Sort & Cull

Has the Cattle Complex Established a New Support Plane?

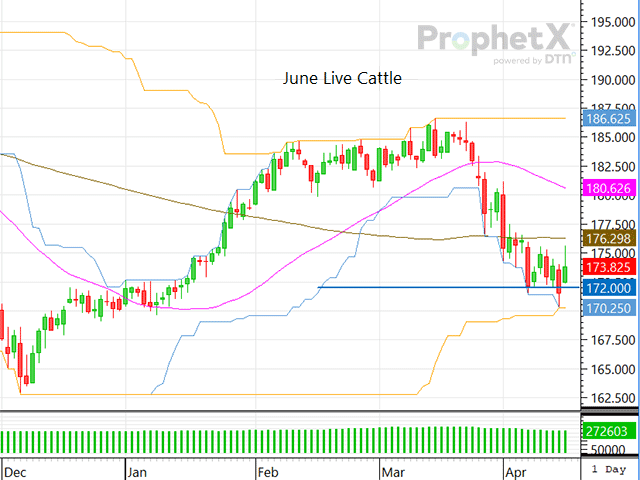

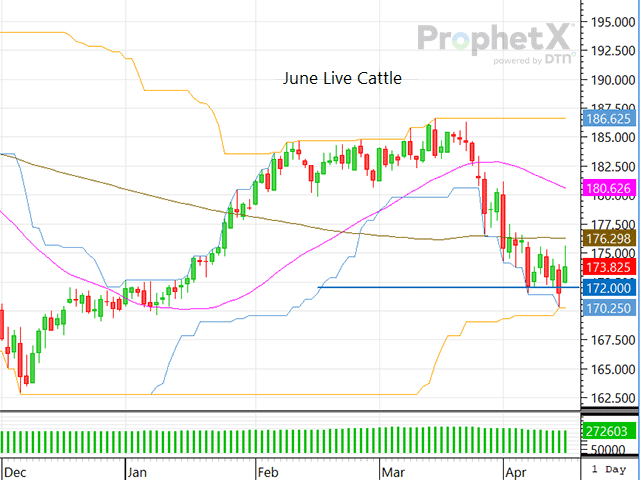

The live cattle complex has been under tough technical pressure during the last four weeks, which has mostly been because of the unknown nature of the highly pathogenic avian influenza (HPAI) found in dairy cattle in eight states (https://www.dtnpf.com/…). But besides anxiousness that came with HPAI cases, the market has also seen fundamental pressure from slower processing speeds, sluggish boxed beef prices and a steady decline in cash cattle prices since the season's high was made during the week of March 22.

But given the combination of last Friday's weaker close, mixed with Monday's strong supportive nature, one is led to wonder: Has the market established a new support plane? And could trade begin to strengthen?

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

I'm hesitant to write too much on the matter, as the market could decide to shift direction, but the support plane of $172 is worth noting, regardless of which way the market trades. The market is at a critical focal point.

It's unlikely that cash cattle will trade higher this week, as showlists are greater in all five of the major feeding states, but if boxed beef prices could show steady movement with slightly stronger prices, traders may be willing to trade the market steady as opposed to breaking support and falling even lower.

But, given that the monthly Cattle on Feed report will be shared later this week, it's unlikely that traders put the cart before the horse and advance the market before seeing what the report unveils. Pre-report estimates have yet to be shared, but it's likely that Friday's COF report at midday will show that feedlots are full as feedlot managers have procured cattle earlier than normal this year as they are keenly aware of the industry's tight supplies. Not to mention, the spot June contracts 100-day moving average is currently sitting at $176.29 which traders will be mindful of, as advancing the market above that price point will no doubt be a bullish move.

As the market trades throughout the week, continue to monitor the support plane at $172 as the market's daily close (whether higher or lower) could signal short-term direction.

ShayLe Stewart can be reached at shayle.stewart@dtn.com

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .