Canada Markets

Canadian Canola Exports compared to the AAFC Forecast

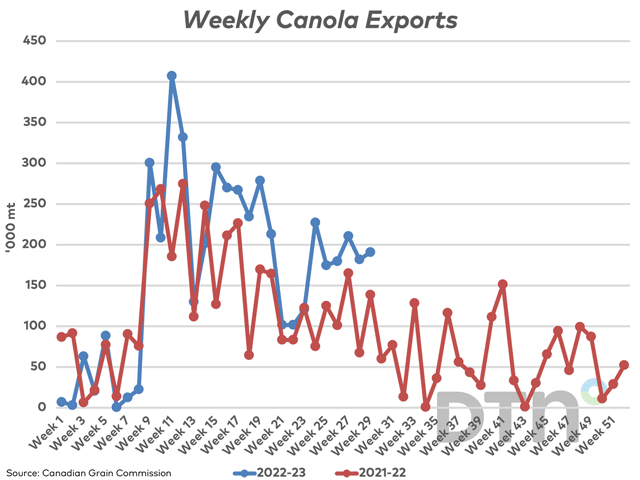

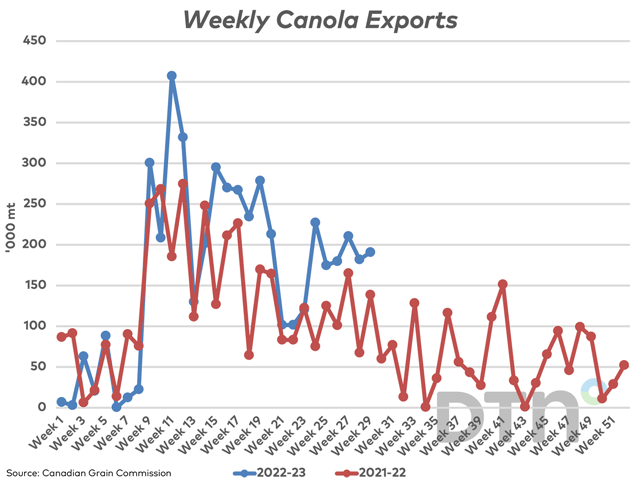

Since August, or the start of the 2022-23 crop year, Agriculture and Agri-Food Canada has scaled back their forecast for Canada's canola exports from a high of 9.3 million metric tons to the most recent forecast of 8.6 mmt, which was first seen in their December forecast, while still up 63.8% from the drought-reduced export volume achieved in the 2021-22 crop year.

The question remains if we are on track to reach this forecast. On Feb. 27, DTN posted morning comments on their marketing page that expresses concern. Exports as of week 29 are up 31% from one year ago, while a pace that would project to "7 mmt, perhaps 7.5 mmt at best." The analysis goes on to indicate that this would lead to 2022-23 ending stocks of 1.8-1.9 mmt, which compares to the 865,000 mt carried out of 2021-22 and the five-year average of 2.629 mmt. AAFC is currently forecasting ending stocks at 800,000 mt, down slightly from the previous year.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Indeed, a 31% increase in volume over the 5.250 mt exported in 2021-22 is approaching a total of 7 mmt for the crop year. At the same time, the weekly exports for 2021-22 (brown line) fell sharply from week 30 through the end of the crop year. From week 30 to week 52, weekly volumes exceeded 100,000 mt only four times, while dipping below 1,000 mt in two of the 23 weeks. Movement was weak due to tight supplies and a 31% increase in the cumulative volume reported for any given week will result in a small volume. From week 30 to week 52, licensed exports reported by the CGC in 2021-22 totaled only 1.3679 mmt.

Since the government forecast was revised lower to 8.6 mmt in December, actual volumes shipped have exceeded the weekly volume needed in seven of the 10 weeks, including the past six weeks, or week 24 through week 29.

As of week 29, or the week ending Feb. 19, the cumulative volume of exports of 4.8898 mmt shipped through licensed facilities is approaching the total volume exported in 2021-22, while is close to 100,000 mt ahead of the steady pace needed to reach the 8.6 mmt forecast.

Unless weekly shipments fall off a cliff, as they did this time last year, there seems little reason to paint an increasingly bearish picture for exports and stocks at this time. The CGC's December data shows exports to China over the first five months of the crop year 1 mmt ahead of the volume shipped in 2021-22, while the USDA revised higher their forecast for China's imports to 3.2 mmt in their February Oilseeds: World Markets and Trade. The track Vancouver cash basis remains steady at $62/mt over the May contract.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .