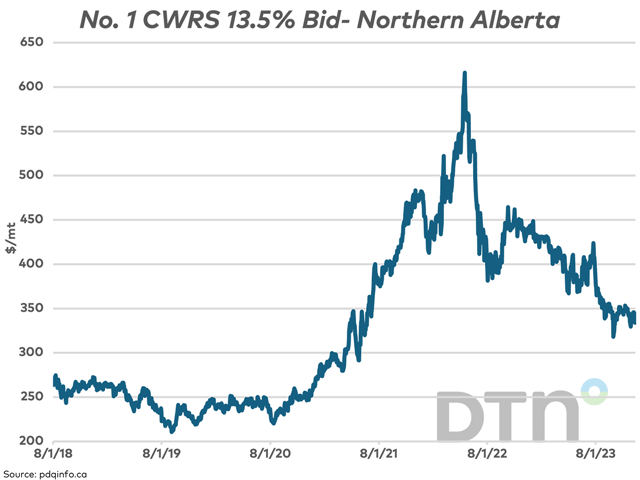

The attached chart shows the move in the cash price for the Northern Alberta region as reported by pdqinfo.ca. The chart is as of Dec. 12, where the bid of $343.89 metric ton (mt) is relatively close to the highest level seen since Nov. 16. The Dec. 13 close resulted in a $10.02/bushel (bu) drop in this price to $333.87/mt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A longer-term view of this cash price shows the Dec. 12 price retracing 67% of the move from the September 2019 low to the May 2022 high. Trade this crop year has ranged within a $40/mt range since late August with Tuesday's close in the upper half of this range.

Canada's wheat situation differs from that of the U.S. with wheat sales (excluding durum) of 7.5 million metric ton (mmt) as of week 18, or the week ending Dec. 3 up 12.5% from the same period last year, with more than 600,000 mt exported in both weeks 17 and 18, the two largest weekly volumes shipped over the 18 weeks.

The elevator basis calculated for Dec. 12, based on the difference between the March future in U.S. dollars per mt and the Canadian dollar street price is $75.84/mt over the March contract is the highest in 13 sessions, which is down from $102.22/mt over the March one year ago and slightly better than the five-year average of $69.33/mt.

In Canadian dollar terms, when the U.S. future is converted to Canadian dollars, the basis is $20.53/mt under the March, close to the $20.34 under calculated for the same date one year ago and is weaker than the five-year average of $15.54/mt under the March for this date.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .