Canada Markets

Canola Board Margin Index Signals Front-end Demand

The August 9 close points to a bearish carry market for canola with an upward-sloping forward curve (each contract closing higher than the one prior to it), with the nearby November closing at $853.90/mt, and the July 2023 contract closing at $876.30/mt. The minus $22.40/mt Nov 22/July 23 spread compares to a $75.70 inverse reported on this date in 2021 (November trading over July), while the five-year average is $1.18/mt carry.

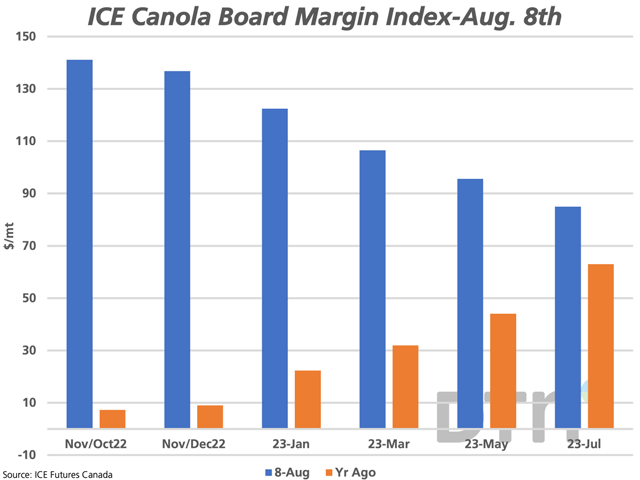

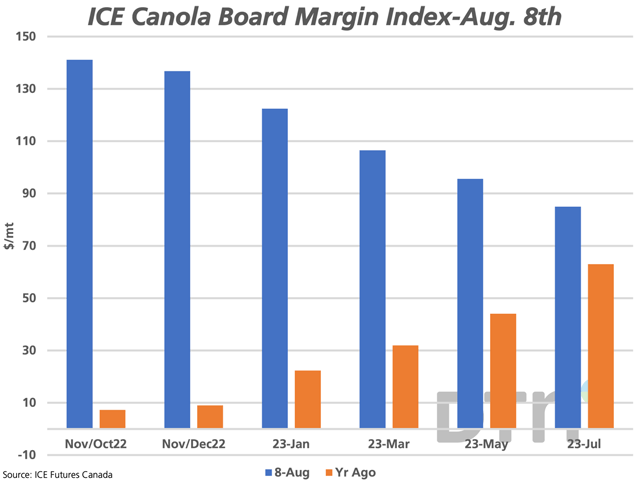

The blue bars on the attached chart show the ICE Canola Board Index as of August, signaling a front-end return from crushing canola of $141.10/mt, well above the $7.29/mt reported on this date one year ago. This is calculated using the November canola future, along with the October soybean oil and meal contracts. This calculated margin drifts lower to $85.10/mt when using July 2023 contracts.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The canola crush activity ended the 2021-22 crop year on a firm note. While official Statistics Canada crush data is not available for the month of July, we see that the Canadian Grain Commission shows canola exports of 180,700 mt over the final four weeks of the crop year (week 49 through week 52) while the domestic disappearance volume totals 734,500 mt, despite tight supplies available. The July crush could potentially be reported at the highest volume seen in at least four months, perhaps even longer, based on the CGC's weekly reports.

While AAFC is currently reporting a return to an orderly division of supplies in 2022-23 (9 million metric tons exported and 9.3 mmt crushed), it is highly likely that the domestic crush will remain the aggressor early in the crop year as the industry aims for the higher margins. Note that the CGC's week 2021-22 52 statistics show domestic disappearance at 9.339 mmt, 4.226 mmt or 45.3% higher than reported exports through licensed terminals.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow Cliff Jamieson on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .