Fundamentally Speaking

WASDE Corn Stocks Revisions

This week the USDA hiked estimated U.S. corn demand for the 2013/14 season by 100 million bushels.

With the five million bushel increase in imports, the net result was ending stocks pared by 95 million to 1.792 billion bushels.

This decline was greater than the trade expectations but the market response was muted given ideas that the January WASDE will post much more bearish numbers.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

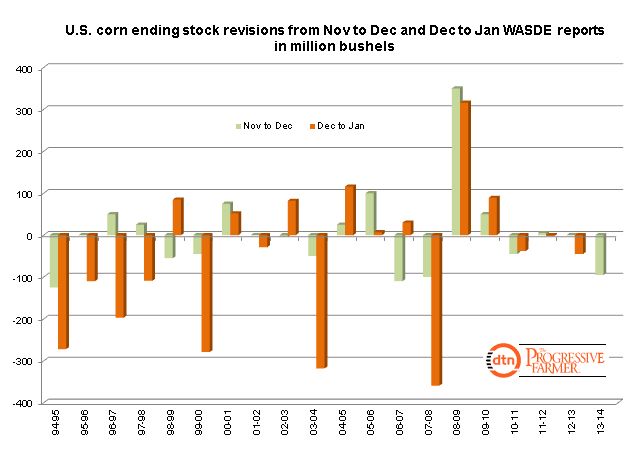

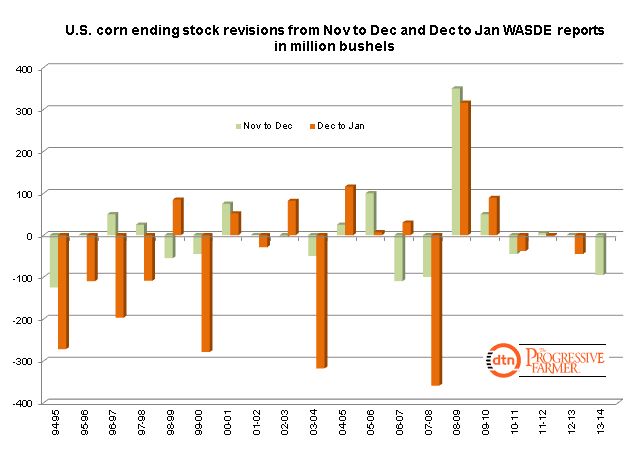

The chart shows the USDA’s monthly supply-demand revisions for U.S. corn ending stocks from the November to December WASDE report and then from the December to January figures.

The 95 million Nov to Dec reduction is the largest since the 100 million bushel reduction in December 2007 with stocks down 110 million the year prior.

Interestingly, in six of the past seven years, the Dec to Jan WASDE change has been in the same direction as the Nov to Dec revision suggesting that 2013-14 corn stocks will be lowered in the January 2014 WASDE report.

This appears unlikely given expectations that the 2013 corn crop size will be increased given yield reports that were coming in well above expectations right until the end of harvest and a very late first fall freeze that allowed the least developed plants to reach full maturity.

In addition, it is anticipated that the December 1 quarterly stocks figure will be exceptionally high implying Sep-Nov corn feed use lower than what the USDA is projecting.

The higher crop output and lower feed utilization should offset any increase in export or ethanol usage should the USDAS choose to increase either or both of these categories for the second month in a row.

Note the largest Dec to Jan ending stocks gain ever was in January 2009 of 316 million bushels and that was on top of a 350 million Nov to Dec increase.

(KA)

Comments

To comment, please Log In or Join our Community .