Canada Markets

AAFC Releases Updated Supply and Demand Estimates

Agriculture and Agri-Food Canada released its April Outlook for Principal Field Crops on Friday, much to my surprise. AAFC is currently affected by the Public Service Alliance of Canada strike, with the delivery of several federal services within AAFC expected to be affected.

There were few changes in this month's report but there was some export demand signals noted along with some changes made in estimated market prices. The following are a few of the largest month-over-month changes reported.

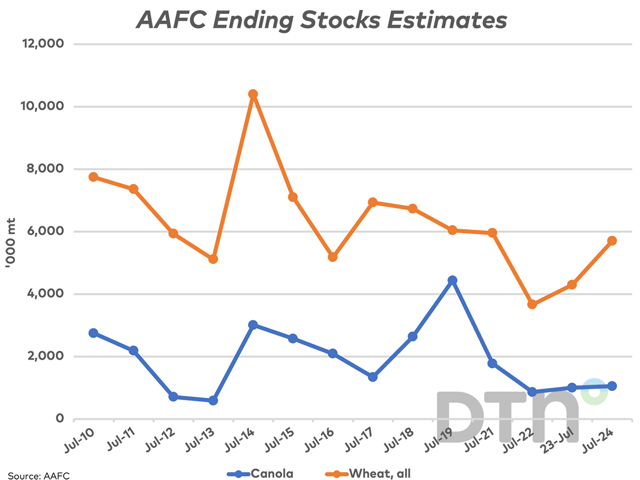

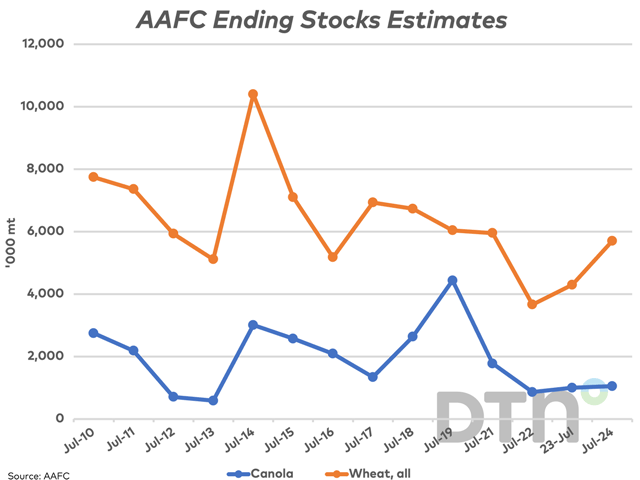

The April report saw the government increase its forecast for wheat exports (excluding durum) by 100,000 metric tons (mt) to 19.6 million metric tons (mmt). This is the eighth consecutive monthly increase, after being estimated at 18 mmt in August or the first month of the 2022-23 crop year. This in turn leads to a 100,000-mt drop in the estimate for ending stocks to 4.3 mmt, which remains 637,000 mt higher than the estimated carry-out for 2021-22.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

It is interesting to note that the Canadian Grain Commission's week 36 statistics, the last report made available due to the PSAC strike, shows Canada's wheat exports through licensed facilities over 350,000 mt higher than the steady pace needed to reach the previous month's forecast. AAFC's estimate points to the potential for slowing demand during the balance of the crop year, while the Public Service Alliance of Canada (PSAC) strike will act to further to erode Canada's export potential. In other changes, AAFC lowered its forecast price for wheat (excluding durum) by $5/mt this month or to $415/mt.

It is interesting to note that AAFC's all-wheat export forecast of 24.4 mmt remains below the USDA's 25 mmt forecast, although the gap is seen narrowing.

Another change made is a 200,000-mt lower revision in Canada's canola export forecast to 8.4 mmt, while ending stocks were revised higher by the same amount to 1 mmt. There has long been concern about Canada's lack of competitiveness with Australia, while lower futures trade may have acted to slow producer selling. As with wheat, week 36 data shows cumulative exports through licensed facilities over 400,000 mt ahead of the steady pace needed to reach the higher March export forecast of 8.6 mmt, while the government clearly has reason to believe that the balance of the crop year will see export volumes under pressure. AAFC estimated the average track Vancouver price for 2022-23 at $850/mt, down $40/mt from the previous month's estimate while down $225/mt from the previous crop year.

AAFC revised higher its forecast for corn exports by 100,000 mt to 1.850 mmt, which is also up roughly 100,000 mt from the previous year's volume shipped. AAFC lowered the expected return by $5/mt this month to $315/mt.

All forecasts may be viewed as jeopardized by the current government worker strike, with the CGC's weighing and inspection staff on strike and the potential to back up grain. While that is of great concern, PSAC is also considering moving picket lines to strategic locations, which includes the ports, which may further complicate movement through the handling system.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .