Canada Markets

November Canola Bears Watching

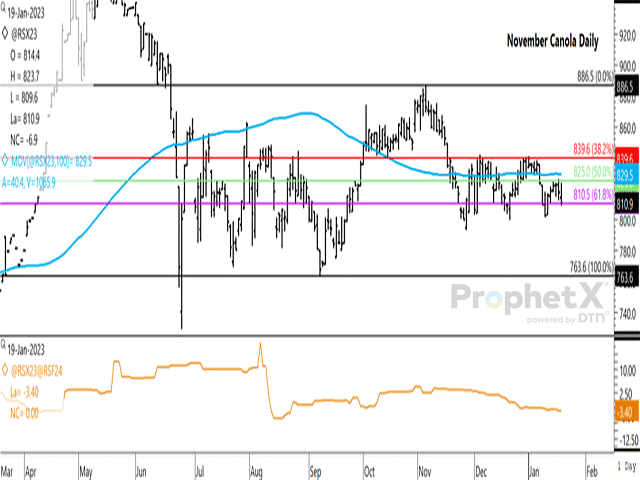

On Jan. 19, November canola closed down $10.40/metric ton (mt) to $807.40/mt, the largest daily loss in seven sessions while ending near the lower end of the $18.70/mt range traded today.

Daily volume in the November contract is shown at 2,342 contracts, the lightest seen in three sessions, signaling a potential lack of conviction despite today's lower move seen across a number of commodities.

New-crop November canola has struggled to hold above its 100-day moving average since late-November (blue line on the attached chart) and has closed below this resistance for nine consecutive sessions. The November soybean contract closed below its 100-day moving average on Jan. 18 for the first time since Oct. 18 and pushed even lower on Jan. 19.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Since Nov. 29, the November canola contract has traded in a range from a low of $800/mt to a high of $841.60/mt. During this period, price has also found support at $810.50/mt, which is the 61.8% retracement of the move from the September low to the November high. The daily close has landed below this support only three times since Nov. 29, while this week's close could be the first weekly close below this support during this period.

Further support lies at the January low of $802/mt and the December low of $800/mt.

Despite the dry conditions faced on the prairies, the new-crop Nov/Jan futures spread ended the session at minus $2.90/mt. This is the first time that this spread has closed at a carry on this date (January 2024 closing higher than November 2023) in three years, while is weaker than the five-year average for this date, calculated at minus $1.80/mt.

While straying away from technicals, the new-crop basis reported by PDQinfo.ca saw the southeast Saskatchewan basis (selected randomly from the nine prairie regions) strengthening by $7.65/mt for September delivery and by $16.67/mt for December delivery on Jan. 18. This is a sudden change and should be watched.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .