Fundamentally Speaking

Small Corn Yield Revisions

In an earlier piece we had suggested that a lack of weather scare this past summer and more than ample global and domestic supplies had resulted in the lowest price volatility for the major grain and oilseed contracts in quite some time.

We note that the December 2015 futures contract has been locked into a mere 15 cent range over the past month and within the confines of a 40 cent range since late July.

One reason for the lack of fireworks is literally an unchanged 2015 U.S. corn yield forecast since the first field based survey back in August.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

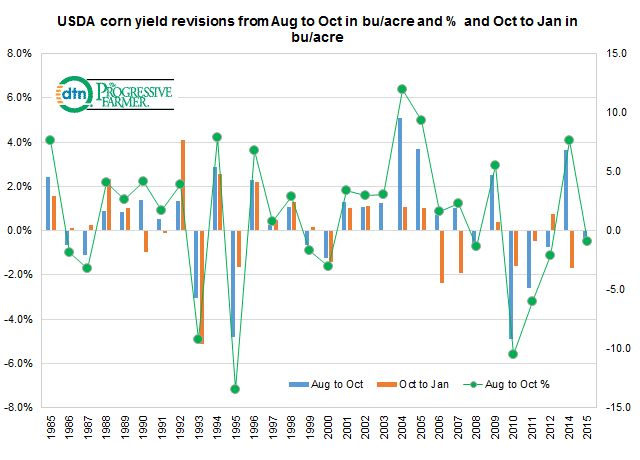

The accompanying graphic shows the USDA U.S. corn yield revisions from the August to the October crop report in both bushels per acre and percent and also the October to January revision just in bushels per acre.

The year 2013 is not included due to the government budget sequester that prevented the release of the October 2013 crop production report.

This year's 0.8 bushel per acre, or 0.4%, decline is the smallest downward revision at least extending back to 1974.

In fact, of any August to October revision either up or down, the only one smaller is 1997's 0.5 bpa or 0.3% increase.

Based on very stable late season crop conditions at a time of year when they usually decline, an extended growing season in the Midwest with a very late first fall freeze allowing even row crops in the Upper Midwest to reach full maturity and stellar reports from the field, upward revisions are implied in Tuesday's USDA 2015 corn yield estimate, perhaps sizable.

(KA)

© Copyright 2015 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .