Canada Markets

The Canola-Soybean Oil Spread Remains Supportive

Canola found independent strength on Feb. 27, closing $4 per metric ton (mt) higher at $823.70/metric ton. Over the past four weeks, the weekly close on the May contract has ranged within a narrow $9.20/metric ton range.

Canola closed higher along with a modest EUR 0.75/mt bounce in May rapeseed, despite weakness seen in soybeans, soybean oil and crude oil. Canadian dollar strength against the USD further acted to limit upside potential.

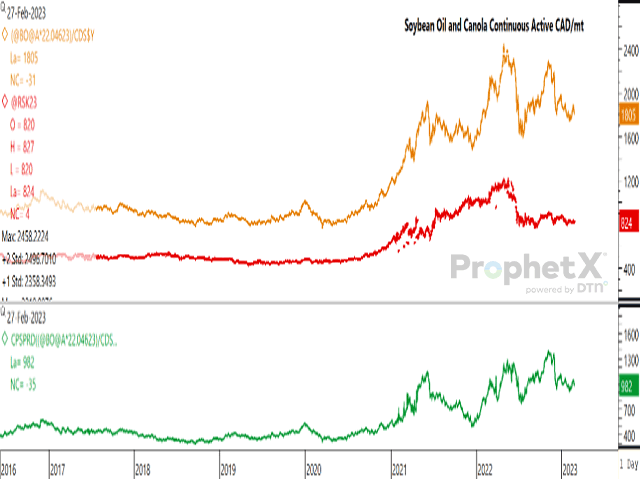

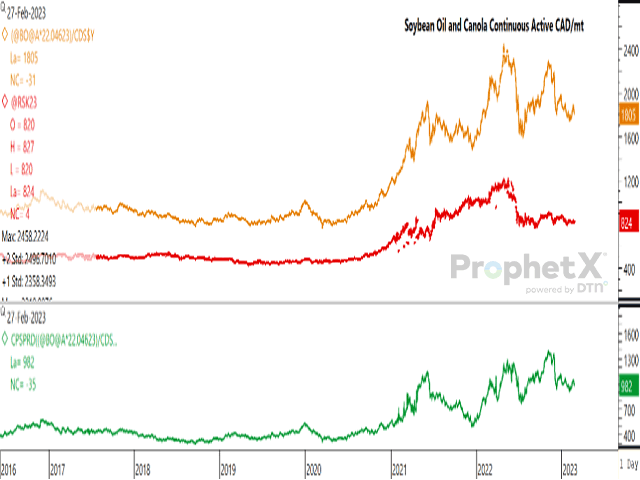

The accompanying chart shows that the sideways trend for the continuous active canola contract (red line) continues to find support from its spread to the continuous active soybean oil chart (brown line), reported in Canadian dollars/mt.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Today's spread is shown at $983/mt, as seen with the green line in the lower study. While this is down from the $1,394/mt high reached on Nov. 7, it remains well above the 2021-22 average of $842.93/mt and the five-year average (2017-18 to 2021-22) of $533.93/mt.

This chart would indicate that canola remains inexpensive relative to soybean oil, while the advancing harvest in Brazil may result in a greater downside risk to soybean oil than canola with the potential for spreads to move closer to historical levels.

Another vote of confidence is seen in Friday's CFTC data for the week ended Jan. 31, which shows the net-long futures position held by commercial traders increasing for a third week to 44,159 contracts, the largest commercial long seen since the week of June 30, 2020.

The May/July futures spread also strengthened by $1.70/mt Monday to $5/mt, the strongest spread seen since Dec. 16, indicating a growing front-end interest that bears watching.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .