Technically Speaking

Weekly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed $2.24 lower at $45.77. The secondary (intermediate-term) trend remains sideways-to-down Initial support is at the 4-week low of $45.32. Weekly stochastics remain bearish meaning the more likely next move would be a break of support. If so, retracement support is at $44.28 and $39.98, prices that mark the 33% and 50% levels of the previous uptrend from $27.10 through the high of $52.86.

Crude Oil: The spot-month contract closed $2.85 lower at $43.03. The secondary (intermediate-term) trend is down after the spot-month contract posted a new 4-week low of $42.74. With weekly stochastics bearish the market is in position to test retracement support between $41.88 and $38.86. These prices mark the 38.2% and 50% retracement levels of the previous uptrend from $26.05 through the high of $51.67.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed 2.53cts lower at $1.4051. The secondary (intermediate-term) trend remains down. The spot-month contract posted a new 4-week low of $1.3790 while weekly stochastics are bearish. Next support is between $1.3036 and $1.2168, prices that mark the 38.2% and 50% retracement levels of the previous uptrend from $0.8487 through the high of $1.5848.

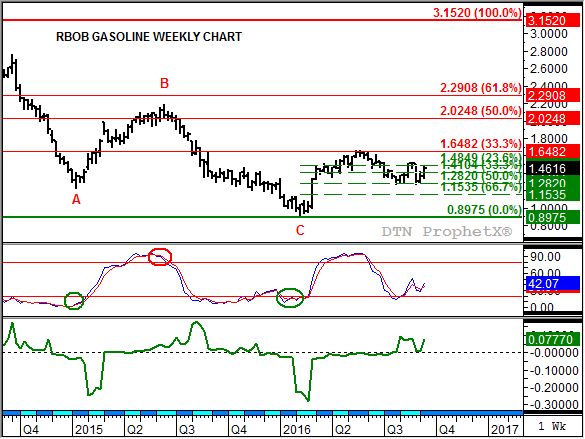

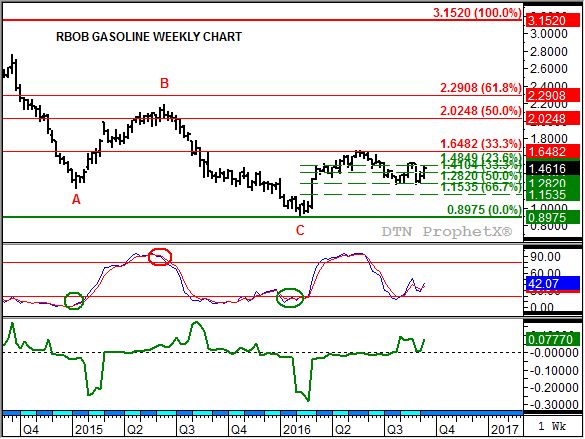

Gasoline: The spot-month contract closed 10.05cts higher at $1.4616. The secondary (intermediate-term) trend turned sideways last week on a short-term supply scare reflected in a spike move in the nearby futures spread. Initial resistance is at the 4-week high of $1.5257.

Ethanol: The spot-month contract closed 2.1cts higher at $1.508. The secondary (intermediate-term) trend is up. Resistance is between $1.505 and $1.550, prices that mark the 38.2% and 50% retracement levels of the previous downtrend from $1.739 through the low of $1.360 (week of August 1).

Natural Gas: The spot-month contract closed 15.1cts higher at $2.948. The secondary (intermediate-term) trend turned sideways with weekly stochastics now bullish again. Resistance is at the recent high of $2.998, with a test possibly setting the stage for a double-top formation.

Propane (Conway cash price): Conway propane closed 1.88cts higher at $0.4463. The secondary (intermediate-term) uptrend continues to strengthen. Cash propane moved above resistance at $0.4400, a price that marks the 50% retracement level of the previous downtrend from $0.5425 through the low of $0.3375. The 61.8% retracement level is up at $0.4642.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .