An Urban's Rural View

Finally, Some Good News on Interest Rates

If you're trying to build up your savings account, these are happy times. For years, you earned almost nothing on your savings, even if you parked them in certificates of deposit. Today you can get a 5.5% CD without much difficulty.

If you're in the market to buy a house, these are definitely not happy times. With mortgage rates around 7%, monthly payments will be out of range for many potential buyers. Would-be home sellers with low-rate mortgages aren't inclined to list, which makes houses scarcer and pushes prices higher. As a Wall Street Journal headline recently put it, "The Math for Buying a Home No Longer Works." (https://www.wsj.com/…)

If you're a farmer or other business person who normally borrows operating money and occasionally investment money, today's rates make you want to tear your hair out. Many farmers have scrambled to find ways to borrow less.

In the economy generally, business fixed investment is down. It hardly needs saying that a prolonged period of rates at today's levels would be very bad for economic growth.

And worse for the federal budget. Interest costs on the federal debt have risen 39% this year from the year before and 91% from three years ago, to $659 billion. According to the Committee for a Responsible Federal Budget, those interest costs now equal 2.5% of the nation's GDP, up from 1.6% in 2020. They're the third largest federal expenditure category after Social Security, Medicare and defense, and in shooting distance of overtaking defense. (https://www.crfb.org/…)

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

It would, in other words, be good in many ways and for many people, savers excepted, for interest rates to come down. Good news: The odds of them coming down are improving.

Thanks mainly to some very good inflation news, Federal Reserve policymakers have become more dovish. At their meeting on Dec. 12 and 13, they not only left their benchmark interest rate unchanged for the fourth month in a row after 11 consecutive increases, they seem increasingly unlikely to be raising interest rates again, and they projected (projected, not promised) that they will cut rates three times next year. They didn't indicate when they'd start cutting. (https://www.federalreserve.gov/…)

In their latest quarterly Survey of Economic Projections, the Fed policymakers forecast that their benchmark rate would be 4.6% at the end of next year, down from 5.4% at the end of 2023, with further declines to 3.9% at the end of 2025 and 2.9% at the end of 2026. In September they had forecast that the 2024 ending rate would be 5.1%. (https://www.federalreserve.gov/…)

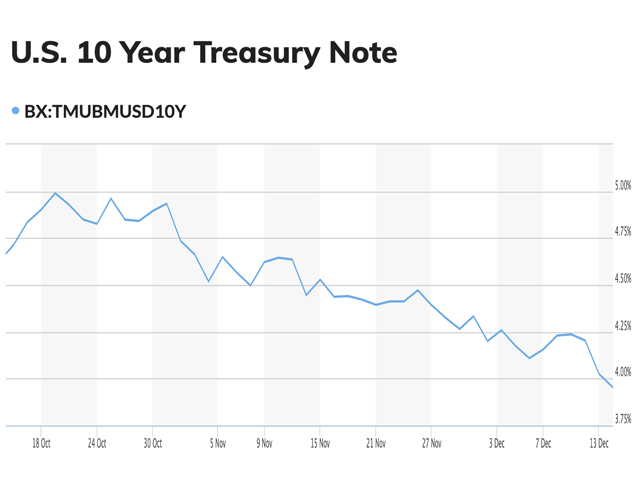

This dovishness represents a real change from as recently as six weeks ago. At their meeting ending Nov. 1, the Fed seemed much less certain about whether the decline in inflation was sustainable. Markets seemed to agree. The yield on the 10-year Treasury note had recently hit 5%.

Since then, inflation has continued to soften. By the most-used measures, it's down to around 3% and by one less-used measure down near the Fed's 2% target. Using the Fed's preferred measure, the policymakers projected inflation would end this year running at a 2.8% rate, down from their 3.3% projection in September. They forecast it would end next year at 2.4%.

That would still be above the Fed's target. But at the post-meeting press conference Fed Chair Jerome Powell said the Fed would not wait for 2% to begin cutting once it felt assured inflation was on a sustainable path to 2%.

In addition to the good news on inflation, the job market has cooled; while there are still more jobs than job seekers economy-wide, the gap is closing rapidly. The Fed doesn't want a recession, but a hot labor market leaves worries about inflation heading north again.

After the Fed announced its latest decision and released the Survey of Economic Projections, the yield on the 10-year was 4.02%, down nearly 20 basis points on the day. (https://www.cnbc.com/…)

Now please, farmers and other business borrowers, take this news with the normal caveats about when to tally poultry. There's always the danger that a surprise future turnaround in inflation will force the Fed to reconsider its dovishness.

While Powell indicated policymakers think interest rates have peaked, they haven't taken a rate increase off the table. "No one is declaring victory; that would be premature," Powell warned at the press conference.

Still, six weeks ago there was good news (no rate increase) and bad news (inflation uncertainty) about interest rates. The news from the latest Fed meeting as well as from financial markets is just plain good.

Urban Lehner can be reached at urbanize@gmail.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .