Technically Speaking

Weekly Analysis: Livestock Markets

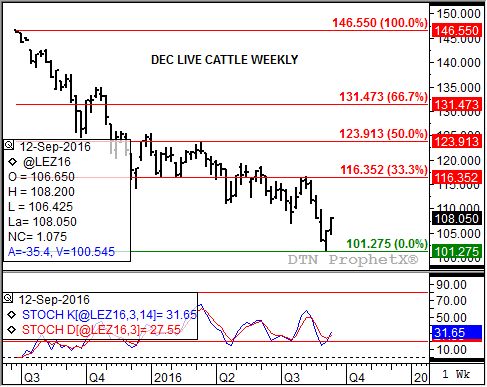

Live Cattle: The more active December contract closed $2.65 higher at $108.05. The market continues to indicate the previous week's action was a bullish spike reversal, last week closing near the weekly high of $108.20. Dec cattle still have work to do to establish an uptrend, starting with a move to a new 4-week high above $112.85.

Feeder Cattle: The October contract closed $1.675 higher at $132.95. Last week's continued rally continues to indicate the previous week's move was a bullish spike reversal. As with live cattle, October feeders need to move to a new 4-week high above $143.175 to establish an uptrend.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Lean hogs: The more active December contract closed $3.975 lower at $49.95 last week. Dec hogs extended its secondary downtrend by moving to a new contract low of $48.375. This was also a new long-term low, extending the market's major downtrend.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $2.96 3/4, down 1 1/4 cents for the week. Weekly stochastics continue to indicate the secondary (intermediate-term) trend is up, though the NCI.X needs to move above the previous 4-week high of $3.02 3/4 to confirm.

The secondary (intermediate-term) uptrend continues to strengthen. However, the NCI.X is testing initial resistance at $3.03, a price that marks the 23.6% retracement level of the previous downtrend from $4.00 1/2 through the low of $2.73. The 4-week high is just above that at $3.03 3/4. Given the market's bullish momentum it should be able to extend its rally to the 38.2% retracement level of $3.21 3/4.

Soybean meal: The December contract closed $3.70 lower at $312.80. The contract is in a sideways trend after testing its low of $303.00 last week. Weekly stochastics remain in single digits indicating a sharply oversold situation, and in position for a possible bullish crossover. If so this would be an early indicator of a turn to a secondary (intermediate-term) uptrend.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .