Technically Speaking

Looking Ahead To 2024: Corn, Soybeans Show No Rush

DTN's National Corn Index of cash prices closed at $4.40 Friday, Nov. 25, so when we look at December 2024 corn trading near $5.10, there is some enticement to make some early sales for the next crop, possibly up to 50% of production, if you're not still threatened by drought. USDA's estimate of 2.16 billion bushels (bb) of U.S. ending corn stocks in 2023-24 is a bearish weight and Brazil's next safrinha crop, if successful, will be another source of bearish influence on prices in mid-2024. However, "if" is still the key word as the uncertainty of weather -- both in South America and the U.S. -- keeps us from ever being over-confident on how things will turn out.

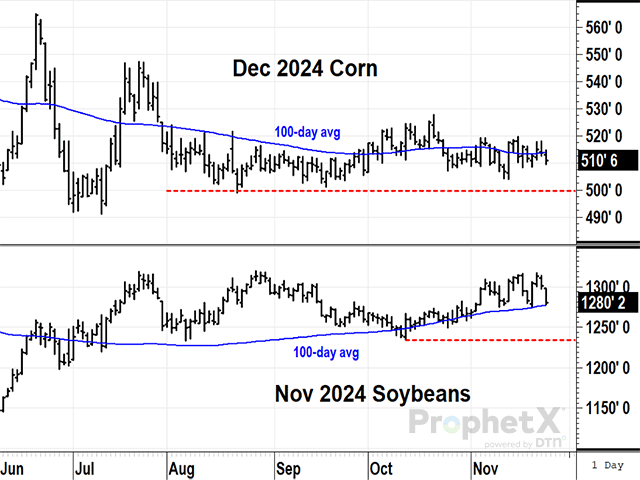

Technically speaking, December 2024 corn prices have traded sideways since August, between roughly $5.00 and $5.25 a bushel. At this time, prices are giving no sign of leaning in either direction and prices typically trade quieter in winter, so there should be some time yet to decide. However, given the larger supplies in 2023-24, you may want to consider making a partial sale, if prices fall below the August low of $4.99.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

DTN's National Soybean Index closed Friday at $12.70 a bushel, near the November 2024 price of $12.80, but well below Friday's July 2023 soybean price of $13.67. USDA's estimate of U.S. ending soybean stocks at 245 million bushels (mb) is the lowest in eight years and is giving soybean prices bullish potential before Brazil harvests a possible near-record crop in February 2024. Once again, the "if" of weather possibilities is raising concerns about Brazil's next soybean crop, while Argentina's production is expected to rebound from drought in 2023.

Like 2024, November 2024 soybeans have been trading sideways since August, between roughly $12.35 and $13.20 and prices appear to be in no hurry to pick a direction. Given the bullish potential of soybean prices, $12.80 isn't very attractive for making sales, but a close below $12.35, if it happened, would force producers to reevaluate soybeans' bullish potential, depending on events in South America.

**

The comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .