Canada Markets

Wheat Investors Increase Their Bearish Bets

On March 14, the CFTC released its Commitment of Traders report as of Feb. 28 in its efforts to catch up with delayed data. This leaves the CFTC just one week behind in its release of data and we could possibly be brought up to date by the end of the week.

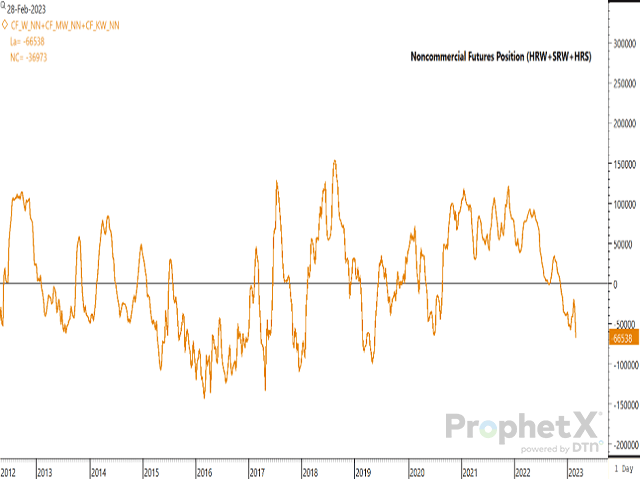

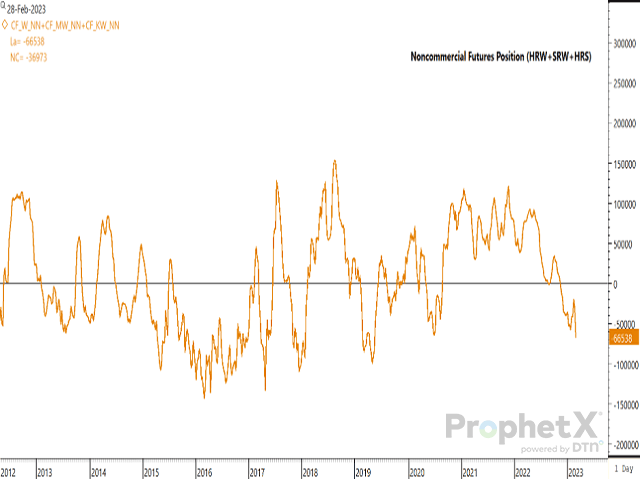

The most recent week shows noncommercial traders increasing their bearish net short position in wheat futures overall, with the combined position for hard red spring wheat, hard red winter wheat and soft red winter wheat increasing from a net-short position of 29,565 contracts to 66,538 contracts, a 36,973 contract or 125% increase from the previous week. The size of this position is now seen at the largest bearish position seen since the week-ending May 14, 2019.

Broken down by class, this number includes a net-short position of soft red winter wheat of 66,762 contracts, which grew by 40.6% during the past week, and a net-short position of 2,548 contracts of HRW, which evolved from a bullish net-long position of 11,864 contracts in the previous week. It also includes a bullish net-long position of 2,772 contracts of HRS, which fell for the first time in three weeks.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

During this same week, the commercial traders increased their bullish net-long position in SRW, moving from a bearish net-short to a bullish net-long position in HRW while sharply reducing their bearish net-short position in HRS.

So, what could go wrong? Actions by speculative traders seem to be defying wheat fundamentals and uncertainty faced in the market. For example, the noncommercial net-short position in SRW of 66,762 contracts represents 333.8 million bushels, which compares to current World Agricultural Supply and Demand Estimates (WASDE) that put production at 361 mb and 2022-23 crop year supplies at 449 mb.

It is interesting to note that since 2017, the four largest peaks in the bearish noncommercial net-short position of the three combined classes was followed by a move back to a net-long position in the following six to nine weeks.

Just as the size of this noncommercial net-short position can increase quickly, as seen in the 125% increase during the past week (from Feb. 21 to Feb. 28), it can also fall quickly. Since 2017, the four-largest week-over-week reductions seen in the size of this net-short position ranged from a 40% drop to a 68% drop. The magnitude of this position can change real fast should speculative traders turn nervous for any reason and cover positions.

Black Sea analyst SovEcon has referred to the current situation as a "powder keg," while prior to the release of the most recent report.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .