Technically Speaking

Weekly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed $0.60 higher at $49.32. The secondary (intermediate-term) trend remains up as the spot-month contract posted a new 4-week high of $50.51. While weekly stochastics are above 90% indicating the market is sharply overbought, the major (long-term) uptrend continues to strengthen with initial resistance pegged near $51.00. Next secondary resistance is between $53.38 and $55.47.

Crude Oil: The spot-month contract closed $1.58 higher at $49.33. The secondary (intermediate-term) trend remains up after posting a new 4-week high of $50.21. However, the spot-month contract is testing resistance between $48.63 and $50.42, prices that mark the 61.8% and 67% retracement levels of the previous downtrend from $62.58 through the low of $26.05. Weekly stochastics above 90% indicate the market is sharply overbought, but could be overridden by the strengthening major (long-term) uptrend that has next resistance pegged at $59.96.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed 0.40ct higher at $1.4940. The market extended its secondary (intermediate-term) uptrend last week by posting a new 4-week high of $1.5208. However the spot-month contract pulled back to finish out the week, and with stochastics above the 90% level is vulnerable to increased selling. Still, the major (long-term) trend is up with the spot-month contract above initial resistance at $1.4437.

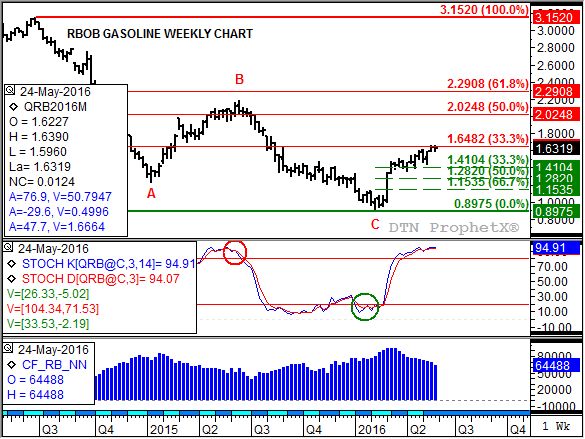

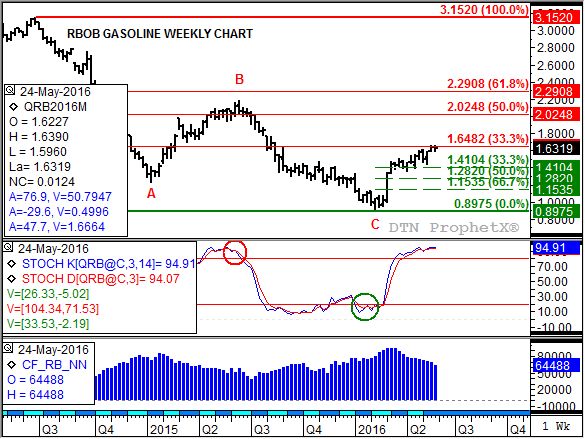

Gasoline: The spot-month contract closed 0.37ct lower at $1.6319. The market is indicating its secondary (intermediate-term) uptrend may be coming to an end. The spot-month contract continues to find resistance at $1.6482, the 33% retracement level of the previous downtrend from $3.1520 through the low of $0.8975. Weekly stochastics are above 90% and nearing a bearish crossover, while last Friday's weekly CFTC Commitments of Traders report* showed noncommercial interests reducing their net-long futures position for the tenth week in a row. If the secondary trend turns down, initial support is pegged near $1.4100.

Ethanol: The spot-month contract closed 5.1cts higher at $1.657. The market extended its secondary (intermediate-term) uptrend as the spot-month contract posted a new 4-week high of $1.660. However, as is the case with most of the energy complex, weekly stochastics are indicating the market is in an overbought situation and vulnerable to increased selling interest. Still, the market remains driven by its major (long-term) uptrend.

Natural Gas: The spot-month contract closed 10.7cts higher at $2.169. The secondary (intermediate-term) trend remains up as the spot-month contract posted a bullish outside range last week. Renewed buying interest was found as the market tested support at $1.903, leading to a test of the previous high of $2.195 by the end of the week. Beyond that, resistance is at the next peak of $2.495 from the week of January 4, 2016.

Propane (Conway cash price): Conway propane closed 0.25ct higher at $0.4875. Despite the higher weekly close the secondary (intermediate-term) trend still looks to be down following the previous week's spike reversal and corresponding bearish crossover by stochastics. Initial support remains at $0.4459, the 33% retracement level of the previous uptrend from $0.2525 through the high of $0.5425.

*The weekly Commitments of Traders report showed positions held as of Tuesday, May 24.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .