Canada Markets

Portland Spring Wheat Basis is Weaker Than Average

In the Dec. 13 Canada Markets Blog, it was mentioned that the national average spring wheat basis in the U.S. was 9 cents weaker than the five-year average as of Dec. 12. When this finding is presented in chart form, we see the current basis of 34 cents under the March MGEX contract is close to equal to the weakest basis seen during the past five years on this date.

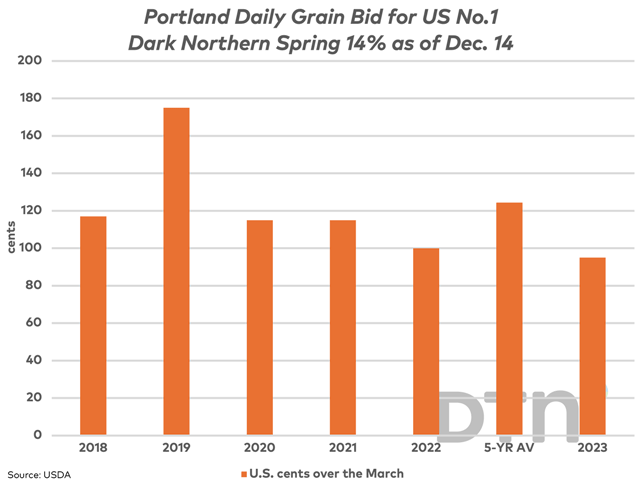

Today's attached chart shows the USDA's reporting of the cash basis at Pacific Ports as of Dec 14 for No. 1 Dark Northern Spring 14%, with the basis shown reported at the upper end of the daily range.

The good news is that this basis has shown strength since Dec. 1. On Dec. 1, this basis was reported to range from 95 cents over the December to 80 cents over the March. The Dec. 14 basis is reported at 80 cents to 95 cents over the March.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

At the same time, today's basis is reported weaker than this date over the past five years. The upper end of this range shows a range from a low of $1/bushel (bu) over the March in 2022 to a high of $1.75/bu over the March in 2019. The five-year average for the upper end of the range is calculated at $1.2440 over the March.

This basis is shown to weaken by a nickel to 90 cents over in January trade, while recovering to return to 95 cents over in Feb/March trade.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on X, formerly known as Twitter, @CliffJamieson

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .