Ag Policy Blog

Higher Reference Price Expected for Corn, Soybeans and Wheat in Future Marketing Years

While complications remain over the drafting of a new farm bill, a University of Illinois farm-bill expert explains that reference prices for some commodities are set to increase for nearly every farm in the country with base acres.

Jonathan Coppess laid out an analysis last week looking at the impact of the effective reference price (ERP) calculation in the 2018 farm bill for Price Loss Coverage.

Higher commodity prices have also bumped up the overall average marketing year average prices in multiple years. The language in the 2018 farm bill sets the ERP based on either the reference prices set in the farm bill, or 85% of the five-year Olympic moving average of marketing year prices, whichever is higher. Another caveat, however, caps that ERP bump at 11% of the statutory reference price (SRP).

It's always astounding how they come up with these equations in the farm bill just to make everyone's head hurt.

While these prices could sting given the declines in grain prices and potentially lower protection in crop-insurance price guarantees, a 15% bump in reference prices does raise the floor from current levels.

Coppess' analysis:

CORN SRP $3.70 per bushel.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Based on adjustments to this moving five-year Olympic average, Coppess mapped out from marketing year 2024-28, the ERP for corn base acres will increase to the maximum, 115% of the SRP, or $4.26 a bushel.

SOYBEANS SRP $8.40 per bushel.

For soybeans, the ERP will increase from marketing year 2024 through 2013. In 2025-27, the ERP will hit the 115% maximum of $9.66 a bushel.

Wheat SRP $5.50 per bushel.

Wheat base acre prices will increase slower than corn and soybeans, but recent high prices will trigger the ERP for marketing-year 2025-28. Wheat reference prices could hit $6.01 in MY2027, about 109% of the SRP. Coppess stated marketing-year prices for wheat might not reach the 115% increase.

The Congressional Budget Office projects that nine of 19 ARC/PLC crops will see higher effective reference prices (ERPs) in at least some years going forward. Those nine commodity crops take up roughly 92% of all base acres enrolled in either ARC or PLC.

"In other words, almost every farm will experience a reference price increase through the ERP for at least one crop," Coppess stated.

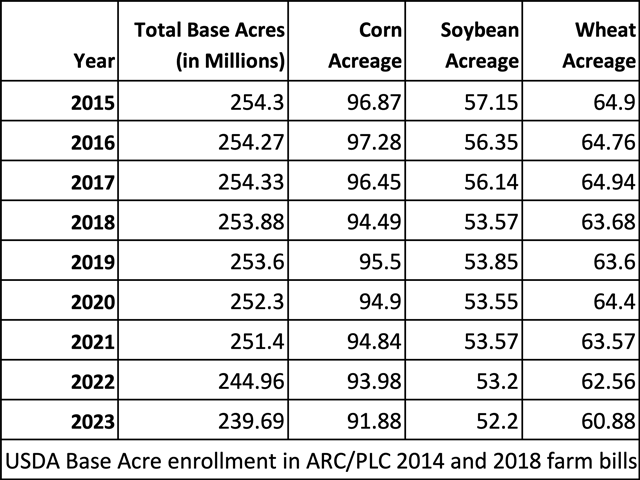

Breaking down acreage even farther, corn, soybeans and wheat amount to nearly 86% of all base acres, according to USDA.

For the full article, see https://farmdocdaily.illinois.edu/…

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on X, formerly known as Twitter, @ChrisClaytonDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .