TREND: The trend for March corn is sideways for now.

NONCOMMERCIAL OUTLOOK: Noncommercial corn traders held a net-short futures position of 18,330 contracts as of Feb. 10 and were net-buyers of 16,368 contracts during the CFTC reporting period as prices have rallied off lows set following the bearish January WASDE report.

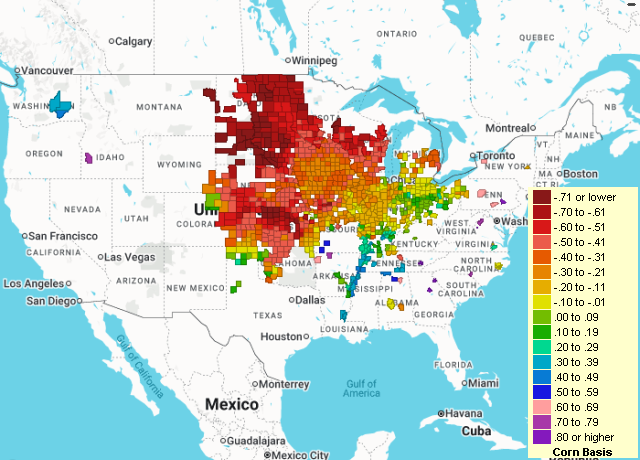

COMMERCIAL OUTLOOK: Commercial corn traders held a net-long position of 37,338 contracts as of Feb. 10 and were net-sellers of 15,578 contracts through the CFTC reporting period. The March 2026 contract is priced 10 1/4 cents lower than the May 2026 contract, moving wider (more carry) through the week, to the highest degree of carry for the boards since early September. National average corn basis fell 1 cent...

DTN's Daily Basis Comments

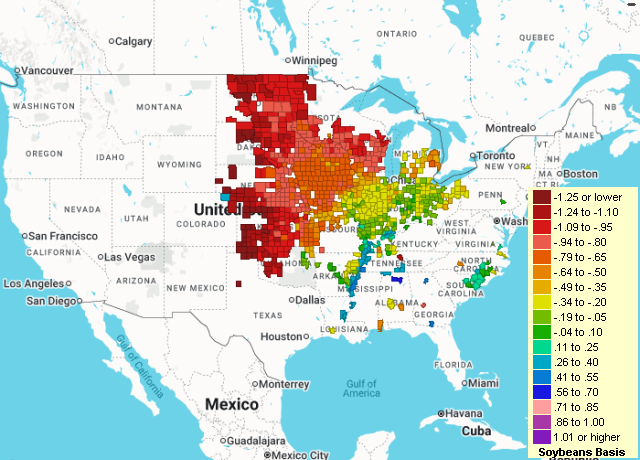

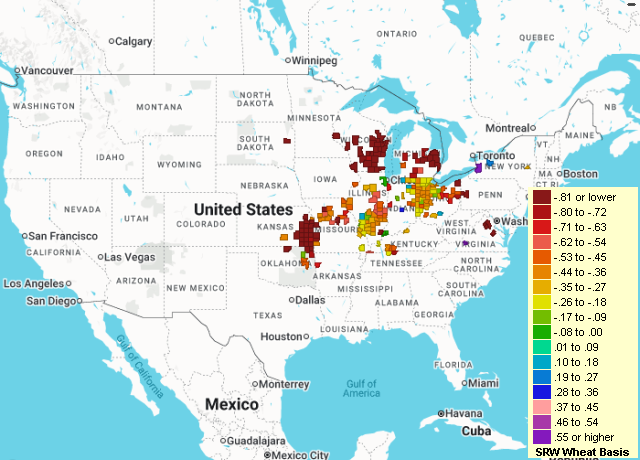

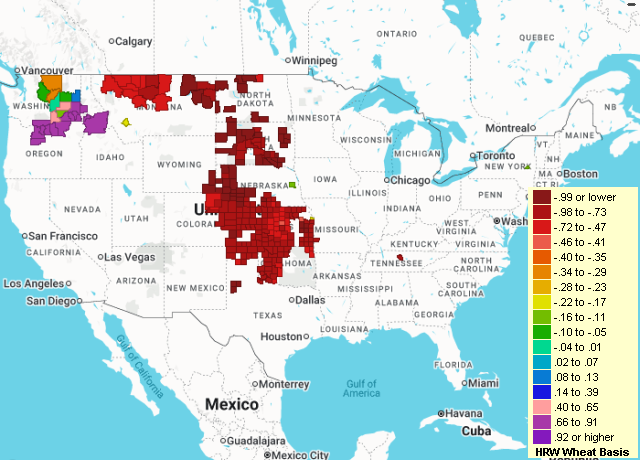

Corn, Soybean Basis Steady

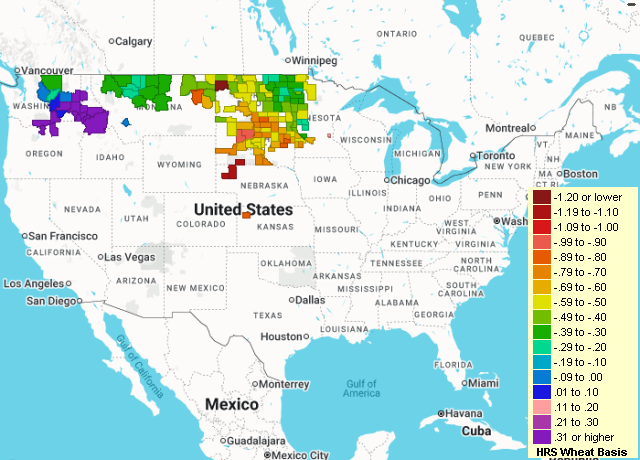

Soybean, corn, and hard red winter wheat basis was steady Tuesday, while spring wheat basis was stronger and soft red winter wheat basis was weaker.