Technically Speaking

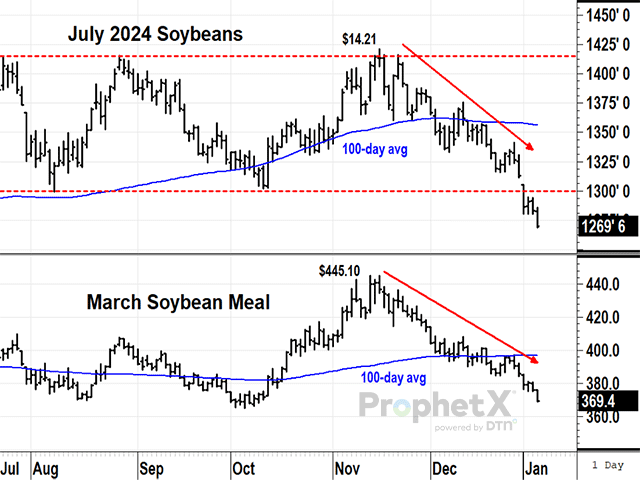

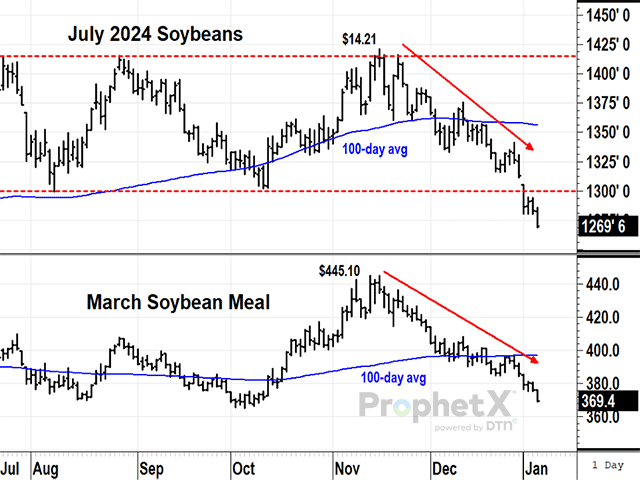

Soybean Prices, Meal Break Support in Early 2024

SOYBEANS:

For six months, July soybeans have traded within a sideways range from $13.00 on the low end to roughly $14.16 on the high end. USDA is estimating the lowest U.S. ending soybean stocks in eight years, a compelling bullish argument. On the other hand, traders started the South American season anticipating a record soybean crop in Brazil, an estimate that has been coming down as the country experienced stretches of hot and dry weather.

Brazil's Conab and USDA will update their estimates this coming week, but the market has already decided. Back from a rainy New Year's weekend in central Brazil, July soybean prices collapsed, falling to a new six-month low and ending Friday at $12.69 3/4. More rain is expected the next two weeks and Argentina's crops are in good shape. It is difficult to know how much downside potential soybean prices have when U.S. supplies are expected to be tight, but for now, the trend is clearly down.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

SOYBEAN MEAL:

With the U.S. expecting tight soybean supplies in 2023-24 and Argentina's crush industry low on soybeans until the next harvest, bulls were in control of March soybean meal in October and early November, but price behavior since then suggests a quick change in outlook.

Technically speaking, the abrupt change in price direction after mid-November could be described as an inverse V-top, a major reversal that is difficult to recognize as it happens. The close at $393.60 below the 100-day average was the first obvious sign of bearish change, but this week's $16.60 drop to $369.40 left little doubt that bullish hopes for meal have been dashed. There is still a chance U.S. soybean supplies will be tight in 2023-24, but the outlook for meal prices is even more bearish in new-crop months, where Argentina's production will likely add to bearish influences.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .