Canada Markets

AAFC's December Balance Sheet Revisions

Agriculture and Agri-Food Canada's December supply and demand tables were revised to incorporate Statistics Canada's latest production estimates, with the November production estimates based on producer surveys for the first time this crop year.

Comparing the government's data for all principal field crops, total crop production was revised 1.477 million metric tons (mmt) lower this month, which resulted in a lower revision of total exports of 235,000 metric tons (mt) and domestic disappearance of 968,000 mt. Ending stocks of all principal field crops were revised 270,000 mt lower this month to 12 mmt, up 2.327 mmt or 24% from 2021-22.

While the wheat production forecast (excluding durum) was revised slightly lower by Statistics Canada, it remains the third largest wheat crop on record. Wheat exports for 2022-23 were revised 400,000 mt higher to 18.9 mmt, up 52.3% from last crop year while ending stocks were revised 600,000 mt lower to 4.5 mmt.

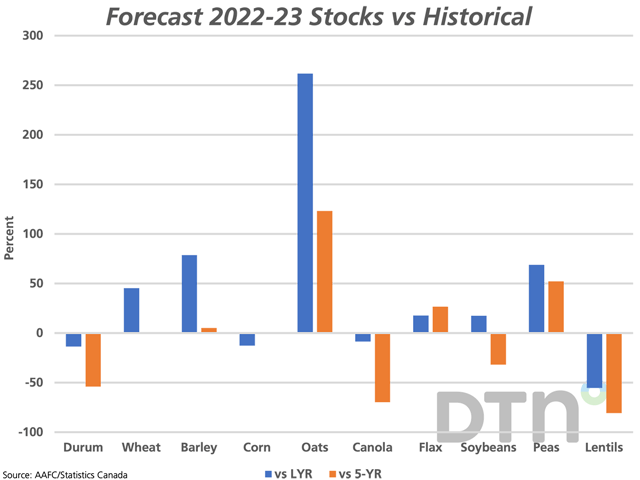

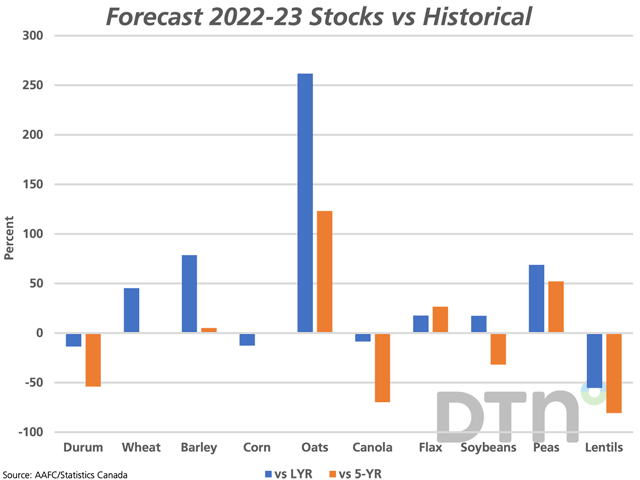

As seen on the attached chart, wheat stocks are forecast up 45.4% from the previous crop year (blue bars) while 0.2% higher than the five-year average. During the first 19 weeks of the crop year, the current pace of exports from licensed facilities is ahead of the steady pace needed to reach this revised forecast, excluding unlicensed exports and the export of flour.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As seen in Statistics Canada's production estimates, the larger downward revision was reported for durum. As a result of this 674,000 mt downward revision, exports were revised 200,000 mt lower to 4.8 mmt and ending stocks were revised 400,000 mt lower to 500,000 mt, just slightly lower than the previous crop year. As seen on the attached chart, this represents a 13.6% drop from 2021-22 and is 54% below the five-year average. As of week 19, cumulative licensed exports of durum are just slightly behind the steady pace needed to reach the current AAFC forecast.

AAFC's latest revisions now show all-wheat exports at 23.7 mmt (wheat and durum), which continues to lag the 26 mmt forecast that the USDA has held to for five consecutive months.

This month's inclusion of Statistics Canada's lower production forecast for canola resulted in a 700,000 mt lower revision in canola exports to 8.6 mmt, a 500,000 mt lower revision in crush and a 300,000 mt increase in ending stocks. Forecast stocks of 800,000 mt for 2022-23 are down 8.6% from last year and 69.6% below the five-year average. It is interesting to note the lower revision in domestic crush given the record crush margins reported over the fall. On Dec. 16, the Canadian Canola Board Margin Index showed continued strengthening, at $215.79/mt it is up from $167.74/mt from a week ago and minus $148.95/mt from a year ago. On Dec. 22, Statistics Canada will report November crush data.

This report comes on the heels of media reports that point to industry insiders that see the potential for canola exports to fall as low as 6 mmt, given heightened competition from Australia, which bears watching. As of week 19, cumulative exports are only slightly ahead of the steady pace needed to reach the revised export forecast, while the Canadian Grain Commission's reported domestic disappearance is also slightly ahead of the steady pace needed to reach the revised forecast.

As seen on the attached chart, the most bullish revisions are seen for lentils, with ending stocks for 2022-23 of 100,000 mt down 55.5% from 2021-22 and 80.8% below the five-year average.

The most bearish data is seen for oats, with ending stocks for 2022-23 revised to 1.150 mmt from 318,000 mt in the previous year, up 261.6% from 2021-22 and 123.2% above the five-year average.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .