Canada Markets

Australia Points to a Larger Canola Crop

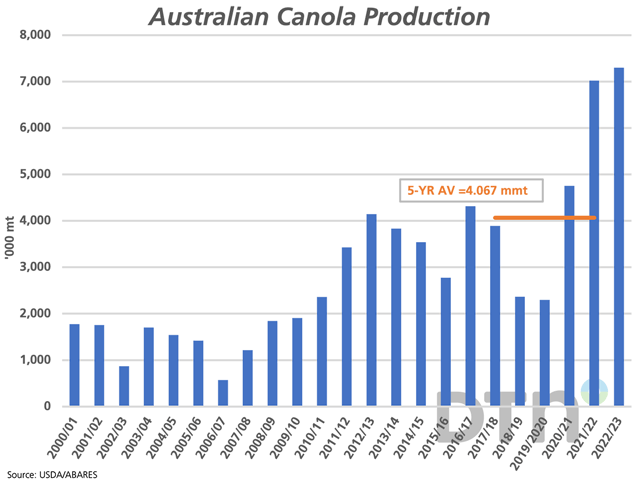

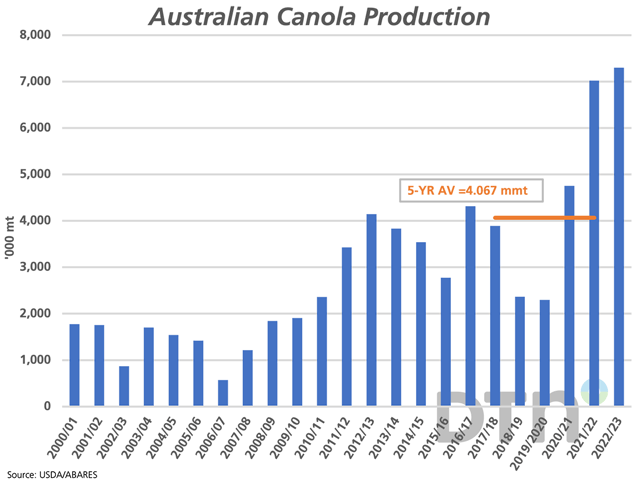

While Canada's official canola production estimate was revised lower in recent days, Australia has revised both its 2021-22 and 2022-23 estimates higher to reach a fresh record level of production for 2021-22 and again for 2022-23.

On Dec. 2, Statistics Canada revised its canola production estimate lower by 925,000 metric tons to 18.2 million metric tons (mmt). While this is up 32.1% from the previous year, it is 4.7% below the five-year average. This estimate would further tighten the global balance sheet for canola/rapeseed. The USDA's November Oilseeds: World Markets and Trade estimates show global ending stocks forecast to rise by 2.8 mmt in 2022-23, to a total of 7.163 mmt, which is already a tight 8.9% of global use.

The bullishness of this news wore off fast on Dec. 5 after Australia's official ABARES estimates included an upward adjustment in both 2021-22 and 2022-23 production estimates. The Australian government increased its production estimate for the current crop year from the 6.6 mmt estimate released in September to a record 7.3 mmt. Its production estimate for the previous crop year was revised from 6.8 mmt to 7.109 mmt. The addition of more than 1 mmt to Australia's potential output offsets the lower revision seen for Canada, resulting in little change to the global balance sheet.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The good news is that canola found independent strength on Dec. 5, with the January contract up $9.70/mt despite weakness in crude oil and soybean oil. Canadian dollar weakness against the USD was a supportive feature. Today's close ended above the resistance of the 50% retracement of the move from the November high to November low, which is calculated at $857.70/mt, clearing a path for a continued move to the 61.8% retracement at $870.50/mt. As well, the Jan/March inverse strengthened by $1.40/mt this session to a $9/mt inverse, a level not seen since Nov. 18.

ProphetX symbols for canola CIF China's ports shows a divergence in the U.S. dollar price of Canadian canola at $722.50/mt USD, up $2.50/mt, and the price of Australian canola at $525.91/mt, down $2.57/mt. The spread closed at $196.39/mt USD, the highest reported in more than four months.

**

DTN Ag Summit

This year's Ag Summit will be held virtually on the mornings of Dec. 12-13, so you can join from the comfort of your own home. Further details can be found at http://www.dtn.com/…

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .