Technically Speaking

Forward Livestock Contracts Looking Bullish for Cattle, Bearish for Hogs

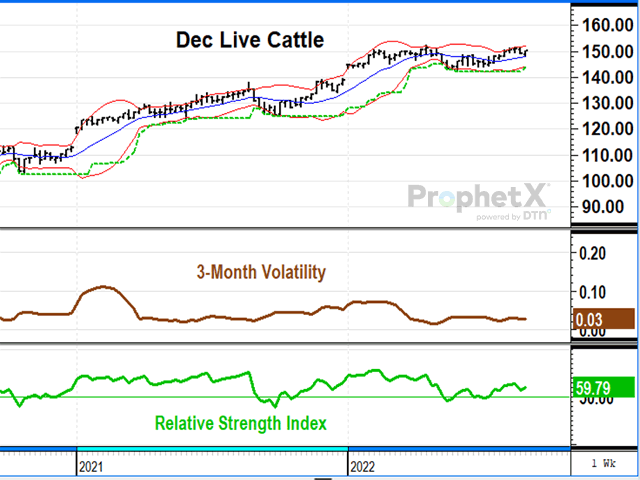

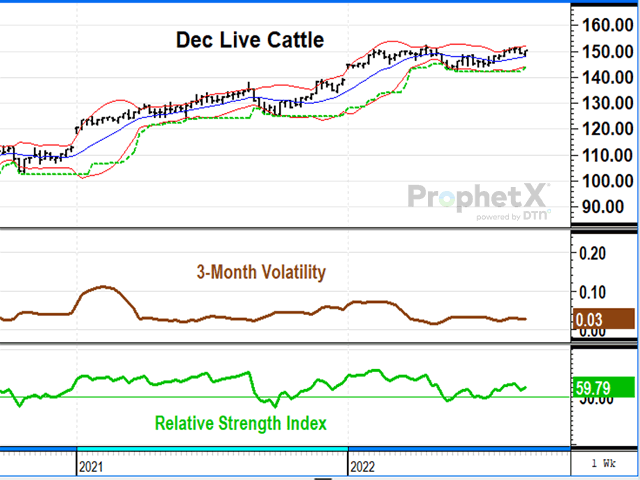

December live cattle finished up $1.15 at $150.25 for the week ended Friday, Sept. 2, pushing closer to its contract high at $152.37, even though dressed cattle prices in the North were estimated $4 lower by DTN. Parts of Texas showed soil moisture improvement the most recent week, but liquidation of the beef cow herd remains a bullish long-term factor for cattle prices. December cattle prices broke below their three-month lows in mid-December, a third failed selling attempt in three years. Three-month price volatility has been unusually low since late March, while prices held sideways, largely ignoring outside market worries about higher interest rates and talk of recession. Technically speaking, December cattle prices have traded above the 100-day average since late July and the weekly relative strength index of 59.8 indicates the path of least resistance remains up.

FEEDER CATTLE:November feeder cattle rebounded from a lower start to the week and finished at $186.25 Friday, a gain of $1.07 on the week. November feeder prices are down from their mid-August high of $191.42 as doubts have grown about this year's U.S. corn yield, but feeder prices have held above their 100-day average since July 11 and survived a test of their one-month low on Monday. Compared to live cattle, feeders suffered more of a loss in April and May but have traded higher since May 20 and have shown slightly higher volatility with the increase in prices, a potentially bullish clue of higher prices ahead. With November feeder cattle prices not far from challenging their contract highs and the relative strength index indicating more progress on up days than down days, the trend remains up with key support at $182.00.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

After starting higher Monday and Tuesday, December lean hogs ended the week down 25 cents at $82.70, perilously close to support at the July low of $80.82. Adding to bearish concerns, noncommercials are on the long side of 84,944 hog futures contracts, a lot to liquidate, if new lows were to happen. Cash negotiated prices for hog carcass in Iowa and Minnesota prices have fallen over $32 since Aug. 10, ending at $102.53 Friday, an obviously bearish change in the demand situation for physical hogs. Technically speaking December hogs are in a sideways trading range as long as prices hold above $80.82, but Friday's relative strength index of 44.6 suggests the path of least resistance for hogs has already turned lower.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .