Canada Markets

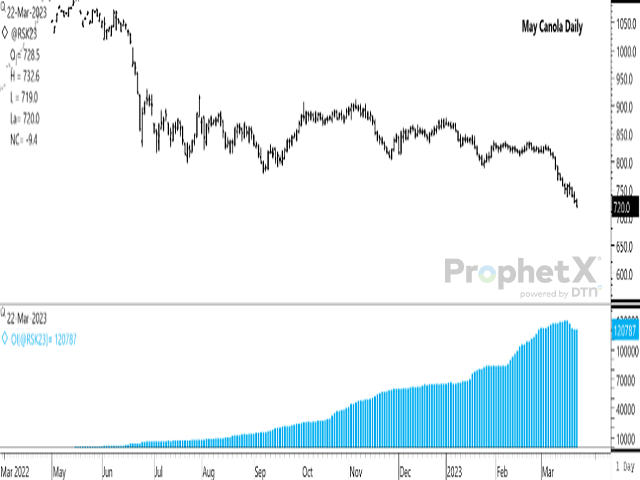

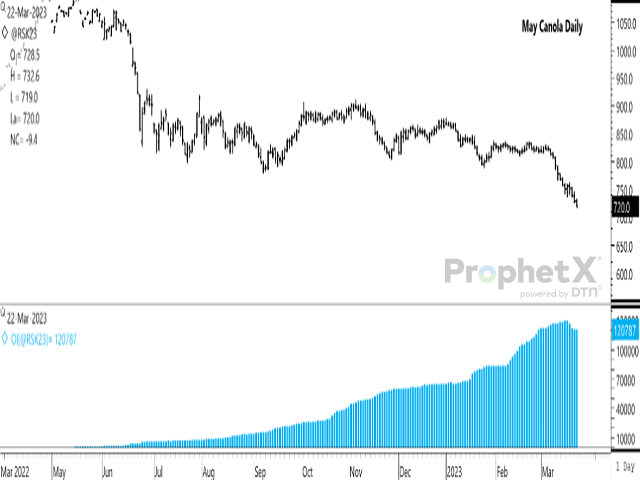

May Canola Open Interest Remains High

As of March 21, the May contract open interest is reported at 120,787 contracts, down only modestly from the 129,489 contract high reached on March 15.

During the past five years, the May open interest peaked between Feb. 24 and March 8, while over this period, the peak is seen in the month of March only once in the five years.

It is also interesting to note that the May open interest on this day is 118.5% higher than the same date in 2021-22 and is 71% higher than the five-year average, very likely the largest open interest on this date ever.

The CFTC's Commitment of Traders report for the week ending March 14 shows a standoff between the commercial and noncommercial side. The noncommercial net-short position grew by 26,464 contracts, the largest week-over-week increase in a net-short position seen since the CFTC began in 2018. The net-short position is seen at 84,402 contracts, or the largest seen since October 2019.

The same week saw the commercial net-long position grow for a fifth week and by 26,385 contracts to 85,253 contracts net-long, the largest net-long position held since September 2019 and only 8,445 contracts below the largest net-long position on record.

The clock is clicking on both sides of the trade and could lead to volatile trade ahead of the May expiry.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .